Australia in the Framework of the Asian Integration Initiatives: The Choice of Future

Journal: Journal of Globalization Studies. Volume 14, Number 1 / May 2023

DOI: https://doi.org/10.30884/jogs/2023.01.01

Elnur Mekhdiev, Center for Analysis and Forecasting the Development of the Scientific and Technological Complex, the Russian Research Institute of Economics, Politics and Law in Science and Technology (RIEPL), Moscow, Russian Federation

Igbal Guliev, International Institute of Energy Policy and Diplomacy, Moscow State Institute of International Relations (University) of the Ministry of Foreign Affairs of the Russian Federation (MGIMO University), Moscow, Russian Federation

Fedor Arzhaev,Institute for Research of International Economic Relations, Financial University under the Government of the Russian Federation (Financial University), Moscow, Russian Federation

Today, various integration initiatives are underway in the Asia-Pacific region. Australia, as one of the fastest growing economies in the region, aspires to regional leadership and pursues a middle power strategy; however, the interests of China and the United States, the key players influencing the integration processes, clash here. In the context of China's creation of new development institutions, there is a considerable amount of interest to the extent to which the existing institutions are suited to the new realities and in determining the country's most favorable developmental strategy. The present article examines how pro-American and sinocentric institutions benefit Australia. The authors identify the characteristics of economic development and, according to the selected parameters, assess the impact of scenario choice on Australia and its main partner – New Zealand. After examining the main advantages and disadvantages of two possible scenarios, the authors confirm the hypothesis that joining the sinocentric institutions is more beneficial for Australia, subject to implementing a national development strategy that compensates for excessive sinicization. The authors propose a system of measures to reduce the impact of the negative effects of this choice on the Australian economy. The authors note that the Oceania region should be included in the integration processes within the Chinese model.

Keywords: Australia, New Zealand, monetary institutions, integration, strategy.

Introduction

Today, globalization processes are the main framework for the interaction between countries on the world stage. No economy in the world can exist in isolation from others, while there is an active search for allies in the implementation of its own economic policies (Ng 2016). It is precisely globalization and transnationalization as parallel processes that create the conditions for the interaction between superpowers on the world stage. Australia can hardly be considered a superpower, although its economic development cannot be ignored. At the same time, for the past decade or so, China has been actively strengthening its positions in the world and in Asia, encroaching on the historically established position of the United States as a result of its participation in supranational organizations (Shulgin, Zinkina, and Andreev 2019; Truevtsev 2016).

At the moment, globalization in Asia unfolds in the format of a bicentric confrontation between the People's Republic of China and the United States just as in Europe (Guliyev et al. 2022). Globalization in China involves a wide range of institutions, including development institutions such as the Asian Infrastructure Investment Bank and participation in the BRICS New Development Bank, and is subject to the global paradigm of the Chinese economic expansion within the Belt and Road. China today has become an alternative center of power not only in Asia, but also in the world, with a large GDP and significant political influence (Sterling 2017; Sznajderska 2017); the country actively uses its economic resources to shape and build political influence. With regard to the Trans-Pacific Partnership initiative, which is quite important for the Asia-Pacific region, one should note the softer position of the PRC in relation to its new format (Petri and Plummer 2020). Nevertheless, one can hardly assume that the PRC will abandon its project of the Regional Comprehensive Economic Partnership (RCEP), which was created as an alternative to the TPP.

During Donald Trump's administration, the United States has somewhat weakened the foreign policy vector and focused on domestic issues, especially since this period was marked by large-scale public protest movements that forced Trump to concentrate on smoothing out these contradictions. The year 2020 was marked by a global slowdown in international relations (Lipscy 2020), the political process concentrated on the fight against COVID-2019, while the confrontation in the political arena somewhat changed its focus. Thus, the United States has played a rather passive role in globalization processes in Asia in recent years.

Positioning itself as one of the centers of power in Asia, Australia cannot but participate in globalization in the region. However, a number of processes in which the country plays the key role are related to the promotion of American initiatives (Beeson 2003; Tow 2017). In fact, Australia is now a fairly mediocre player in the political arena in Asia, the country's economic integration is largely associated with its participation in the Comprehensive and Progressive Agreement for the Trans-Pacific Partnership (TPTPP) (Nguyen 2017). In fact, the US withdrawal from the format and Biden's refusal to consider a return to it as a priority suggests that the USA is not ready to develop it further (Nikkei Asia 2020).

