Globalization and Innovative Performance: An Analysis of Moderating Role of Intangible Knowledge Assets of a Country

Journal: Journal of Globalization Studies. Volume 13, Number 2 / November 2022

DOI: https://doi.org/10.30884/jogs/2022.02.09

Globalization has opened new avenues for international trade. Multinational Enterprises (MNEs) are shifting their production facilities to other countries to benefit from cheap factors of production. However, the influence of globalization on innovative performance is not consistent. This means that globalization is a necessary but not sufficient condition for explaining innovative performance. The intangible knowledge assets may explain this variation. For this purpose, data on 125 countries from different sources was gathered for the period from 2018 to 2020. Results findings show that globalization is positively correlated with the innovative performance of the country. Moreover, countries having a higher level of intangible knowledge assets tend to get more benefits from globalization in enhancing their innovative performance. Thus, countries possessing such comparative advantages become more attractive for MNEs, which in turn fosters technological output and economic growth of the host country.

Keywords: globalization, intangible knowledge assets, innovative performance, technology output.

Ansar Waseem, University of Management and Technology more

1. Introduction

Globalization entails a combination of different economic, social, environmental, and political factors (Dreher 2006). Globalization is not a unified term. Rather, it is an aggregate of manifold facets. In economic terms, it is explained through trade openness and free movement across geographical boundaries. It also entails the free exchange of ideas, information, and learning at a global level (Zheng et al. 2019). Globalization transcends geographical boundaries and allows for the integration of ideas, technology, and governance in a complex interdependent system (Gygli et al. 2018). It has enabled Multinational Enterprises (MNEs) to develop global supply chain systems by outsourcing production activities and conducting business in other countries (Buckley and Hashai 2020). Consequently, globalization fosters technological transfer from one country to another. Since it is changing the landscape of global scientific knowledge (Gui, Liu, and Du 2019).

The topic of innovation is popular among scholars and practitioners. Literature concurs that internationalization activities of multinational enterprises supported by globalization spur innovation activities (Leiponen and Helfat 2011; Pla-Barber and Alegre 2007; Rakho 2016; von Zedtwitz and Gassmann 2002). These studies focus only on the economic aspects of globalization (Zheng et al. 2019); whereas the political and social dimensions of globalization are somewhat ignored. But the effect of globalization on innovative performance is not consistent. For instance, Ali and Malik (2021) note that there exists a wide variation in technological output between high, medium, and low-income countries. Moreover, the sub-sample analysis conducted by Zheng et al. (2019) reveals that globalization produces better innovative performance for medium-innovative countries. This shows that globalization is a necessary but not sufficient condition to explain the technological output of any country. This variation may be explained by other boundary conditions. One such condition is the intangible knowledge assets of the country since previous research work establishes that education influences innovation and technology adoption (Chi and Qian 2010; Danquah and Amankwah-Amoah 2017).

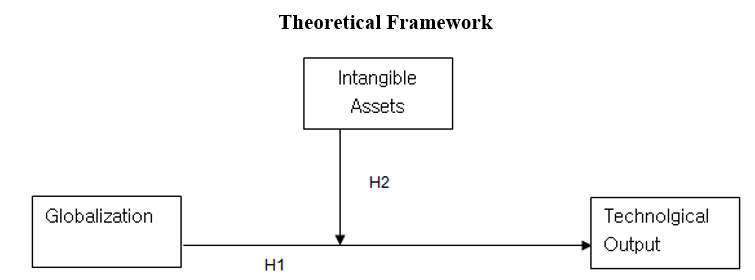

The present study investigates whether the current wave of globalization is indeed beneficial in improving the technology output of a country, and in what way are the country's intangible knowledge assets beneficial in strengthening the relationship between globalization and technology output. Drawing inspiration from the OLI Framework, Resource-Based View, Knowledge-Based View, and Ricardian theory of comparative advantage, the purpose of this study is to investigate the relationship between globalization and the innovative performance of the country. This is done by taking the technological output score from Global Innovation Index as a measure of the innovative performance of a particular country. In addition, the intangible knowledge assets of the host country are important boundary conditions that may complement the relationship between globalization and innovative performance. It is argued that a higher level of intangible knowledge assets will lead to higher technology output attributable to globalization.

The effect of globalization on innovation is a topic of interest for scholars, governments, and international institutions alike (Archibugi and Iammarino 2002). Studies regarding the development, use, and eventual diffusion of innovation are conducted both at national and international scales (Sundqvist et al. 2005). An important contribution of this paper is to study the influence of globalization on innovation performance at the country level. Most of the existing studies take firms as their unit of analysis and/or their effect is limited to firms operating in a particular country. This creates that doubt that the findings of these research studies are limited to a particular country (Lu and Beamish 2004). This is a major research limitation declared by Castano, Mendez, and Ga-lindo (2016) since it creates issues of generalization as pointed out by Berry and Kaul (2016). Moreover, studies that undertake cross-country analysis in studying the relationship between globalization and innovative performance are rare (Griffith et al. 2006). Ali and Malik (2021) noted that it is difficult to monitor the dynamic effect of globalization over an extended period. Here we use data for the period from 2018–2020 to study the variation in innovative performance due to globalization.

In addition, the local factor of the host country in transforming the positive effect of globalization into enhanced innovative performance has not received much attention. Researchers tend to overlook the role of country-specific factors in shaping the innovative output of the study (Rahko 2016). This can be a potentially interesting area for future research. To the best of the authors' knowledge, no empirical work has been conducted to gather data at the country level to study the relationship between globalization and the innovative performance of a country especially by considering intangible knowledge assets of the host country as a moderating variable. Hence, the current paper seeks to provide insight into the role of country-specific factors in enhancing the innovative performance of a country.

