The Global Coffee Commodity Chain: Coffee Farmers in Costa Rica and Its “Ups and Downs”

Journal: Journal of Globalization Studies. Volume 8, Number 2 / November 2017

The volatility of the global coffee market has forced small-scale coffee farmers in Costa Rica to react. Some farmers support their coffee earnings with supplemental income they receive from other activities beyond agriculture; others diversify their fields with other crops they hope to sell in the market; and yet others, afraid that their impoverished condition will outlast them, are making great sacrifices in sending their children away to school so they themselves switch professions, away from their parents' coffee plots. In order to imagine a world where commodity producers can live decent productive lives, the current system of international trade require some modifications to give rural producers in the South a chance to take a fair role in the globalized economy. Commodity producer countries need a type of global trade that is equitable for all actors involved and must not be based on exploitative conditions where some enrich themselves at the expense of others. Long lasting peaceful trade must be profitable for all actors involved in business transactions, not just for those who control knowledge, technology, capital and marketing tools. A reformulation of the GCC is needed in order to achieve this equity. State and non-state actors must be included in the discussion of the global trade of commodities since government and its institutions have a critical role to play in the regulation of the free market of coffee.

Keywords: globalization, global economy, coffee production, small farmers, global commodity chain, coffee farmers.

The examination of the system of coffee production that operates within the context of globalization reveals the social, political, economic and environmental pressures that small farmers continuously face, whether prices for their crops are high or low. All small agricultural producers, including coffee producers, face similar challenges when global competition is fierce and they lack the basic inputs needed to remain competitive (credit, stable markets, and appropriate technology). However, such challenges are not entirely new. The inclusion of coffee farmers in the world market began in the 1800s when their production became a cash crop and started to be produced majorly for the export market, initiating a process of ‘internationalization’, defined as ‘the geographical spread of economic activities across national boundaries’ (Garretón et al. 2003). Coffee farmers experienced back then similar sort of pressures as they do now in the globalized twenty-first century. Most of these pressures are economic and are embedded within the framework of unequal power. Coffee farmers, as most farmers of any crop, find themselves depending, in many cases, on monocultural production as their main source of income. This makes them extremely vulnerable to the price fluctuations that are inherent in the international market of commodities. In addition to this, at present farmers have to deal with an unprecedented number of aspects in the already dispersed international activities. These are intrinsically involved in the trade of coffee. These include the intensification of global competition and the emergence of new centers of production, the proliferation of transnational corporations (TNCs), the advantage of technological innovations in transportation and communication, a global finance system, the near-hegemony of the United States, the weakened role of nation-states in matters of regulatory trade policy, and the influence of international organizations such as the European Union or the North American Free Trade Agreement (Garretón et al. 2003).

Small farmers have a long history of being located in a position of disadvantage within the world economy and coffee farmers are no exception: the structure of the global coffee market is based on a system of unequal power relations. The global coffee market operates within the global commodity chain (GCC), a network of unregulated actors intertwining at different levels that unavoidably create a struggle for power and market share that results in the near-elimination of the weaker and poorer link: the small farmer.

The examination of the main characteristics and outcomes of the ‘boom-and-burst’ condition of commodities such as coffee reveal not only economic and political drastic outcomes that separate people as ‘winners’ and ‘losers’ but most importantly they reveal tragic human stories. The ‘winners’ are actors who have monopolized the power within the global coffee industry at the expense of the farmer who is left alone, ignored, and exploited for economic gains. In terms of power, the trading of coffee is extremely concentrated while the producing of coffee is very dispersed (Fitzgerald 2012: 378). While producers are the ‘makers’ of the commodity, they do not benefit from the sale of it in the global market and, in fact, are largely excluded from significant earnings in the free market due to ‘market failures [that] are endemic to the free trade system’ (Fitzgerald 2012: 378). These market failures, as this paper shows, are the intrinsic unavoidable nature of the Global Commodity Chain (GCC).

The challenges that small coffee farmers strive to manage today are very similar to those they faced in the early 2000s (Pongratz 2007). Although there are a number of studies of the economic, social, political and environmental outcomes of international commodity production and trade, this article adds to the literature in two ways. First, by examining the structural problems of the commodity chain, it contributes to academic discussions on the power relations that exist within the GCC by suggesting that small coffee growers worldwide face what Rice (2003: 239) calls a ‘deep and structural’ crisis. And second, it ‘zooms in’ from the macrolevel examination of the chain actors, their roles and scopes of power, and looks into the specific social and economic implications that the chain network have on small producers. The following section lays out the theoretical framework for understanding the structure of the GCC and provide an insight into the system's structural inequalities. It reviews the literature on commodity chains demonstrating that the inequalities of the coffee commodity chain are structural in nature while integral to the current functioning of the world economy. Then, I analyze who are the major actors in the global production and distribution of coffee and their level of power within the commodity chain. Finally, and drawing from participatory field research and interviews that took place in Costa Rica in 2013, I highlight the responses of coffee farmers to the crisis of uncertain prices and the role that the GCC has in reproducing, harvest after harvest, this uncertainty and high fluctuation of prices.

The Global Commodity Chain: Review of Literature

The term commodity chain is associated with the work of Hopkins and Wallerstein (1986) within the world-systems framework and in the 1990s became associated with the work of Gereffi (1994). A commodity chain is ‘a network of labor and production processes whose end result is a finished commodity’ (Hopkins and Wallerstein 1986: 159). Within the global world-economy, commodity chains are used to explain the movement of commodities from Southern tropical countries to Northern industrialized countries. Like in dependency theory, Gibbon (2001) argues that the GCC focuses on who controls global trade and how actors located in different segments in the trade can break out of the situation of dependency. However, unlike dependency, the GCC does not assume that control lies in TNCs nor assumes that the world fits into neatly defined ‘core’ and ‘periphery’ sections (Gibbon 2001: 346). But, as Hopkins and Wallerstein (1986) contend, although the core/periphery image might be too simplistic, it is starkly clear that ‘the principal interzonal movements along the commodity chains are in the direction periphery-to-core’ (Gibbon 2001: 346). The coffee chain reproduces this periphery-to-the-core structure, as small growers are usually located in poor, peripheral countries while other activities, such as the creation of new brand names or new coffee beverages for niche markets, take place mainly in developed countries (Talbot 2002: 7).