In the modern context, the Asia-Pacific region is developing at a rapid pace. Within the region, the number of integration initiatives aimed at creating a new regional hegemon, that is the PRC, is growing. In this situation, within the concept of regional integration, Australia's position as one of the new forces in the region should be determined in order to identify the opportunities and disadvantages of cooperation for the country.

In this study we propose to identify the opportunities and risks of Australia's cooperation with China-centered and pro-American institutions in Asia; we also propose to identify the opportunities and risks associated with regional integration associations with Australia's participation in the formation of the Asian monetary and financial architecture.

We suppose that the integration processes in Asia can be clearly divided into those initiated by China and those initiated by the United States, as there is a confrontation between these two key players in the region today. At the same time, it should be noted that there are still a significant number of countries in the region that can claim to be Australia's key partners in terms of both trade and investments, for example, Vietnam, Japan or South Korea; but all these countries follow the two above-mentioned political and economic vectors.

In terms of institutional development, the PRC offers inclusive institutions for Australia and its regional satellites, while the United States and its allies see the Asia-Pacific regional development in the context of elite development institutions, of which Australia is also considered a member.1

From this perspective, the pro-American institutions offer Australia peculiar privileges over other countries in the region in the short term, while China-centric potential benefits are the long–term prospects (Cook 2015). In this context, it seems highly relevant to identify the main advantages and disadvantages of both paths.

Literature Review

The Asian integration model is characterized by numerous regional centers and the search for regional sub-leaders under all integration models (Andreosso-O’Callaghan 2008). This situation presents a very difficult choice for Australia: the two main models in Asia are the China-led model and the pro-American model (Demir 2018), both of which are familiar to Australia and may provide various opportunities. The choice which Australia is to make is even more difficult since Australia has long pursued a ‘third power’ strategy. The main outcomes of this strategy are described in (Carr 2019), where the author states, that Australia will have to find a new balance between these two powers instead of choosing one side. The other point of view is expressed by Nick Bisley (2017), who states that Australia will have to rely on its own policies and look for allies in South Asia and Commonwealth countries, for instance, try to become an ally of India. However, India is currently more inclined to counter China and seek to protect its interests in an alliance with the USA, so there is no new opportunity for Australia in the game of two. The idea of the ‘middle power’, not dependent on global powers is expressed in (White 2011), but can Australia afford it? The same question is posed by Baogang He (2011). The authors of the present paper seek to find an answer.

Methodology

To achieve the objectives of the present article, it is necessary to assess both the short-term and long-term results of choosing each of the two paths. At the same time, priority is given to the long-term period since it determines the strategy of the country's economic development, and it does not determine the adoption of momentary tactical decisions. So the authors reveal the characteristics of economic development which will change in one way or another depending on the development time horizon (Figure 1).

In order to identify the most profitable option for Australia, the impact of Australia's choice on New Zealand, its main economic partner in terms of finance and trade, should be evaluated using the same parameters. Consequently, the consideration of selected parameters will apply to the AANZFTA agreement2 for the selected countries.

Within the comparing, the indicators direct comparison method and a retrospective analysis are used; on this basis, a linear econometric model is developed which allows predicting the main trends in the situation’s development.

Results

Australia and New Zealand's partnership with other countries in the region should be examined from the perspective of these countries implementing coordinated economic and monetary policies. Australia's integration policy is based on cooperative economic development activities with New Zealand. Moreover, until recently, both countries have adhered to a moderate integration policy in international associations other than the proposed Commonwealth (McDougall 2018). At the same time, priority was given to associations that implied partnership with the United States. Today the situation is changing, especially with the new vision of the Trans-Pacific Partnership. Let us consider all possible scenarios for the development of economic cooperation in the region with Australia's participation.

The first scenario is cooperation with pro-American institutions. These institutions include the Trans-Pacific Partnership, AUSFTA, and the basis for economic cooperation such as political and military unions, for example, ANZUS, Lower Mekong Initiative, Blue Orb and others.