2. Literature Review

Globalization is explained as ‘the process of creating networks of connections among actors at multi-continental distances, mediated through a variety of flows including people, information and ideas, capital, and goods. It is a process that erodes national boundaries, integrates national economies, cultures, technologies, and governance, and produces complex relations of mutual interdependence’ (Dreher 2006: 1092). Globalization means removing trade barriers and making resource mobility easier (Oladimeji, Ebodaghe, and Shobayo 2017). As a result, dependency and connectivity between different global actors have increased (Waseem et al. 2018). In terms of scientific and technical knowledge, globalization means the easy exchange of ideas on a global level. Mobility of knowledge workers from technological advance countries to developing ones and technology transfer through trade globalization fosters technological adoption (Febiyansah 2017; Zheng et al. 2019). Moreover, the closed model of innovation has become outdated, and firms are adopting the open-innovation paradigm. This process is facilitated by Multinational Enterprises (MNEs) that are an efficient source for the transfer of firm-specific technology and advanced knowledge from one country to another (Buckley and Hashai 2020). Hence, a swift cross-border flow of complex scientific and technical knowledge is the most prominent outcome of globalization (Gui et al. 2019) that spurs technological innovation.

Technological innovation is defined as a ‘multi-stage process whereby organizations transform ideas into new/improved products, service or processes, in order to advance, compete and differentiate themselves successfully in their marketplace’ (Ba-regheh, Rowley, and Sambrook 2009: 1334) Continuous organizational learning, internationalization, and innovation are imperative for an organization to survive (Chiva, Ghauri, and Alegre 2014). Internationalization, in terms of business research, is defined as ‘the process of becoming aware of the importance of international transactions for the future development of the firm, as well as the process of investing in and undertaking business transactions in other countries' (Calof and Beamish 1995). Internationalization is an important activity in the acquisition of knowledge related to innovation (Ghauri and Park 2012) as it allows the firm to gather new and diverse ideas from different markets and cultures (Hitt, Hoskisson, and Ireland 1994). Further, internationalization allows a firm to become closer to their local customers, which enables them to tailor their product according to their needs.

Mostly, big firms are moving towards internationalization, especially in international R&D, to create and maintain sustainable competitive advantage (Lu and Beamish 2004), and this trend is present in the MNE of both developed and emerging economies. International diversification is defined as ‘expanding across country borders into geographical locations that are new to the firm’ (Hitt, Hoskisson, and Ireland 1994). The firms can also make use of the knowledge acquired through globalization to increase their technological output and outperform their rivals (Kim, Kim, and Hoskisson 2010; William and Shaw 2011). The firms can acquire important strategic assets and critical resources from their global operations, which help them not only avoid the institutional constraint of the local market but also compete at a global scale (Luo and Tung 2007). Organizations tend to expand their operation to exploit new opportunities, develop their innovation capabilities, attract local talent and reduce R&D expenses (Fan 2011). The use of cutting-edge technology and internationalization provides firms with a first-mover advantage (Castano et al. 2016). In addition, globalization also helps MNEs to access local universities, scientists, researchers, and knowledge spillover (Florida 1997; von Zedtwitz and Gassmann 2002). Thus, international diversification has become a source of higher performance for the firms operating in the global market as compared to the firms operating locally.

The benefits of globalization are not only limited to Multinational Enterprises of developed countries. Rather, globalization has allowed firms in emerging economies to expand their business into foreign countries (Wu et al.2016). Luo and Tung (2007) define Emerging Market Multinational Enterprises (EM MNEs) as ‘international companies that originated from emerging markets and are engaged in outward FDI, where they exercise effective control and undertake value-adding activities in one or more foreign countries’ (p. 482). Foreign companies of emerging economies are increasing their innovation and technological output not just through conducting R&D activities in other countries, but they have also established collaborative relationships with knowledge centers such as universities (Jin, Wu, and Chen 2011). These EM MNEs take advantage of knowledge creation through increased global collaboration and interaction among various actors at different levels. In emerging economies, the MNEs manage to overcome their competitive disadvantage by developing strategies of technological learning and innovation to catch up with the dominating firms (Fan 2011). They are using their global alliance and joint ventures to make breakthrough products. These firms use their glo-bal network to imitate the technology developed in the advanced countries, then acquire and assimilate their knowledge, and improve that developed technologies to compete with the global leaders (Ibid.). This may be attributed to the fact that ‘networks with greater amounts of knowledge offer greater opportunities for knowledge access and hence greater possibilities for innovation’ (Almeida and Phene 2004: 851). The motive to operate in overseas business provides the MNEs, especially in emerging economies with a springboard that can be used for learning and innovation (Luo and Tung 2007). Resultantly, the EM MNEs have given rise to a new phenomenon of ‘reverse innovation’ that is ‘the case where an innovation is adopted first in poor (emerging) economies before “trickling up” to rich countries’ (Govindarajan and Ramamurti 2011: 191).

3. Research Hypotheses

3.1. Globalization and Technological Output

Nowadays, many MNEs are shifting their production facilities to under-developed countries. On the one hand, the MNEs enjoy lower transaction and production costs, while on the other hand, the host country can gain access to the latest technology. Likewise, the competition between foreign and host counties may also increase. Many scholars believe that competition between firms results in the reduction of monopoly rents, and increases the innovation and productivity of competing firms. From a neo-classical economic perspective, technological transfer from advanced countries is an important source of technological advancements in poor countries. Thus, multinational corporations have become a means to transfer technology from developed countries to un-developed ones since these corporations have worked for decades to establish an ‘efficient production network’ throughout the world (Wang and Hong 2012). The facility of cheap factors of production such as low wages labour and land in third-world countries has attracted global capital. Now many multinational enterprises are shifting their production facilities to low wages countries. This causes knowledge spillover which the host country can use to increase its innovation output.

Hypothesis No 1:

Keeping in view the above discussion, we can propose our first hypothesis

‘The technological output of a country is positively associated with its globalization score.’

3.2. Moderating Role of Intangible Knowledge Assets

Nowadays, organizations are operating in the era of a knowledge-based economy. To compete in such an environment, organizations are constantly required to update their knowledge base. For this purpose, organizations must overcome the mental and physical obstructions of learning and innovating (Chiva, Ghauri, and Alegre 2014). The Resource-Based View (Barney 1991) and Knowledge-Based View (Grant 1996; Nonaka and Takeuchi 1995) of the firms have emphasized the importance of using firm-specific resources, especially knowledge resources, by exploitation of the knowledge and ideas of different markets (Von Zedtwitz and Gassmann 2002). The main underpinning of these theories shows that firms with unique and inimitable resources can leverage them in the international markets (Kotabe, Srinivasan, and Aulakh 2002). Likewise, evolutionary theories of the firms suggest that the knowledge-based assets acquired and assimilated by the firm due to its foreign operations help to increase the knowledge-base which in turn enhances the firm's innovation capacity (Kogut and Zander 1993).