The GCC assumes a process of linearity because it assumes that there are a number of ‘steps’ or ‘chains’ that products have to move through, from producers through intermediaries to end consumers. With a commodity such as coffee, the linear project begins with the poor coffee producers in the South Periphery who produce a crop for sale to affluent rich Northern consumers in the Core.

The GCC shifts the focus of analysis away from the way a particular country is linked to the world economy through the sale of a particular commodity and directs its attention towards the global organization of production, processing, and distribution of a particular commodity. In this way, the unit of analysis is the commodity chain, bigger than the nation-state but smaller than the entire world-system (Talbot 2002: 6). In this way, ‘the focus is on how states and actors in the different countries cooperate or come into conflict over the rules governing the chain and the division of income and profits along it’ (Talbot 2002: 703). It is in this particular way that the GCC works, organizing the various scopes of transnational production arrangements – the linkages between various economic agents such as raw material suppliers, factories, traders, and retailers- and attributing different sources of power (Gereffi 1994: 96). These linkages, which Gereffi (Ibid.: 2) calls boxes or nodes, provide a production process in which the commodity is transformed in some way. In this way, the GCC functions in the following manner: ‘Each successive node within a commodity chain involves the acquisition and/or organization of inputs (raw materials or semifinished products), labor force (and its provisioning), transportation, distribution (via markets or transfers), and consumption’ (Gereffi and Korzeniewicz 1994: 2). At each successive node and as the commodity is transformed in some way, value is added, and profits are generated (Talbot 1997: 57).

In an essay laying out the main elements of the GCC analysis, Gereffi (1999) identified four dimensions: the input-output structure (set of products and services linked together in a sequence of value-adding activity); territoriality (spatial dispersion or concentration of production and distribution networks); governance (authority and power relationships that determine how financial, material, and human resources are allocated and flow within the chain); and institutional framework (how local, national and international conditions and policies shape the production process at each stage of the chain) (Gereffi 1999: 97). The governance structure of the GCC has perhaps received the most attention of all these dimensions in part because it is here where barriers of entry and chain coordination appear and where the distinction between producer-driven and buyer-driven GCC governance structures is introduced (Raikes et al. 2000: 393). The distinction between producer and buyer driven governance involves power relations with respect to capital and technology. According to Gereffi (1994), producer-driven chains are often controlled by TNCs, global enterprises that manage the complete (or nearly complete) production system. Automobiles, computers or electrical machinery where capital and technology are intensive are good examples of this. Buyer-driven chains, on the other hand, seem to be controlled by large retailers, brand-names merchandisers and trading companies that control a decentralized production network, typically in Southern nations. The production of garments, footwear, toys, and consumer electronics where labor and production are intensive are examples of this type of chain.

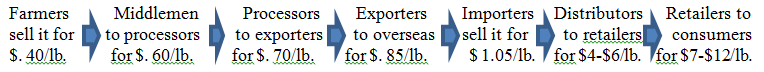

Coffee, like most agricultural commodities, falls into the category of a buyer-driven chain because processing companies, large retailers, and international traders control the industry's global trade pattern (Ponte 2002: 1101). These powerful actors have the capital needed to add value to the commodity as it changes hands. Large retailers, for instance, do this by creating brand names that highlight some unique trait of the coffee and then investing heavily in advertising and marketing. Furthermore, coffee is labor-intensive and mostly produced by millions of small farmers worldwide who enter the global market by selling their product to intermediaries or exporters. In the global movement of coffee, the issue of chain governance becomes linked to the issue of power relations, one intrinsically interwoven in the commodity chain itself. Power in the chain is reflected in the role of large firms as they coordinate overseas supplier networks (Patel-Campillo 2011: 82). In this way, in buyer-driven coffee commodity chains, large multinationals are able to coordinate and control overseas (Southern producers) networks because they maintain a hierarchical and capitalist power over smallholders. As the following figure shows, adapted from Levi and Linton (2003), the coffee chain involves a number of actors that shape the social and power relations within the global coffee trade.

As a commodity, coffee gains value as it moves away from the farmer, through the various stages of processing and distribution, until it reaches the consumer. With each passing stage in the process, profit margins increase. However, the value of the commodity increases disproportionally once the coffee leaves the farmers and reaches the hands of roasters and retailers. But nowhere is more evident to find disproportionate differences in the value of the commodity than in the comparison between the price paid at the first ‘stage’ in the commodity chain, the farmer, and the price paid by the last ‘stage’, right before it reaches the consumer: the retailer. For example, a coffee farmer in Uganda might sell a kilogram of green coffee beans for US $0.14 cents but by the time that kilogram of coffee reaches the shelves of a supermarket in the United Kingdom, the price has risen to US $26 (Gresser and Tickell 2002: 22). In the case of Costa Rican coffee farmers the situation is very similar. Carlos Jones, the Executive Director of Café Forestal Foundation, a non-profit organization associated with COOCAFE, describes the location of coffee farmers bluntly. ‘We are only in the first link, we are the ones that produce the raw material and it is other people who take the best out of it.’1 A coffee farmer associated with the cooperative Coopeatenas, located in the province of Alajuela, describes the vulnerability of the small coffee producer by saying ‘Who suffers the low [coffee] prices exactly? The producers. That is where we are and I don't know what we will do but something is going to have to be done because I think we would have to abandon production because we are [producers] exclusively the ones who suffer the low prices.’2