In this scenario, a number of new cooperation forms between member countries are emerging. The United States considers these initiatives as a springboard for strengthening its influence in the region, and is, therefore creating conditions for the economic development of its allies. Nevertheless, as mentioned above, these institutions are elitist in their nature and they are aimed at creating an alternative modern monetary, financial and political regulatory system in the region (the US partners must support the global liberal order as it follows from the WTO [Daalder and Lindsay 2018]). In particular, the elitism and purpose of such institutions is confirmed by two major initiatives – the TPP, which was closed to the PRC at the stage of the Partnership's formation by the United States, and also by a new project – The Blue Dots Network, which today is both economic in nature and has the features of a limited agreement on regional security (Goodman et al. 2020). This scenario is different because the USA and Japan do not consider Australia as an equal partner, but as an advantageous regional support center and resource base for the further development of Southeast Asia and the Asia-Pacific region. This approach is based on a number of factors, including Australia's reliance on the US military support in the event of a conflict in Asia (Vaughn 2017), a unified security system with the United States and Japan (Tatsumi 2015), the raw material base of Australian exports (Anderson 2014), a relatively low level of proprietary technologies and the close relationships between Australian companies, especially large ones, and the American and Canadian ones (Bingham 2019; Kirchner 2022). At the same time, the investment cooperation between the countries is developing rapidly and appears to be mutually beneficial. Thus, regardless of the scenario chosen by Australia, we may argue that FDI inflows to the country will decline slightly, especially in the context of investment dependence on commodity booms (Walker and Saunders 2018; Tulip 2014).

The second scenario involves an active financial and economic cooperation with the PRC and Australia's integration into the Asian monetary and financial institutions system created by the PRC. In this scenario, one should point out to Australia's important role in the expanded format of ASEAN, the East Asia Summit, and in security initiatives such as the ASEAN Regional Forum. It is worth saying a few words about RCEP and its role in the region. At this stage, it is one of many regional free trade and economic liberalization agreements. It was established as a counterbalance to the TPP, and with the weakening of the organization, it has become less necessary for the PRC. One gets the impression that China is trying to find the ways to expand the functionality of the agreement, and it willing to take advantage of existing agreements in Asia, for example, ASEAN and bilateral agreements.

According to this scenario, the Australian economy, which is one of the two developed Asian economies, will offer best practices in monetary and financial regulation to China-centric institutions, in particular, Australia will join the Regional Comprehensive Economic Partnership and expand the ‘One belt, one way’ initiative in Oceania. In this context, Australia's advantages will be a more stable economic and financial system, and access to both American and Japanese capital and the China-oriented trade and investment, and high-quality products compared to those of Asian countries, especially in the agricultural sector (Jackson, Zammit, and Hatfield-Dodds 2018; Lockie 2015). This is possible because of the non-elitist concept of the Asian institutions and the US need for an ally in the Pacific, which does not allow Australia to be excluded from the US-oriented projects. In addition, Australia is integrated into the inclusive system of Asian institutions, which allows it to realize the concept of the link between the Western and Asian institutions and countries. In this scenario, the Australian economy can gain significant long-term benefits from developing and gaining investment and trade advantages with both parties, but in the short term there is likely to be strong pressure on the Australian establishment from the United States and its allies in the region.

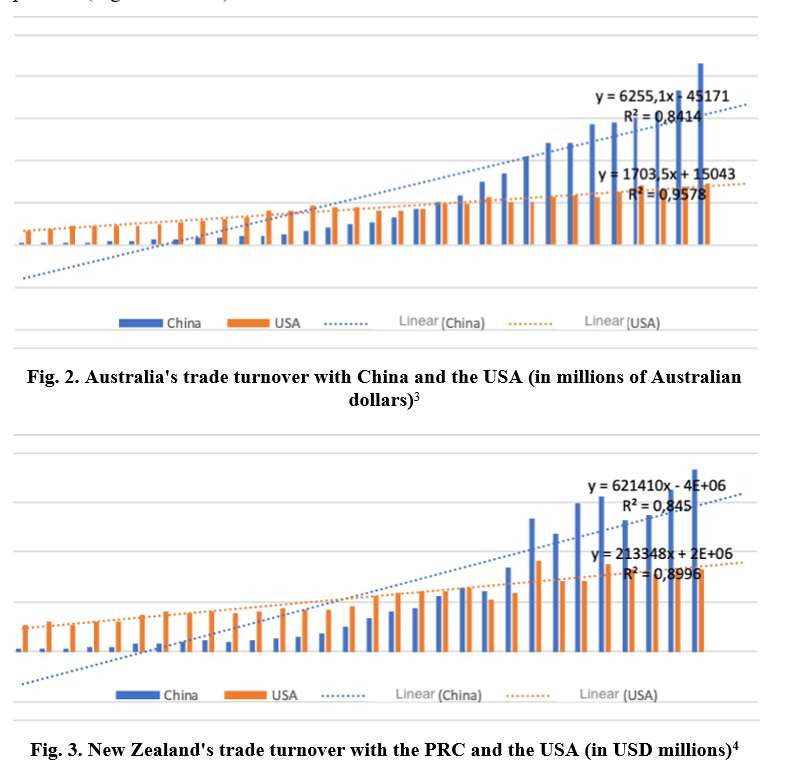

Let us consider Australia and New Zealand's trade dynamics with key regional partners (Figures 2 and 3).