Resultantly, MNEs use the host countries as a source of new knowledge as well as a source of cheap labour (Dunning 1994; Almeida and Phene 2004). The knowledge-based assets are highly tacit and thus difficult to replicate. Scholars believe that absorptive capacity (Cohen and Levinthal 1990; Zahra and George 2002) is an important factor that enables firms to reap maximum advantage through their globalization initiatives (Wu et al. 2016) since the innovation is the ability to learn and combine knowledge obtained from different sources (Yamakawa et al.2008). The absorptive capacity also helps to internalize the knowledge obtained from global operations and bridges the technological gaps between home and host countries (Rosenkopf and Almeida 2003). On the other hand, the MNEs with low absorptive capacity may be unable to take full advantage of their international collaboration, which hampers their innovation output (Wu et al. 2016).

The motive of having better access to the latest knowledge and technology also prompts MNEs to internationalize their R&D activities (Kuemmerle 1999). Firms that are successful in acquiring knowledge-based assets are in a better position in the Global Value Chain system. For this purpose, MNEs have developed subsidiaries that are working in different countries to use unique resources and knowledge for the generation of novel technological ideas (Jacobides, Knudsen, and Augier 2006). These can be either market-seeking units or resource-seeking ones (Dunning 1994). These subsidiaries also act as ‘listening posts’ for the MNEs (Hedge and Hicks 2008) and become an important source of transferring knowledge back to the home country (Wu et al. 2016). They are used for increasing the flow of knowledge from technologically advanced countries to MNEs (Dabicet al. 2012). Foreign subsidiaries of the firms also help in attracting, recruiting, and nurturing the global talent of scientists and researchers, which can enhance the innovative output of the firm (Tung 2007; Kwan and Chiu 2015; Wu et al. 2016). Nowadays, subsidiaries are used for both knowledge exploration and knowledge exploitation (Kuemmerle 2002). Kotabe, Srinivasan, and Aulakh (2002) have found that the globalization of firms leads to better performance under the condition of a higher level of R&D capabilities as compared to those firms with lower R&D capabilities. Thus, it can be inferred that the innovative capabilities of the host countries also affect the innovative performance of MNEs.

The knowledge-based theory postulates that the competitive advantage of a firm is based on its ability to acquire, create, share and apply knowledge. This theory is regarded as an outgrowth of different research which includes ‘organizational learning, the resource-based view of the firm, organizational capabilities and competencies, and innovation and new product development (Grant and Baden-Fuller 1995). This theory is based on the assumption that knowledge is a key strategic resource for sustainable competitive advantage, and a firm can increase its productivity through a combination of different types of knowledge (Ibid.). Therefore, the important question for the strategic managers of MNEs is how they can exploit the existing knowledge or organize different knowledge to generate a new form of knowledge (Breschi, Lissoni, and Malerba 2003).

The primary role of the firm is to integrate special knowledge possessed by the individual into products or services (Grant 1996). By discovering new knowledge or solutions through a unique combination of different forms of knowledge possessed by the organization, the managers can earn above-normal profits (Nickerson and Zenger 2004). It can be inferred that the firm can take advantage of specialized owned resources, particularly knowledge assets, in the international market. It can produce better products or solutions through the combination of knowledge in the home country and the knowledge obtained from R&D internationalization. Such firms can enjoy a sustainable competitive advantage both in the domestic and foreign markets.

In similarly vain, the role of intangible knowledge assets of the host country can attract foreign MNEs as such countries offer better protection of intellectual property. So, the MNE can invest in these countries without the fear of losing their knowledge assets. The MNEs are usually more inclined to invest in countries that themselves are good in innovation and technological output. The innovative capabilities of the host countries can also substantially affect the innovative performance of MNEs. Hence, it can be concluded that a country with a larger scope of intangible knowledge assets can use globalization to produce more technological output as compared to the countries that possess fewer such assets.

Hypothesis No 2:

‘The relationship between globalization and technological output is moderated by intangible assets of a country in such a way that a higher level of intangible assets will lead to higher technological output as compared to lower level of intangible assets.’

4. Research Design and Result Section

4.1. Data Collection

This study follows the positivist paradigm and deterministic view which implies that any phenomenon is a chain of events; wherein ‘chains of events follow one after the other according to the law of cause and effect’ (Chiva, Ghauri and Alegre 2014: 867). This study employs secondary data for analysis and our unit of analysis involved countries. For this purpose, data were collected from different reliable sources for 125 countries for the period from 2018 to 2020. For instance, data regarding globalization was gathered from the KOF globalization index, which represents a composite score along social, economic, and political dimensions of globalization similar to the conceptualization of Dreher (2006) and Xiaoqun (2018), etc. Similarly, Global Innovation Index was consulted to measure the technological output of a country. In this index, the technological output is represented through knowledge creation, knowledge impact, and knowledge diffusion. Moreover, the Global Innovation Index was also the source of data regarding intangible knowledge assets.

4.2. Preliminary Data Analysis

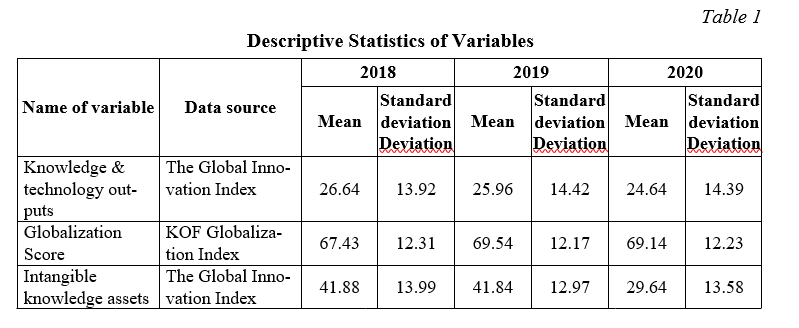

The SPSS software was used to perform different statistical tests. In the first step, mean and standard deviation scores were calculated. The results of the uni-variate descriptive statistics for different years are presented in Table 1.