Coffee: A Global Commodity

Coffee provides income for about 25 million smallholders around the world (FairTrade Labelling Organization International [FLO] 2011) but most of the coffee produced, about 70 per cent, is grown in farms of less than 25 acres (10 hectares). In fact, most farms are between 2.5 and 12.5 acres (1–5 hectares). In some Latin American countries, such as Mexico, 90 per cent of coffee is grown on these types of small plots (Murray, Raynolds, and Taylor 2003). In Costa Rica, 92 per cent of coffee producers have coffee plots no larger than 5 hectares (Instituto del Café de Costa Rica [ICAFE] 2015). These small farmers experience a wide array of hardships, including lack of information on many issues regarding the production and sale of their crop – such as on coffee prices or an unfamiliarity with new technologies for coffee production and harvesting. Farmers also tend to lack their own transportation and must pay for the delivery of their green coffee beans to the mill. Many – if not most – need credit to finance their coffee operation but when the sale price of their crop is below their cost of production – situation that happens very often – many farmers are unable to repay their loans, reducing furthermore their ability to obtain credit in the near future, and placing them in a position of poverty.

Producers who harvest the coffee, who carry all the risks associated with the planting, caring of, and recollecting the fruit obtain little profits from the sale of their crop and yet consumers in wealthy nations pay a high price for their cup of coffee, not only at the supermarket but also at the coffee shop. Where is all the money going? The distribution of income for all actors involved in the global coffee market shows that transnational corporations (TNCs) are the actors that make most of the profits: In the early 1990s, earnings from coffee producing countries amounted to US $10 to $12 billion while the value of coffee in retail – owned by TNCs – was approximately US $30 billion. In 2003, producers only received US $5.5 billion from coffee production while retail sales exceeded US $70 billion (Kilk 2005: 228–229). The income gap seems to keep widening as coffee growers continue to receive a small fraction of the overall profits. It is difficult to ascertain to any specificity the net profits of TNCs as they do not disaggregate their profits by products in their financial reports but TNCs are the big winners in the whole global production and sale of coffee, an industry with an estimated total earnings of $173 billion in 2012 (ICO 2014: 12). Kraft Foods, for instance, with its two coffee brands – Maxwell House and Jacobs – each generated revenues exceeding $1 billion in 2010 (FLO 2012). But the power of these TNCs goes beyond their astounding profits. A small number of TNCs now dominate each part of the food chain, not just in coffee but also in other commodities such as flour, corn, beef or grain. For instance, only three companies today control 90 percent of world coffee exports (Redfern 2002). Beyond exporting and involving themselves in other aspects of the global trade, four companies today – ECOM, Louis Dreyfus, Newmann, and Volcafe – control about 40 per cent of all global coffee trade (FLO 2012).

Coffee roasters and marketers are also powerful players in the global distribution of coffee: Five corporations – Kraft, Nestlé, Sara Lee, Procter & Gamble and Tchibo – control about half of the global market (Daviron and Ponte 2005). These roaster companies purchase green coffee and roast it themselves, increasing profits because they purchase large volumes of coffee at lower prices. They also gain from the strength of their brands and products, investing heavily in advertising and product differentiation so they can compete on image and taste of their coffees and avoid competing with each other on price alone. They can mix and match different blends and qualities of coffee, developing technologies that mask the bitterness of the cheaper and lower quality coffees. They reduce costs by utilizing complex mathematical modeling tools that allow them to sign purchase agreements on a price to be paid for coffee six to eighteen months in the future, which gives them flexibility while reducing the risks of price volatility (Gresser and Tickel 2002: 27).

Exporters, roasters, importers and marketers of coffee – the agribusiness of coffee – capture most of the crop value as they control the processing of coffee in the countries of origin, the global coffee brands, and the distribution networks in the consuming countries. The small-scale farmer does not have access to the export market directly and they rarely have direct relationships with international buyers. According to Bacon et al. (2008: 47), the situation of coffee today shows the many power imbalances in the market.

The ‘bigger, faster, and cheaper’ mentality has created a supply-chain dynamic that exploits the most vulnerable at the bottom of the supply chain, including small-scale coffee farmers and farm workers. Regardless of price swings and market stagnation, transnational companies are increasing their control of the supply chain, squeezing out profits from producing countries and passing on costs to consumers… farm workers are losing out as the gains from globalization shift to the top… trade will continue to be a negative force in poverty reduction for export-oriented economies.