As Figures 2 and 3 show, for both countries, the trade turnover with China is growing much faster than the trade turnover with the USA, which is particularly noticeable after the 2008 crisis. At the same time, we would like toemphasize that a significant part of the trade volume is made up of the exported goods and services (despite the fact that several free trade area agreements have been signed with the USA) (e.g., in the medical sector, this agreement creates conditions for price discrimination against the poorest part of the population in the Pacific countries due to the possibility of cartel pricing (Faunce et al. 2005; Tully 2016).

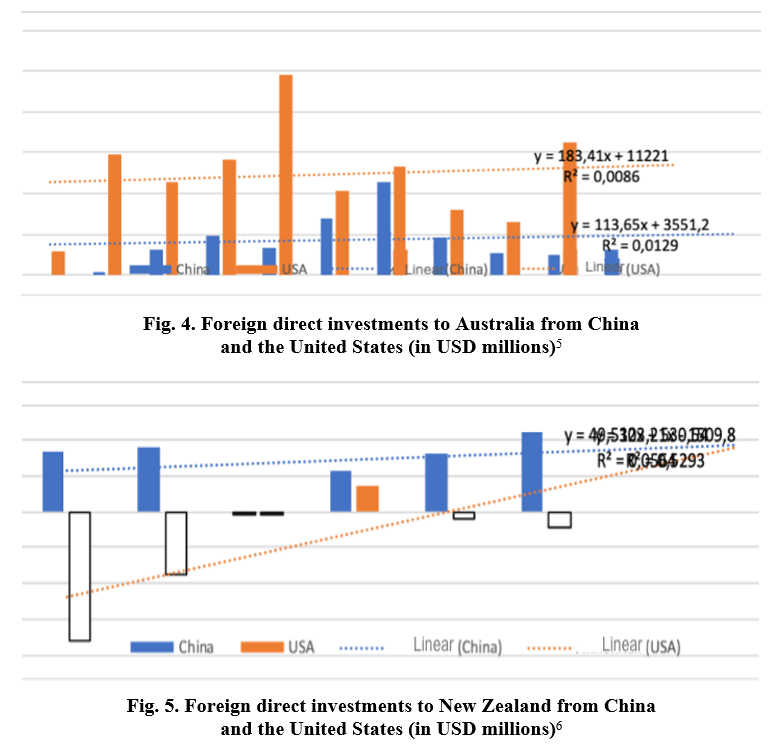

Let us consider the investment dynamics in the countries under study (Figures 4 and 5). In general, one observes a different situation than in trade.

As shown in Figures 4 and 5, it is impossible to get a complete picture and a reliable forecast of the investment component for each developmental scenario in the long term; however, we can state that the Chinese investment dynamics and the US investment dynamics have the same nature and vector.

According to the results obtained, it can be confidently stated that the choice of strategy for further development generally depends on the Asian political monetary and financial institutions: if this component is not significant (i.e., Australia does not have to change its policy significantly because of its participation in Asian integration associations), the effects of choosing the pro-China path will be much more remarkable.

Discussion

The analysis of the two development scenarios and their possible influence shows that trade with Asian countries offers significantly more advantages to Australia and New Zealand than participation in privileged trade agreements with the United States and its allies, which include investment aspects. In terms of economic development through direct investment, the way to increase its inflow to Australia and New Zealand also lies in the entry of their companies into Asian capital markets, which require safe assets which are more characteristic of developed countries (Ahrend, Saia, and Schwellnus 2018; Caballero, Farhi, and Gourinchas 2017). Thus, it is more profitable for Australia to participate in the China-centric initiatives.

Nevertheless, there are many long-standing constraints on the ability of the Anglo-Saxon bloc countries to participate in the new initiatives of developing countries; for example, there are a number of military treaties and security arrangements in the region. As a result, Australia and New Zealand cannot smoothly integrate into the Asian system of monetary and financial institutions.