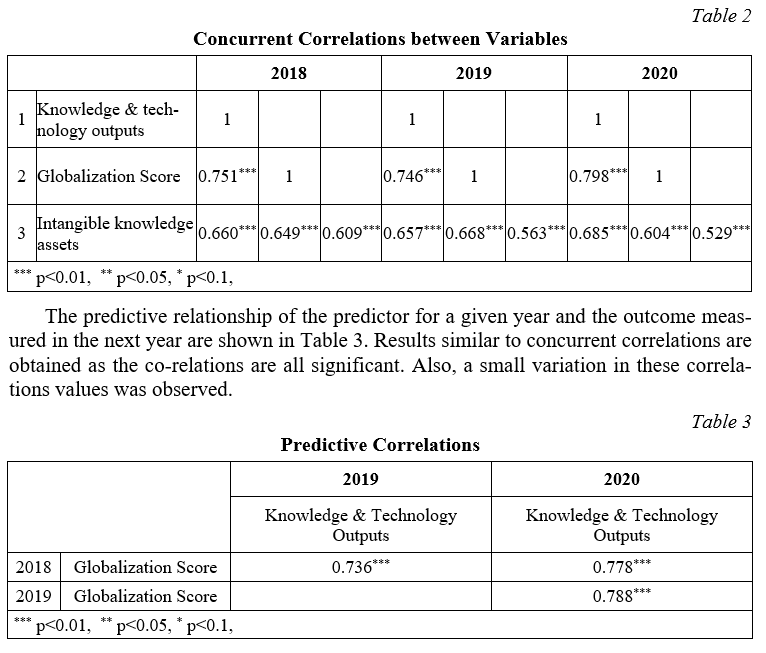

In the next step, concurrent and predictive correlations between variables were determined, which are demonstrated in Table 2 and 3 respectively. For concurrent correlations, all the variables were measured in the same year. As can be seen from Table 2, these correlations were statistically significant with a moderate to a strong association between the three variables.

4.3. Hypothesis Testing

In order to test the proposed research hypotheses, the hierarchical regression analysis approach was applied. Moreover, the moderating effect of intangible knowledge assets on the relationship between globalization and technological output was assessed through interaction term, effect size, and slope of the regression equation.

Hierarchical regression analysis was carried out to test out research hypotheses. For testing the hypothesis which predicts that Intangible Knowledge Assets moderate the relationship between globalization and technology output, the interaction term was calculated through a mean-centered predictor and moderating variables. This allows for reducing the potential effect of multi-collinearity (Cohen et al. 2013).