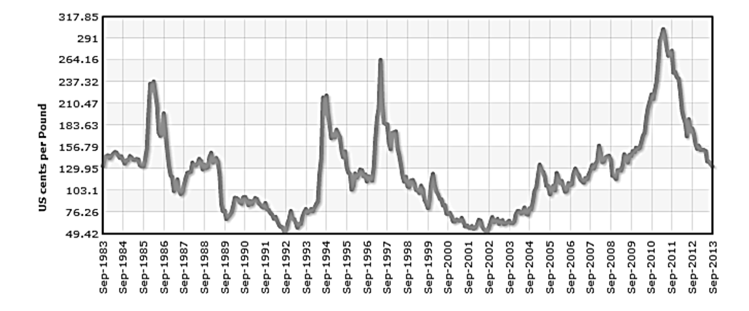

Producers, retailers, roasters, and marketers are all part of our globalized coffee market, a market that is defined by a lack of institutional regulation thus creating high volatility and uncertain prices. But regulation of the coffee market has existed in the recent past. From the 1960s until 1989, the global coffee industry was regulated through a system of export quotas which maintained the supply of global coffee stable and allowed for remunerable prices for coffee growers. Global coffee prices were determined at the New York Coffee, Sugar and Cocoa Exchange and fluctuated between $1.00 and $1.50 per pound, a high enough and stable price paid to farmers (Loveless 2012: 3). This balance between the global supply of coffee and the global demand was possible in part due to the 1962 International Coffee Agreement (ICA), signed by governments of producing and consuming countries. In 1989, however, and mainly due to the blatant incompatibility of such a global regulatory body with the strong free market economic policies of the era, the ICA collapsed. This collapse resulted in the plummeting of coffee prices in the international market and the devastation of many coffee producing communities around the world. After plummeting to just US $.45 cents per pound in 2001, worldwide coffee prices began to steadily increase year per year. Coffee prices increased to US $ .47 cents per pound in 2002; $ .51 cents in 2003; $.62 cents in 2004, $ .89 cents in 2005; and $ .95 cents in 2006. By 2007, coffee prices surpassed the dollar mark. Prices steadily increased and by 2008 coffee prices were US $1.24 per pound (International Coffee Organization [ICO] 2009). Prices were the highest in 2011, when a pound of coffee was sold at $2.10. However, since then, prices once again have begun to recede (in 2013, coffee prices were $1.19 per pound) (ICO 2014a).

Without the ICA, coffee producers around the world continued to produce without knowing whether or not and at what price they were going to be able to sell their crop. Moreover, global institutions such as the International Monetary Fund (IMF) and the World Bank – in their goal to boost small production around the world to carry out poverty reduction macro-plans – instituted controversial structural adjustment programs (SAPs) whereby the governments of coffee producing nations were to privatize state-owned industries (the coffee sector among them) and open them to global competition from private global traders, theoretically in order to improve their efficiency (ICO 2014b). These market liberalization policies have reduced the traditional role of states in controlling and regulating the coffee market, resulting in more power for the wealthy international investors. But lack of regulation created yet another huge detrimental issue for coffee farmers worldwide: Overproduction.

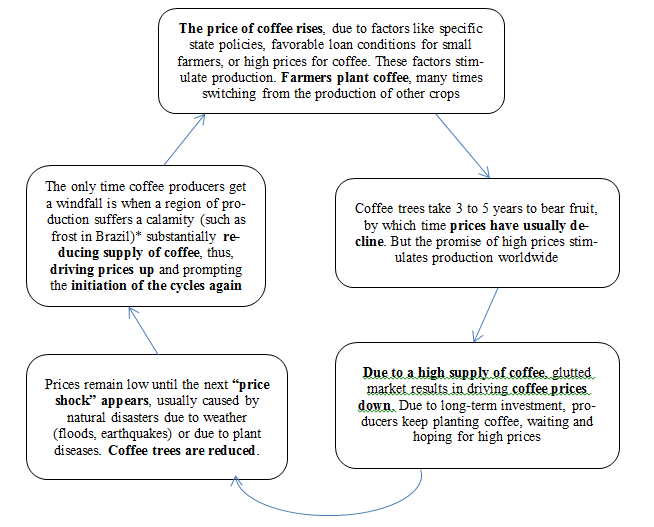

Traditionally, Brazil and Colombia had been the top world coffee producers until the fast growth of production in Vietnam in the 1990s that challenged Colombia's position and, with its huge supply contributions, pushed coffee prices down (Ponte 2002). The resulting oversupply of coffee sat the low price precedence that characterized the market between the years of 1999 and 2004 (as mentioned earlier, plummeting to a 30-year low of $.45 cents per pound) (Ponte 2002). Hundreds of thousands of coffee families abandoned their farms, migrated to urban centers in search for employment, or became paid laborers in other larger emerging plantations in their area (Ponte 2002). In a deregulated global coffee market, this market saturation that drives the price of coffee so low occurs in a cyclical pattern: overproduction sets the price extremely low. Farmers switch to other crops. Supply is then more limited. Underproduction sets the price high. This cyclical pattern – also called ‘boom-and-burst’ cycle – reflects extreme price fluctuations and contributes to the global condition of price uncertainty. This graph shows the ‘ups’ and ‘downs’ of coffee prices (September 1983 – September 2013) (adapted from Ritger 2013).

Fig. 1

The ‘boom-and-burst’ cycle of coffee production is historical. It existed in the late 1800s, when ‘too much coffee, then too little, then too much whipsawed Latin American economies’ (Pendergrast 1999: 1). These historical fluctuations continued after the deregulation of the coffee market throughout the 1990s. By the start of the 21st century, this price roller-coaster is becoming disproportionately problematic under current condition of globalization. This condition of volatility is ‘a measure of a market's propensity to variation used to describe the extent of price fluctuation’ (ICO 2005). These drastic price fluctuations affect small farmers in the most dramatic ways. These fluctuations have increased rural poverty, especially since the start of the free market period in 1990 as small producers have more difficulty in efficient planning of their resource allocation when the internal regulatory mechanisms in their own countries have been largely dismantled (ICO 2014a: 16). But how does the overall volume of coffee change so dramatically? The following flow chart, taken from Dicum and Luttinger's The Coffee Book, explains price instability and the response(s) of producers (Dicum and Luttinger 1999: 59).

Fig. 2

Note: * Brazil suffered an acute episode of frosts and droughts between June and July of 1994 that affected production. From August to November 1999, the country experienced one of its most severe droughts, contributing to the loss of approximately 40 percent of all coffee production. ICO: Frost and Droughts: About Coffee 2005.