It is also worth mentioning Australia's integration initiatives in the region, both the AANZFTA and initiatives related to the development of Oceania, namely, the Pacific Agreement on Closer Economic Relations (PACER Plus).7 This aspect of Australian foreign policy reflects its focus on becoming a regional hegemon, which also limits its cooperation with China.

Thus, the future choice depends entirely on Australia's actions, and this is the key difference between the country's current and past positions. In order to mitigate the risks associated with choosing China-centric initiatives for the country, it is necessary to implement a number of measures, among which we should highlight the following:

1) Tougher migration policy;

2) Support for national companies entering the international market; implementation of the ‘Made in Australia’ program as a national product brand, especially in agriculture.

3) The development of the banking market through the establishments of national and regional development banks.

4) The establishment of the Development Bank of Oceania modelled on the Asian Infrastructure Investment Bank, to operate in Australia and Oceania region; and the signing of agreements with the AIIB to co-finance projects in the Asia-Pacific island states.

5) The creation of barriers to the active penetration of Chinese capital into the Australian economy both through market mechanisms (protectionist policies to protect national producers) and through international regulatory instruments (in particular, through certification and standardization mechanisms).

These recommendations seem important in order to create a stable market for Australian and New Zealand national products in Asia, while avoiding the excessive countries sinicization which is already observed (Smith, Spaaij, and McDonald 2019).

However, one cannot ignore the fact that Australia is heavily dependent on the United States. The aforementioned military agreements between the United States and Australia, the deployment of American military bases on its territory and long-term security cooperation in the region could not help but have an impact on Australian policy. The United States views Australia as its ally, a junior partner in Asia, so the country's choice of the path of rapprochement with the PRC will disrupt the US plans. The United States can hardly agree to this, and so it actively involves Australia in creating contradictions with the PRC. For example, Australia has supported the American project to combat disinformation in Asia directed against the PRC, supports the American sanctions on Chinese goods, etc. In fact, Australia is largely dependent on the United States and today has no alternatives in the fight against threats to national security – international terrorism and sinicization except for partnership with the United States. The latter is also not ready to give up the advantages that Australia provides for the American interests in Asia; therefore, Australia's implementation of a partnership strategy with China is only possible after a careful consideration of the pros and cons of such consequences as the political vacuum that the country will find itself in for a long time and the economic pressure from the most developed countries. Thus, the choice of a pro-China development path is therefore fraught with great risks for Australia.

Conclusion

For Australia and New Zealand, the path of cooperation with pro-American institutions appears to be a dead-end, since the advantages gained in trade and investment benefits gained apply to the American domestic market, while the Chinese and ASEAN markets are much larger. In addition, the elitism of the Western institutions does not allow Australia to change its role and become a supplier of high value-added products; we mean that the country continues to exploit the commodity model of development. At the same time, there are a number of risks (notably the lack of political and military freedom for Australia and New Zealand) that may lead to the countries' greater dependence on the United States in the future.

At the same time, the path of developing relations with China has a number of economic advantages; for example, Australia can extensively increase its goods exports to Asia and ASEAN, and it can also realize the concept of ‘building a bridge’ between the emerging monetary and financial institution system in Asia and Western institutions. In this scenario, the investment growth in Australia has slowed down, but the proposed measures to reduce the country's sinicization will help solve investment problem.

Australia' role in integration processes is largely determined by its cooperation policy conducted in the Oceania region, and this fact cannot be ignored: despite the region's small share in the global economy, the PRC is interested in it both economically and politically, since after establishing control over this region, China will strengthen its position in the confrontation with the United States. It is in the Australia and New Zealand's interests to include the region in the paradigm of cooperation with China, both to gain support for the Asian countries and to attract financing for the economies of the island states, which will become sales markets, primarily, for Australian goods.

The US reaction to Australia's decision to abandon its partnership in favor of cooperation with the PRC remains an open question. In this situation, if the second strategy is chosen, one should expect a harsh reaction from the United States and other developed countries to Australia's choice.

NOTES

1 Australia and China: Does our policy allow us to be allies to the world’s greatest superpowers? 2018. URL: https://government.unimelb.edu.au/__data/assets/pdf_file/0006/2881284/Australia-and-China.pdf.

2 Overview: The ASEAN-Australia-New Zealand Free Trade Area (AANZFTA). 2020. URL: https://aanzfta.asean.org/aanzfta-overview.