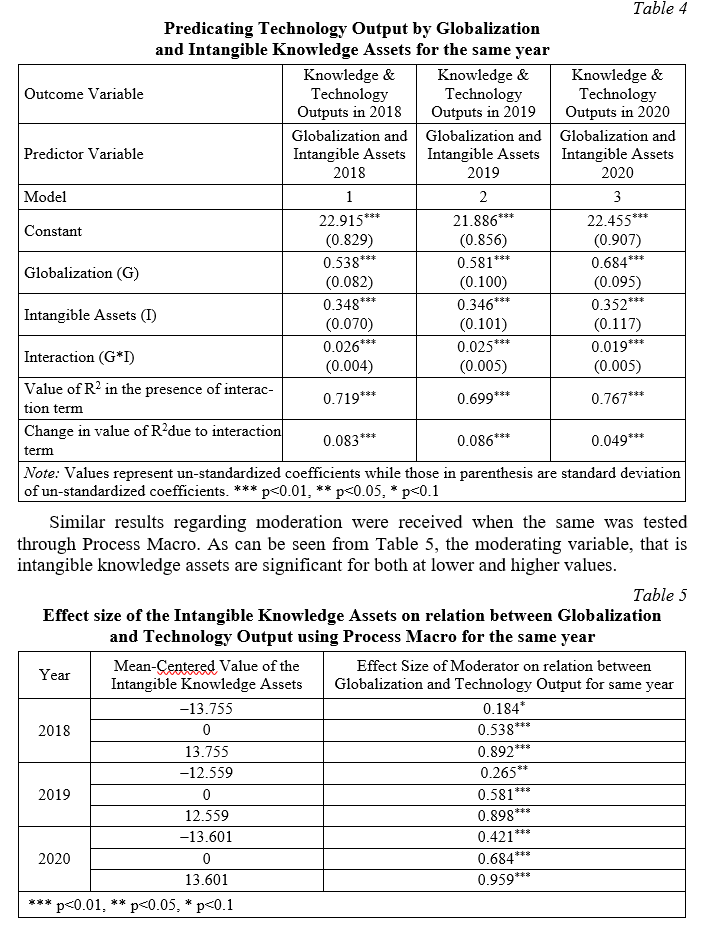

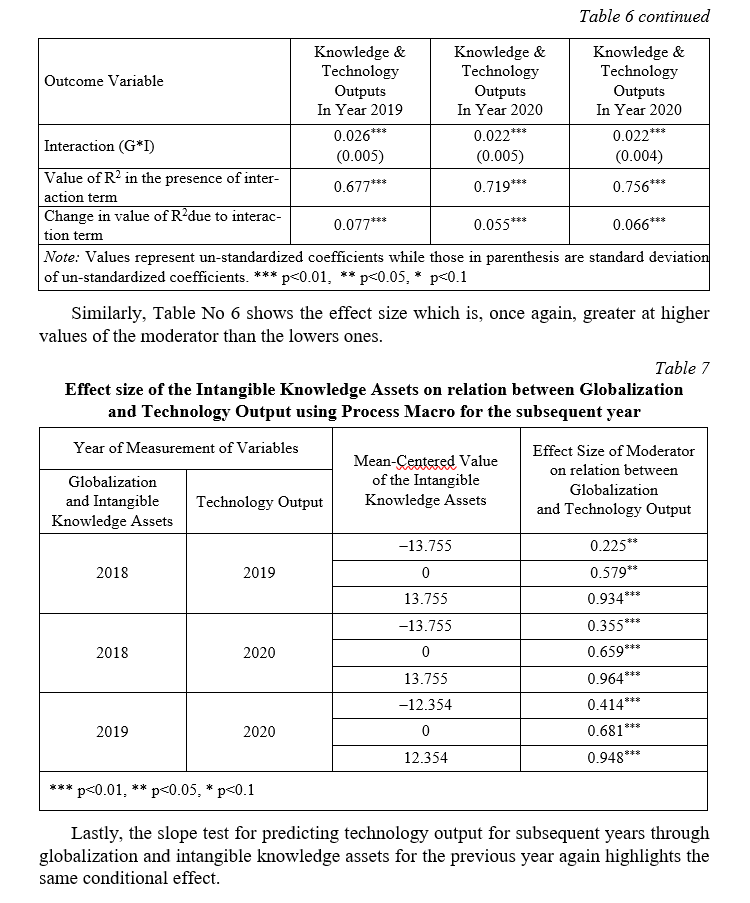

In the first part of this hierarchical regression analysis, values for all three variables for the same year were taken into consideration. As evident from Table 4 (Models 1–3), the standardized coefficient for the globalization score is positively and significantly associated with the technological output of the country. Therefore, our first hypothesis is supported. Also, these concurrent association highlights that our interaction terms are statistically significant for all three models, and the interaction terms resulted in an increase in the value of R2 which lends support to our second hypothesis.