How has the collapse of the ICA in 1989 and the subsequent price roller-coaster of prices worldwide affected coffee producers in Costa Rica? Harvesting of coffee declined in the 1990s as many farmers considered planting coffee an economic suicide. The reduced production of coffee is seen in exports. In 1990, Costa Rica exported 3,145,000 bags of coffee (60 kilograms each) while in 1995 only 2,698,000 bags were exported (Pratt and Harner 1997: 4). Export quantities have been in the decline since the 2000s as well: in 2003, Costa Rica exported 1,783,000 bags but by 2008 only 1,594,000 were exported (Pratt and Harner 1997: 4). As of November 2014, the ICAFE reported the number of 46 kilogram bags to be exported as 1,500,014 (ICAFE 2014). In a country such as Costa Rica, where growing coffee is a part of the country's identity and a source of national pride and history, the decline of coffee production is not only a sign of changing economic times but also a symptom of global production re-structuring processes that place small producers at a clear disadvantage.

Regardless of whether the price of coffee is on the rise or on the decline, the high volatility of the market creates high levels of uncertainty and other detrimental outcomes to the most disenfranchised actors in the global coffee chain, the farmers. One of these detrimental outcomes has become, in fact, a vicious circle. The low prices farmers obtain from their coffee translates into a lower investment in their plot which, in turn, translates into producing coffee of a much lower quality (and quantity) thus producing a lower return in their investment. A lower return in their investment means not only farmers make less money out of their coffee plot but also means that they will have less money to re-invest in their plot. The director of the group COOCAFE, – Consortium of Cooperative Coffee Growers of Guanacaste y Montes de Oro, – a second-level cooperative consortium in Costa Rica, considers this a very serious problem. Selling coffee at a low price means that

this is not going to allow you as a producer or as a family to survive. This is a vicious circle: not taking good care of your coffee plot because of a lack of [economic] resources means that the coffee plot – not well taken care of – will not only produce not as much coffee but also coffee with less quality. When you go to market, what is going to happen? They will ask for both things: quantity and quality. They'll argue ‘you don't bring volume or quality’. Hence the vicious circle.3

Many other interviewed farmers are well aware of this condition. A 30-year-old farmer, working and living on his father's 7 hectare farm and an associate of Coopesarapiquí, a coffee cooperative located in the province of Alajuela, explained that the idea that Costa Rica's coffee continues to be today, in 2014, the ‘granito de oro’ (golden seed) of Central America is unrealistic. ‘That is gone because plots don't harvest what they ought to harvest [due to] expensive fertilizers and low [coffee] prices. This is why people don't apply what they need to apply. If they would, then our production would increase, we would make more money.’4 Low coffee prices mean low earnings. Low earnings mean lower investment in the coffee plot. Lower investment in the plot mean lower coffee quantity produced and lower coffee quality all together. Lower quantity and lower quality mean less money in the market. In another instance, in this case a man who owns 1.5 hectares of land and an associate to the CoopeMontes de Oro cooperative, a cooperative located in the province of Puntaneras, explains that the reason why farmers do not produce today as much quantity of coffee as in the past twenty-five years can be understood under the global framework that encompass the GCC: the ups and downs of prices. He argues that

due to the fall of prices, coffees [prices] are good one or two years. After that it falls and stays down. If it was good for two years, it takes four years to get high back again. Then while the price is down, producers give up coffee production and move to the village and start to look for other opportunities. Then, coffee plots are abandoned and coffee is lost. That is why producers get unmotivated, due to the lack of stability in the price of coffee.5

Impoverished small-scale coffee farmers fight this ‘vicious cycle of destitution and debt’ (Clayton 2011: 9) when they do not produce enough coffee to cover their costs of production or they receive too little for their coffee, whatever price is allocated to the crop in the global economy. How can the farmer, the producer of the crop, be in such a disenfranchised position?

Implications for Producers

Not all coffee that is produced and sold in the global market follows all of these stages and some variations do apply. For instance, in Costa Rica many small farmers have formed cooperatives and their cooperatives own their own processing plants – precisely to shortcut the coffee transition from plot to market. Cooperatives also produce contracts and direct sales in consuming countries in other to avoid paying surcharges to export companies in their country. However, the context in which small coffee farmers are located within the commodity chain and the location – and access to power – that small producers occupy in the global sale of coffee condemns farmers to an eternal position of disadvantage. A coffee farmer and an associate of the cooperative Coopesarapiquí and owner of 4.5 hectares of land in the province of Alajuela explains that coffee farmers ought to be given more importance in the global production and sale of coffee. He argues that

the producer must be taken into account because, unfortunately, [this] goes according to hierarchies and the producer is never heard. In Costa Rica, small producers are discarded, like a person very far away, like [producers] are not important, [as if] there are more important things than the [coffee] production.6

Small farmers feel ‘discarded’, their work and crops underestimated, and their profession and livelihoods at risk. Their future prospects and economic safety have become dependent on their ability to manage the imposed risks of the market and develop coping strategies to survive the ‘ups and downs’ of the GCC. Producers have reacted in numerous ways to uncertain market conditions. According to Shannon (2009: 178), some farmers abandon their farms, their teenage boys leave the family and migrate to the United States in search of employment opportunities, or switch their crop from coffee to other more remunerable crops, sometimes illicit drugs. Aside from diversifying coffee production into other crops (mostly vegetables and fruits, in small quantities, and mostly for family consumption), the diversifying strategy undertaken by many of the farmers interviewed go beyond switching crops; it means engaging into other economic activities while trying to keep their coffee production. A farmer of the cooperative Coopeldós, located in the Tilarán, Abangares and Monteverde regions, who among other 77 men created the coffee cooperative in 1971 and owner of 2.5 hectares, explained the reason why he was not experiencing dire economic circumstances was that he supplemented his income with his job as a car mechanic. He argued that the money he obtains from his job is the reason why he has not lost his entire coffee production. ‘Whatever I make at the garage I use it to fumigate.’7 Another farmer who is an associate from another cooperative, CoopeAtenas, explained that