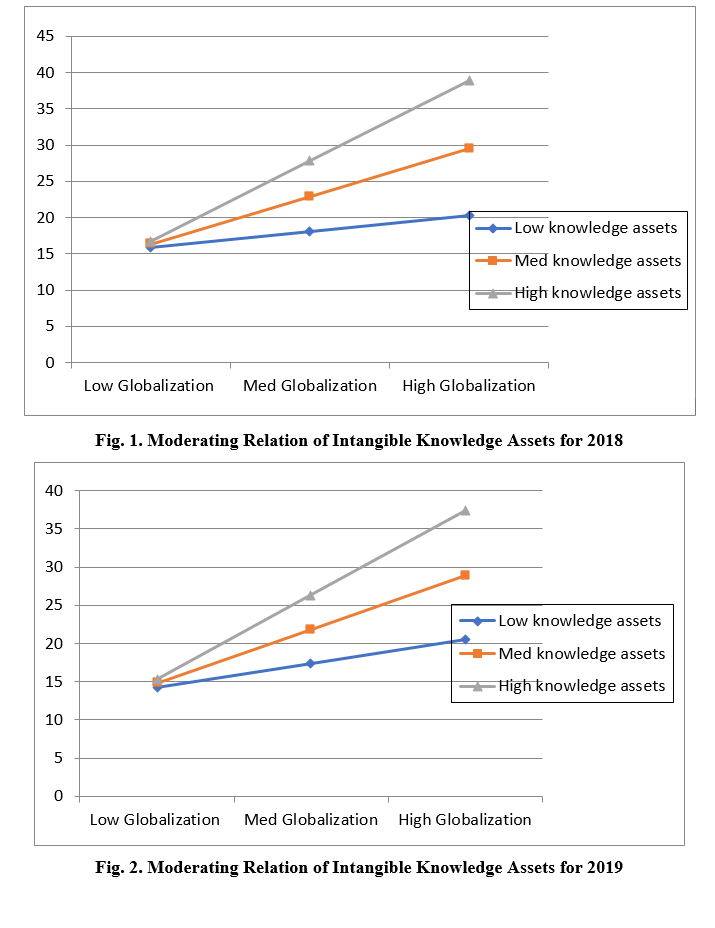

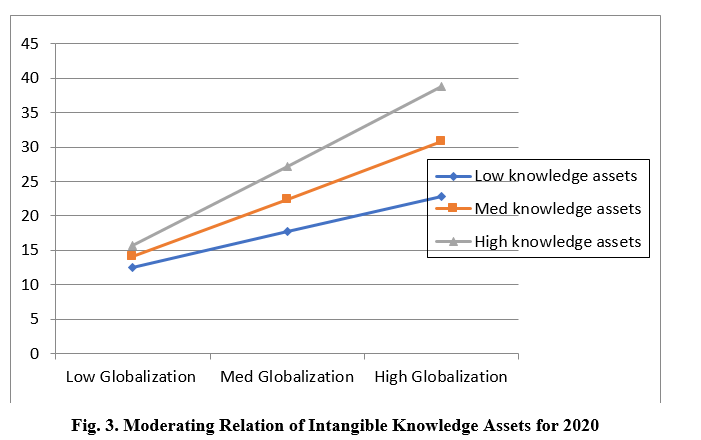

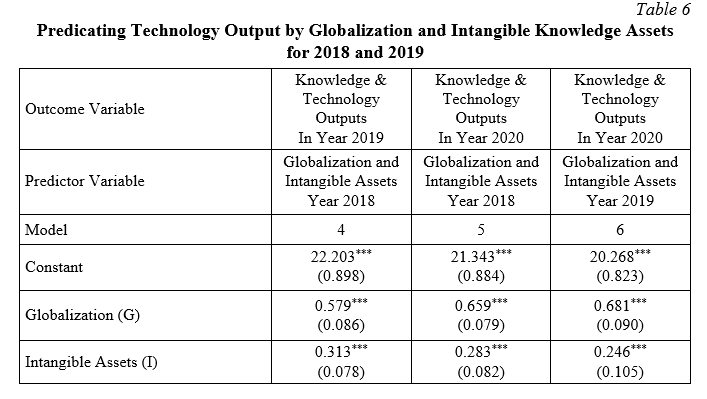

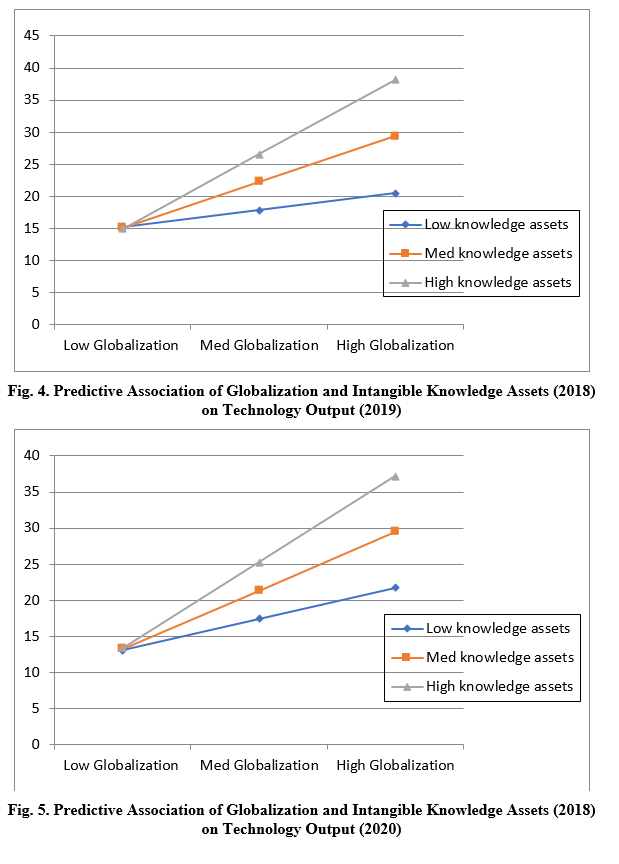

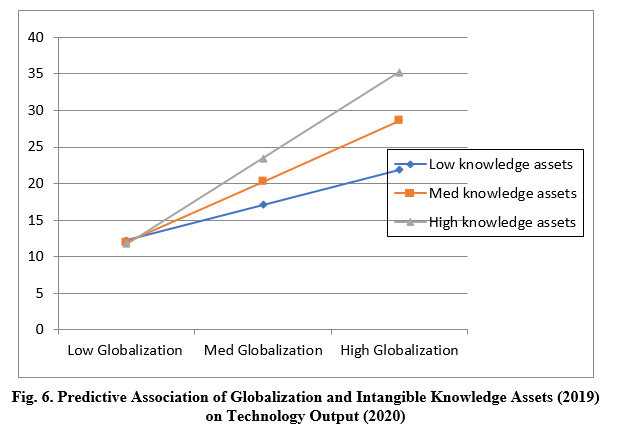

In the end, slope analysis was employed to confirm the moderating hypothesis. Figures 1–3 show that the slope of the regression equation becomes steeper as we move from a lower to a higher value of the moderator. This is indicative of the fact that the relationship between globalization and technology output becomes stronger at a higher value of intangible knowledge assets.

The validity of the above results was checked by repeating these three tests through predictive association. For instance, in the hierarchical regression analysis, the value of technology output for the years 2019 and 2020 (subsequent years) was used; whereas globalization, Intangible Knowledge Assets, and their interaction term were used for the preceding year 2018. Still, globalization was positively and significantly related

to technological output. In addition, the interaction term in all three models (Models 6 & 7) remained statistically significant.

5. Discussion on Results

The current paper aims to study the relationship between globalization and innovative performance at the country level. For this purpose, the KOF Globalization Index was used to measure the globalization score of different countries. Unlike previous studies that relied solely on the economic aspect of globalization, this study uses a composite indicator of the KOF Globalization Index that measures globalization along economic, political, and social dimensions. This enabled us to capture the essence of globalization more holistically. The research findings reveal a high correlation between globalization and technological output. These results are aligned with the argument of Zhang and Roelfsema (2015) who emphasized that those local regions that maintain more connections with the global actors exhibit higher innovative performance. Globalization is regarded as the prime driver of economic activities in underdeveloped countries (Xiaoqun 2018). As such, globalization has a direct and indirect influence on the innovative performance of firms. On a direct level, it provides an opportunity to learn by observing the activities of MNEs. Indirectly, it fosters technological growth by stimulating competition. Such stiff competition keeps local firms on their toes, and they have to improve the technological processes as well as the quality of their offerings to compete at the international level. This also enables local firms to provide a substitute for imported goods. Furthermore, technological innovation in one country produces imitation and demand gaps in the host country. China is a prominent example here. Despite being a socialist country, the Chinese government has allowed foreign multinational firms to establish their production facilities in China. This is supported by ‘repositions of the value of innovation’ (Ramo 2005: 228). As a result, the Chinese GDP increased annually by 9.8 per cent from 1978 to 2007 (Cheng and Yang 2012).

The second objective of the current paper is to study the moderating influence of intangible knowledge assets on the relationship between globalization and innovative performance. Our findings, duly supported by the robustness check, provide empirical support to this hypothesis. The endogenous growth theory proposed by Romer (1990, 1994) argues that technological innovation leads to economic growth (Fatima 2017). This effect is strengthened under the condition of the educational attainment of the workers (Zheng et al. 2019). Indigenous innovation and local knowledge assets are beneficial in the assimilation of knowledge obtained through the activities of MNEs. Education imparts technical competence that strengthens imagination and creativity regarding the use of available technology and promotes innovative processes. Thus, a country having a strong base for intangible knowledge assets has a comparative advantage over others. It becomes attractive for foreign firms to shift their R&D and production facilities to that country. India has a solid base for IT industries. This attracted various mobile phone manufacturing and software developing MNEs to work in India to tap into their knowledge assets. This example can also encourage governments to devise policies for the growth of entrepreneurial activities and the creation of small and medium enterprises (Datis 2014). Such comparative advantages allow developing countries to benefit from the wave of globalization.

The Great Convergence Theory (Grinin and Korotayev 2015) also predicts that the rate of economic growth of poorer countries is faster compared to richer ones. In a similar vein, the shifting of production facilities of MNEs to underdeveloped economies will boost their technological output at a faster rate than the more technologically advanced countries. The knowledge spill-over created by the transference of knowledge by MNEs urges the local industries of the host country to innovate and find new sources to survive the global competition. In this way, the under-developed countries may become closer to the developed countries in terms of technological progress. Globalization of science and technology creates a win-win situation as both the MNEs' parent country and host country benefit from it (Guiet al. 2019).

6. Conclusion

The purpose of this study is to investigate the impact of globalization on the innovative performance of a country. The moderating effect of intangible knowledge assets has been also examined. The results show that globalization is positively and significantly associated with the technological output of a country. Moreover, the country's intangible knowledge assets have moderating influence on boosting technological output attributable to globalization. The study establishes that less developed countries may benefit from globalization to gain access to advanced forms of scientific and technical knowledge. The center of production is shifting from the West towards the East. This provides unique opportunities for these underdeveloped countries. They should develop pro-globalization policies. The anti-globalization policies come at a cost of reduced knowledge transfer as they restrict the movement of scientific and technical knowledge, ideas, and knowledge workers across political borders. Therefore, the policies that facilitate internationalization and activities of MNEs become a source for improvement of technological output as well as of the economic growth.