I think with that [low prices] I could not have survived and, if I myself could have, I could not have given my children their education. More so now that coffee prices, you well know, always have had strong fluctuations. Some years ago we were okay but now we are very bad. It is impossible for someone who produces a low amount of coffee to pay for their kids' education… I have a truck and I work on deliveries… I also deliver the gas to the cooperative.8

If the price paid for coffee is simply too low (sometimes so low it does not cover the costs of production) and working elsewhere is insufficient or not an option, farmers opt for diversifying their plots. This same farmer explained that coffee is only one of the crops planted. In addition, he plants citrus such as lemons and tangerines. Other farmers opt for farming. A 30-year-old farmer has cows, pigs, and chickens in his land. He uses the milk he obtains from seven cows to make cheese and sale it, already packaged and labeled, to the cooperative's supermarket and another small supermarket in the region, located very close to the farm. He started to diversify about twenty years ago. Until then, the whole plot had always been dedicated to the harvesting of coffee. When asked what factors contributed to his decision to diversify his coffee plot, he explained it was mainly due to

low [coffee] prices and high prices in agricultural inputs … we are con-sidering the alternative of diversification in order to have a little bit of different things so we live off different things, not just coffee. It is true that for the past 10 to 15 years, coffee prices have been going down, and that is the reason we had to diversify. Many people around here sold their farm and lost everything. Others abandoned them because they had to go work someplace else and coffee earnings were not enough. Climate change has also contributed a lot.9

Although farmers might be able to cope with the detrimental outcomes of the GCC – mainly low prices and a high level of uncertainty – by crop diversification and alternative job earnings, there is a difficult decision they must bear when it comes down to their own children's future. Most farmers with children save money to send their children to College in order to get a University degree that will free them from the obligation of farm work. Costa Rican small coffee communities are experiencing a high level of brain drain that is already quite visible. The manager of CoopeMontes de Oro explained that farmers are simply tired of so much hardship and that, in general, it is becoming almost impossible to work more than one hectare of coffee without family help. She said ‘The producer is tired of so much work; there are a lot of producers who are very old, many children who have gone away to College outside of the com-munity.’10 A farmer of the cooperative CoopeAtenas, a member of this cooperative for over 20 years, does not want his son to follow his footsteps in the coffee industry. When asked whether or not his 20-year-old son was going to follow the family business and keep the coffee plot, he stated

No, no, he is already in College. He studies Computer Science. Coffee is not doing well… it is not being fruitful. With the little that I get from it [coffee] I pay his studies so that he gets into something better, another field, in computers. It is better that he does not follow my footsteps.11

A farmer from Coopesarapiquí who plants coffee in 2.5 hectares of land argued that young people leave their homes in search of new types of jobs. Kids, he argued,

do not come back. It is very hard [here]. Depending on the degree they obtain. Even if they come back, there is no opportunity for employment so most of them stay in the Central Valle… This is very typical. Those who go away to study stay in San José… Young people have lost their interest; it is obvious that younger people do not want to produce coffee because they realize that coffee [production] is a lot of work… The sale of coffee is very difficult because it is very unstable; you go to sell it to the international market today at $1.80 and tomorrow it is at $1.50… it is very hard.12

Conclusion

The idea that small coffee producers living in remote areas of the world, most of them considered unschooled and poor, could be not only successful actors but active participants in the outcomes of the global trading mechanisms of commodities remains a challenge, especially if those farmers produce coffee for export. Traditionally, the wealth produced in the coffee industry has bypassed the people who actually produce the crop. In our globalized world and under current free market ideology, coffee producers continue to be unfortunately largely excluded from the great wealth that trading can produce once their crop leaves their hands and enters the global market trading system. The GCC depicts the movement of coffee from Southern tropical producing countries (such as Costa Rica) to Northern industrialized consuming countries (such as the United States and countries in Europe). This linear movement of commodities, from the periphery to the core, denotes a condition of dependency whereby producing nations produce a cash crop for Northern consumers and depend on the revenue obtained from the sale to subsist. This linear movement involves a number of ‘steps’ or ‘chains’ that the product must pass through, from producers to consumers. In the GCC of coffee the key actors involved in the set of chains from producers to consumers involve intermediaries, processors, exporters, roasters, distributors, and retailers, all adding value to the commodity, even though many times the commodity itself does not experience any physical change. But this added value excludes the very first actor in the chain: the small producer. As the examination of the GCC has shown, small farmers must navigate in a tumultuous, unpredictable, and highly volatile sea of prices. When prices are so low that they are unable to cover their expenses, their livelihoods are at risk. With less money, families have less money to buy food, medicines and other living expenses and farmers have less money to re-invest in their fields, re-pay their previous loans and debts, and save for future harvests. Entire communities might compete for the few employment opportunities available to its residents in their local area and many suffer great financial and social losses.

As this paper has shown, the volatility of the global coffee market has forced small-scale coffee farmers in Costa Rica to react. Some farmers support their coffee earnings with supplemental income they receive from other activities beyond agriculture; others diversify their fields with other crops they hope to sell in the market; and yet others, afraid that their impoverished condition will outlast them, are making great sacrifices in sending their children away to school so they themselves switch professions, away from their parents' coffee plots. In order to imagine a world where commodity producers can live decent productive lives, the current system of international trade require some modifications to give rural producers in the South a chance to take a fair role in the globalized economy. Commodity producer countries need a type of global trade that is equitable for all actors involved and must not be based on exploitative conditions where some enrich themselves at the expense of others. Long lasting peaceful trade must be profitable for all actors involved in business transactions, not just for those who control knowledge, technology, capital and marketing tools. A reformulation of the GCC is needed in order to achieve this equity. State and non-state actors must be included in the discussion of the global trade of commodities since government and its institutions have a critical role to play in the regulation of the free market of coffee.