REFERENCES

Ali, S., and Malik, Z. K. 2021.Revisiting Economic Globalization‐Led Growth: The Role of Economic Opportunities. Journal of Public Affairs 21 (2): e2193.

Almeida, P., and Phene, A. 2004. Subsidiaries and Knowledge Creation: The Influence of the MNC and Host Country on Innovation. Strategic Management Journal, 25 (8–9): 847–864.

Archibugi, D., and Iammarino, S. 2002. The Globalization of Technological Innovation: Definition and Evidence. Review of International Political Economy 9 (1): 98–122.

Baregheh, A., Rowley, J., and Sambrook, S. 2009. Towards a Multidisciplinary Definition of Innovation. Management Decision 47 (8): 1323–1339.

Barney, J. 1991. Firm Resources and Sustained Competitive Advantage. Journal of Management 17 (1): 99–120.

Berry, H., and Kaul, A. 2016. Replicating the Multinationality‐Performance Relationship: Is there an S‐curve? Strategic Management Journal 37 (11): 2275–2290.

Breschi, S., Lissoni, F., and Malerba, F. 2003. Knowledge-Relatedness in Firm Technological Diversification. Research Policy 32 (1): 69–87.

Buckley, P. J., and Hashai, N. 2020. Skepticism toward Globalization, Technological Knowledge Flows, and the Emergence of a New Global System Global Strategy Journal 10 (1): 94–122.

Calof, J. L., and Beamish, P. W. 1995.Adapting to Foreign Markets: Explaining Internationalization. International Business Review 4 (2): 115–131.

Castano, M.-S., Mendez, M.-T., and Galindo, M.-A. 2016. Innovation, Internationalization and Business-Growth Expectations among Entrepreneurs in the Services Sector. Journal of Business Research 69 (5): 1690–1695.

Cheng, L., and Yang, P. 2012. China Model in Globalization Process. Journal of Globalization Studies 3 (1): 67–78.

Chi, W., and Qian, X. 2010. The Role of Education in Regional Innovation Activities: Spatial Evidence from China. Journal of the Asia Pacific Economy 15 (4): 396–419.

Chiva, R., Ghauri, P., and Alegre, J. 2014. Organizational Learning, Innovation and Internationalization: A Complex System Model. British Journal of Management 25 (4): 687–705.

Cohen, J., Cohen, P., West, S. G., and Aiken, L. S. 2013. Applied Multiple Regression/Cor-relation Analysis for the Behavioral Sciences. Routledge.

Cohen, W. M., and Levinthal, D. A. 1990. Absorptive Capacity: A New Perspective on Learning and Innovation. Administrative Science Quarterly 128–152.

Dabic, M., Daim, T. U., Aralica, Z., and Bayraktaroglu, A. E. 2012. Exploring relationships among Internationalization, Choice for Research and Development Approach and Technology Source and Resulting Innovation Intensity: Case of a Transition Country Croatia. The Journal of High Technology Management Research 23 (1): 15–25.

Danquah, M., and Amankwah-Amoah, J. 2017.Assessing the Relationships between Human Capital, Innovation and Technology Adoption: Evidence from Sub-Saharan Africa. Technological Forecasting and Social Change 122: 24–33.

Datis, K. 2014. A Perspective on Media Entrepreneurship Policy: Globalization of Knowledge and the Opportunities for Developing Economies. Journal of Globalization Studies 5 (2): 174–187.

Dreher, A. 2006. Does Globalization Affect Growth? Evidence from a New Index of Globalization. Applied Economics 38 (10): 1091–1110.

Dunning, J. H. 1994. Multinational Enterprises and the Globalization of Innovatory Capacity. Research Policy 23 (1): 67–88.

Fan, P. 2011. Innovation, Globalization, and Catch-up of Latecomers: Cases of Chinese Telecom Firms. Environment and Planning 43 (4): 830–849.

Fatima, S. T. 2017. Globalization and Technology Adoption: Evidence from Emerging Economies. The Journal of International Trade and Economic Development 26 (6): 724–758.

Febiyansah, P. T. 2017. Indonesia's FDI–Exports–GDP Growth Nexus: Trade or Investment-driven? Buletin Ekonomi Moneterdan Perbankan 19 (4): 469–488.

Florida, R. 1997. The Globalization of R&D: Results of a Survey of Foreign-Affiliated R&D Laboratories in the USA. Research Policy 26 (1): 85–103.

Ghauri, P. N., and Park, B. I. 2012. The Impact of Turbulent Events on Knowledge Acquisition. Management International Review 52 (2): 293–315.

Govindarajan, V., and Ramamurti, R. 2011. Reverse Innovation, Emerging Markets, and Global Strategy. Global Strategy Journal 1 (3–4): 191–205.

Grant, R. M. 1996. Toward a Knowledge‐Based Theory of the firm. Strategic Management Journal 17 (S2): 109–122.

Grant, R. M., and Baden-Fuller, C. 1995. A Knowledge-Based Theory of Inter-firm collaboration. Paper presented at the Academy of Management Proceedings.

Griffith, R., Huergo, E., Mairesse, J., and Peters, B. 2006. Innovation and Productivity across Four European Countries. Oxford Review of Economic Policy 22 (4): 483–498.

Grinin, L., and Korotayev, A. 2015. Great Divergence and Great Convergence. A Global Perspective. Springer International Publishing.

Gui, Q., Liu, C., and Du, D. 2019. Globalization of Science and International Scientific Collaboration: A Network Perspective. Geoforum 105: 1–12.

Gygli, S., Haelg, F., Potrafke, N., and Sturm, J. E. 2019. The KOF Globalization Index–Revisited. The Review of International Organizations 14 (3): 543–574.

Hegde, D., and Hicks, D. 2008. The Maturation of Global Corporate R&D: Evidence from the Activity of US Foreign Subsidiaries. Research Policy 37 (3): 390–406.