NOTES

1 ‘Nosotros estamos nada más en el primer eslabón, somos los que damos la materia prima y los otros son los que se llevan lo mejor.’ Carlos Jones, Executive Director of Fundación Café Forestal. Alajuela. Interviewed and translated by the author. March 2013.

2 ‘¿Quién sufre los bajos precious exactamente? Los productores. Ahí estamos y no sé qué vamos a hacer pero algo va a haber que hacer porque yo creo que vamos a tener que abandoner la producción porque somos exclusivamente los que sufrimos los bajos precious’. Carlos Carranza, coffee producer and associate of Coopeatenas. Interviewed and translated by the author. March 2013.

3 Esto no le permite a Usted como productor y como familia sobrevivir. Eso lleva a un círculo vicioso: attender mal el cafetal porque no se tiene recursos significa que ese cafetal mal atendido te va a producer no solo menos café sino un café de menor calidad. Cuando Usted vaya al mercado ¿qué va a pasar? Te van a reclamar esas dos cosas: No traes volúmenes pero tampoco calidad. Entonces se entra en un círculo vicioso. Alvaro Gómez, interviewed and translated by the author, March 2013.

4 ‘Eso se ha perdido porque la plantación aqui no cosecha lo que deberia cosechar debido a las trabas del abono, que está caro, y los bajos precios del café. La gente aquí no aplica lo que tienen que aplicar. Si aplicamos lo que tenemos que aplicar, entonces vamos a subir la producción, habría más dinero.’ José Francisco Mairén Méndez, coffee farmer and associate of Coopesarapiquí. Alajuela. Interviewed and translated by the author. March 2013.

5 ‘[Por las caidas de precios] que el café un año está bien, dos está bien, después baja y dura. Si estuvo a buen precio dos años, dura 4 años para volverse a levantar. Entonces mientras se levanta [el precio] muchos productores desisten de la actividad y se van al pueblo o empiezan a buscar otras alternativas y entonces descuidan el café y empieza a perderse. Es por eso que el productor de desmotiva, por la falta de estabilidad en el precio del café.’ Miguel Elisando Mesén, coffee farmer and associate of CoopeMontes de Oro. Interviewed and translated by the author. March 2013.

6 William Valverde Zamora, ‘El productor tiene que ser tomado más en cuenta porque desgraciadamente esto va por orden de jerarquías y el productor no es escuchado. En Costa Rica los caficultores nos tienen allá, como una persona muy lejana, como que no es importante, como que hay cosas mas importantes que la producción.’ Alajuela. Interviewed and translated by the author. March 2013.

7 ‘Lo que saco en el taller pues lo agarro para fumigar.’ Carlos Paulino Román Vega, associate from Coopeldós. El Dos de Tilarán, Aguacaste. Interviewed and translated by the author. March 2013.

8 ‘Creo que con eso [bajos precious] no podría vivir y si podría vivir no les podría dar estudio a mis hijos. Y más aún cuando los precious del café, Usted lo sabe bien, siempre han sido con fluctuaciones muy Fuertes. Hace un par de años estábamos muy bien, ahorita estamos muy mal. Sería casi imposible para alguien que produzca poco café que pueda darle estudio a los hijos… Yo tengo un camion y hago transporte… y le transport el combustible a la cooperative.’ Gavelo Vargas. Interviewed and translated by the author. March 2013.

9 ‘Los bajos precious y altos precious de consumes agrícolas… estamos considerando la alternative de diversificación para tener un poquito de cada cosa para que chupemos de diferentes cosas, no simplemente del café. El café, es cierto, de 10 años para acá o 15 años los precios han estado disminuyendo, por alli es donde tuvimos que diversificar. Mucha gente de por aqui de la zona que vendieron la finca y se quedaron sin nada. Otros que las abandonaron porque tenian que ir a trabajar a otro lado y no les daba el café en ese momento. El cambio climático tambien ha afectado mucho.’ Jose Francisco Mayren Mendez, farmer and associate of Coopesarapiquí. Interviewed and translated by the author. March 2013.

10 ‘El productor está cansado de tanto trabajo, hay muchos productores que son muy mayors, muchos hijos se han ido a estudiar fuera de la comunidad.’ Margarita Jimenez, General manager of CoopeMontesdeOro. Interviewed and translated by the author. March 2013.

11 ‘No, no, él está ya en la Universidad. Estudia Informática. El asunto del café no está muy bien… no está dando. Yo de lo poquito que me queda le estoy pagando el estudio para que él vaya mejor a coger otro ámbito, en la Informática. Mejor no siga mis pasos, mejor.’ Carlos Carranza, farmer and associate of CoopeAtenas, Atenas. Interviewed and translated by the author. March 2013.

12 ‘No regresan. Es que es muy dificil. Depende de la carrera que estén llevando. Bueno, si regresan, aquí no hay oportunidad de empleo entonces la mayoria se quedan en la Meseta Central… Esto aquí es muy típico. Todo el que se va a estudiar se queda en San José… La gente joven pierde el interés; se ve que la gente joven no quiere producer café porque se dan cuenta que el café lleva mucho trabajo… La comercialización del café es muy dificil porque es muy inestable; si Usted va a venderlo al mercado internacional hoy puede estar a $180 y mañana puede que esté a $150… es muy dificil.’ William Valverde Zamora, associate of Coopesarapiquí. Interviewed and translated by the author. March 2013.

REFERENCES

Bacon, C. M., Méndez, V. E., Gliessman, S. R., Goodman, D., and Fox, J. A. (eds.) 2008. Confronting the Coffee Crisis: Fair Trade, Sustainable Livelihoods and Ecosystems in Mexico and Central America. Cambridge: The MIT Press.