Hitt, M. A., Hoskisson, R. E., and Ireland, R. D. 1994. A Mid-Range Theory of the Interactive Effects of International and Product Diversification on Innovation and Performance. Journal of Management 20 (2): 297–326.

Jacobides, M. G., Knudsen, T., and Augier, M. 2006. Benefiting from Innovation: Value Creation, Value Appropriation and the Role of Industry Architectures. Research Policy 35 (8): 1200–1221.

Jin, J., Wu, S., and Chen, J. 2011.International University-Industry Collaboration to Bridge R&D Globalization and National Innovation System in China. Journal of Knowledge-based Innovation in China 3 (1): 5–14.

Kim, H., Kim, H., and Hoskisson, R. E. 2010. Does Market-Oriented Institutional Change in an Emerging Economy Make Business-Group-Affiliated Multinationals Perform Better? An Institution-Based View. Journal of International Business Studies 41 (7): 1141–1160.

Kogut, B., and Zander, U. 1993. Knowledge of the Firm and the Evolutionary Theory of the Multinational Corporation. Journal of International Business Studies 24 (4): 625–645.

Kotabe, M., Srinivasan, S. S., and Aulakh, P. S. 2002.Multinationality and firm Performance: The Moderating Role of R&D and Marketing Capabilities. Journal of International Business Studies 33 (1): 79–97.

Kuemmerle, W. 1999. The Drivers of Foreign Direct Investment into Research and Development: An Empirical Investigation. Journal of International Business Studies 30 (1): 1–24.

Kuemmerle, W. 2002. Home Base and Knowledge Management in International Ventures. Journal of Business Venturing 17 (2): 99–122.

Kwan, L. Y. Y., and Chiu, C. y. 2015. Country Variations in Different Innovation Outputs: The Interactive Effect of Institutional Support and Human Capital. Journal of Organizational Behavior 36 (7): 1050–1070.

Leiponen, A., and Helfat, C. E. 2011. Location, Decentralization, and Knowledge Sources for Innovation. Organization Science 22 (3): 641–658.

Luo, Y., and Tung, R. L. 2007. International Expansion of Emerging Market Enterprises: A Springboard Perspective. Journal of International Business Studies 38 (4): 481–498.

Lu, J. W., and Beamish, P. W. 2004. International Diversification and Firm Performance: The S-curve Hypothesis. Academy of Management Journal 47 (4): 598–609.

Nickerson, J. A., and Zenger, T. R. 2004. A Knowledge-Based Theory of the firm – The Problem-Solving Perspective. Organization Science 15 (6): 617–632.

Nonaka, I., and Takeuchi, H. 1995. The Knowledge-Creating Company: How Japanese Companies Create the Dynamics of Innovation. New York: Oxford University Press.

Oladimeji, M. S., Ebodaghe, A. T., and Shobayo, P. B. 2017. Effect of Globalization on Small and Medium Enterprises (SMEs) Performance in Nigeria. International Journal of Entrepreneurial Knowledge 5 (2): 56–65.

Pla-Barber, J., and Alegre, J. 2007. Analysing the Link between Export Intensity, Innovation and Firm Size in a Science-Based Industry. International Business Review 16 (3): 275–293.

Rahko, J. 2016. Internationalization of Corporate R&D Activities and Innovation Performance. Industrial and Corporate Change 25 (6): 1019–1038.

Ramo, J. C. 2005. The Beijing Consensus: Notes on the New Physics of Chinese Power. London: Foreign Policy Centre.

Romer, P. M. 1990. Endogenous Technological Change. The Journal of Political Economy 98 (5): 71–102.

Romer, P. M. 1994. The Origins of Endogenous Growth. Journal of Economic Perspectives 8 (1): 3–22.

Rosenkopf, L., and Almeida, P. 2003. Overcoming Local Search through Alliances and Mobility. Management Science 49 (6): 751–766.

Sundqvist, S., Frank, L., and Puumalainen, K. 2005.The Effects of Country Characteristics, Cultural Similarity and Adoption Timing on the Diffusion of Wireless Communications. Journal of Business Research 58 (1): 107–110.

Tung, R. L. 2007. The Human Resource Challenge to Outward Foreign Direct Investment Aspirations from Emerging Economies: The Case of China. The International Journal of Human Resource Management 18 (5): 868–889.

Von Zedtwitz, M., and Gassmann, O. 2002. Market versus Technology Drive in R&D Internationalization: Four Different Patterns of Managing Research and Development. Research Policy 31 (4): 569–588.

Wang, H., and Hong, Y. 2012. Globalization and its Impact on China's Technology Innovation System. Journal of Technology Management in China 7 (1): 78–93.

Waseem, A., Ullah, M., Naveed, and Azam, F. 2018. Interactive Effect of Globalization and FDI in Predicting Technology Output of a Country. Dialogue (Pakistan) 13 (4): 403–416.

Williams, A. M., and Shaw, G. 2011. Internationalization and Innovation in Tourism. Annals of Tourism Research, 38 (1): 27–51.

Wu, J., Wang, C., Hong, J., Piperopoulos, P., and Zhuo, S. 2016. Internationalization and Innovation Performance of Emerging Market Enterprises: The Role of Host-Country Institutional Development. Journal of World Business 51 (2): 251–263.

Xiaoqun, Z. 2018. Globalization and the Contribution of the Media Economy to a National Economy: A Cross-Country Empirical Study. Journal of Globalization Studies 9 (2): 32–49.

Yamakawa, Y., Peng, M. W., and Deeds, D. L. 2008. What Drives New Ventures to internationalize from Emerging to Developed Economies? Entrepreneurship Theory and Practice 32 (1): 59–82.

Zahra, S. A., and George, G. 2002. Absorptive Capacity: A Review, Reconceptualization, and Extension. Academy of Management Review 27 (2): 185–203.

Zhang, Y., and Roelfsema, H. 2015. Globalization, Foreign Direct Investment, and Regional Innovation in China. In Khee Giap Tan and Kong Yam Tan (eds.), Foreign Direct Investment and Small and Medium Enterprises: Productivity and Access to Finance (pp. 9–34). WSPC.

Zheng, M., Feng, G. F., Feng, S., and Yuan, X. 2019. The Road to Innovation vs. the Role of Globalization: A Dynamic Quantile Investigation. Economic Modelling 83: 65–83.