Clayton, T. 2011. Fair Trade Coffee in a Global Economy. Global Tides 5 (4): 1–17.

Daviron, B., and Ponte, S. 2005. The Coffee Paradox: Global Markets, Commodity Trade and the Elusive Promise of Development. London: Zed.

Dicum, G., and Luttinger, N. 1999. The Coffee Book: Anatomy from Crop to the Last Drop. New York: New York Times.

Fair Trade Foundation. 2012a. Fair Trade and Coffee: Commodity Briefing. URL: www. fairt rade.net. Accessed 3 December 2014.

Fair Trade Foundation. 2012b. The Coffee Supply Chain: Who Wields the Power? URL: www.fairt rade.net. Accessed 3 December 2014.

Fitzgerald, C. S. 2012. Fair Trade as a Community Development Initiative: Local and Global Implications. Advances in Social Work 13 (2): 375–390.

Garretón, M. A., Cavarozzi, M., Cleaves, P. S., Gereffi, G., and Hartlyn, J. (eds.) 2003. Latin America in the 21st Century: Towards a New Sociopolitical Matrix. Miami: North-South Center at University of Miami.

Gereffi, G. 1994. The Organization of Buyer-Driven Global Commodity Chains: How U. S. Retailers Shape Overseas Producion Networks. In Gereffi, G., and Korzeniewicz, M. (eds.), Commodity Chains and Global Capitalism (pp. 95–122). Westport, CT: Praeger.

Gereffi, G. and Korzeniewicz, M. 1994. Introduction: Global Commodity Chains. In Gereffi, G., and Korzeniewicz, M. (eds.), Commodity Chains and Global Capitalism. Westport, CT: Praeger.

Gibbon, P. 2001. Upgrading Primary Production: A Global Commodity Chain Approach. World Development 29 (2): 345–363.

Gresser, C., and Tickell, S. 2002. Mugged: Poverty in Your Coffee Cup. London: Oxfam International.

Hopkins, K., and Wallerstein, I. 1986. Commodity Chains in the World Economy Prior to 1800. Review 10 (1): 157–170.

Instituto del Café de Costa Rica (ICAFE). 2014. Estadísticas de Café. Comercialización. Cosecha 2013–2014. URL : http://www.icafe.go.cr. Accessed 11 November 2014.

Instituto del Café de Costa Rica (ICAFE). 2015. Nuestro Café: Productores. URL : http:// www.icafe. go.cr. Accessed 16 January 2015.

International Coffee Organization (ICO). 2005. Letter from the Executive Director: Coffee Market Report. URL : http://www.ico.org. Accessed 3 May 2005.

International Coffee Organization (ICO). 2009. Indicator Prices: Monthly and Annual Averages (1998–2009). URL : http://www.dev.ico.org/prices/p2 files/sheet001.htm. Accessed 26 May 2009.

International Coffee Organization (ICO). 2014a. Indicator Prices: Monthlly and Annual Averages. URL: http://www.dev.ico.org/prices/p2 files/sheet001.htm.

International Coffee Organization (ICO). 2014b. World Coffee Trade (1963–2013): A Review of the Markets, Challenges and Opportunities Facing the Sector. London: 112th Session, March 2014.

Kilk, A. 2005. Corporate Social Responsibility in the Coffee Sector: The Dynamics of MNC Responses and Code Development. European Management Journal 23 (2): 228–229.

Levi, M., and Linton, A. 2003. Fair Trade: A Cup at a Time? Politics and Society 31 (3): 407–432.

Loveless, K. 2012. The Impact of the Fair Trade Market on Coffee Farmers in Costa Rica. Undergraduate Journal of Global Citizenship 1 (2): 1–21.

Murray, D., Raynolds, L. T., and Taylor, P. L. 2003. One Cup at a Time: Poverty Alleviation and Fair Trade Coffee in Latin America. Fair Trade Research Group. Colorado State University.

Patel-Campillo, A. 2011. Transforming Global Commodity Chains: Actor Strategies, Regulation, and Competitive Relations in the Dutch Cut Flower Sector. Economic Geography 87 (1): 79–99.

Pendergrast, M. 1999. Uncommon Grounds: The History of Coffee and How It Transformed Our World. New York: Basic Books.

Pongratz, K. 2007. Fair Trade Coffee in Costa Rica: A New Model for Sustainable Development? Ph. D. Dissertation.

Ponte, S. 2002. The Latte Revolution? Regulation, Markets and Consumption in the Global Coffee Chain. World Development 30 (7): 1099–1122.

Pratt, L., and Harner, C. 1997. Sustainability Analysis of the Coffee Industry in Costa Rica. Centro Latinoamericano para la Competitividad y el Desarrollo Sostenible (CLACDS).

Redfern, A. 2002. A Third World Perspective. Proceedings of a Meeting of the British Society of Animal Science and the Scottish Centre for Animal Welfare Sciences.

Ritger, M. 2013. What Goes Up Must Come Down: Coffee Futures Boom to Burst. Alternative Assets/Commodities/Futures. www.michaelritger.com. Accessed 29 October 2013.

Shannon, S. W. 2009. Economic Stimulation: The History and Hope of Coffee in Development. Transnational Law & Contemporary Problems 18 (1): 169–196.

Talbot, J. M. 1997. Where Does Your Coffee Dollar Go? The Division of Income and Surplus Along the Coffee Commodity Chain. Studies in Comparative International Development 32 (1): 56–91.

Talbot, J. M. 2002. Tropical Commodity Chains, Forward Integration Strategies and International Inequality: Coffee, Cocoa and Tea. Review of International Political Economy 9 (4): 701–734.