3 Foreign investment statistics. URL: https://www.dfat.gov.au/trade/resources/investment-statistics/Pages/foreign-investment-statistics.

4 New Zealand Export in thousand US$ for all products United States between 1989 and 2018. URL: https://wits.worldbank.org/CountryProfile/en/Country/NZL/StartYear/1989/EndYear/2018/

TradeFlow/Export/Indicator/XPRT-TRD-VL/Partner/USA/Product/all-groups.

5 FDI financial flows – By partner country. https://stats.oecd.org/Index.aspx?QueryId=64194.

6 FDI financial flows – By partner country. https://stats.oecd.org/Index.aspx?QueryId=64194.

7 Pacific Agreement on Closer Economic Relations Plus. URL: https://www.mfat.govt.nz/assets/Uploads/PACER-Plus-consolidated-legal-text.pdf.

REFERENCES

Ahrend, R., Saia, A., and Schwellnus, C. 2018. The Demand for Safe Assets in Emerging Economies and Global Imbalances: New Empirical Evidence. The World Economy 2 (41): 573–603. DOI: 10.1111/twec.12526.

Andreosso-O’Callaghan, B. 2008.Comparing and Contrasting Economic Integration in the Asia-Pacific Region and Europe. In Murray, P. (ed.), Europe and Asia. Palgrave Studies in European Union Politics (pp. 61–83). London: Palgrave Macmillan. DOI: 10.1057/ 9780230583160_4.

Anderson, D. 2014. Fifty Years of Australia's Trade. Australian Government. URL: https://www.dfat.gov.au/sites/default/files/fifty-years-of-Australias-trade.pdf

Beeson, M. 2003. Australia's Relationship with the United States: The Case for Greater Independence. Australian Journal of Political Science 38 (3): 387–405.

Bingham, F. 2019. Economic Activity of Australian Majority-Owned Businesses Located in Canada, the European Union and the United States. Australian Government. URL: https://www.dfat.gov.au/sites/default/files/economic-activity-of-australian-majority-ow-ned-business....

Bisley, N. 2017. Integrated Asia: Australia's Dangerous New Strategic Geography. Centre of Gravity series paper. No 31.

Caballero, R. J., Farhi, E., and Gourinchas, P.-O. 2017. The Safe Assets Shortage Conundrum. Journal of Economic Perspectives 3 (31): 29–46. DOI: 10.1257/jep.31.3.29.

Carr, A. 2019. No Longer a Middle Power: Australia's Strategy in the 21st century. Focus strategique. No 92. Paris: IFRI.

Cook, M. 2015. Australia and U.S.–China Relations: Bandwagon and Unbalancing. Facing Reality in East Asia: Tough Decisions on Competition and Cooperation. Joint U.S.–Korea Academic Studies. Washington, DC: Korea Economic Institute of America.

Daalder, I. H., Lindsay, J. M. 2018. The Committee to Save the World Order. Foreign Affairs, September 30. URL: https://www.foreignaffairs.com/world/committee-save-world-order.

Demir, E. 2018. Fragmented or Integrated Asia: Competing Regional Visions of the US and China. Rising Powers Quarterly 3: 45–65.

Faunce, T., Doran, E., Henry, D., Drahos, P., Searles, A., Pekarsky, B., and Neville, W. 2005. Assessing the Impact of the Australia-United States Free Trade Agreement on Australian and Global Medicines Policy. Globalization and Health 1: 15. DOI: 10.1186/ 1744-8603-1-15.

Goodman, M. P., Runde, D. F., and Hillman, J. E. 2020. Connecting the Blue Dots. Center for Strategic and International Studies. URL: https://www.csis.org/analysis/connecting-blue-dots.

Guliyev, I. A., Kiselev, V. I., Sorokin, V. V. 2022. Global Energy Resources Market: Resource Allocation Imbalance and the Concept of Sustainable Development. Diskussiya [Discussion], 114: 62–70. URL: https://discussionj.ru/index.php/polemik/article/view/91

He, B. 2011. The Awkwardness of Australian Engagement with Asia: The Dilemmas of Australian Idea of Regionalism. Japanese Journal of Political Science 2 (12): 267–285. DOI: 10.1017/S1468109911000077.

Jackson, T., Zammit, K., and Hatfield-Dodds, S. 2018. Snapshot of Australian Agriculture. Canberra: Australian Bureau of Agricultural and Resource Economics and Sciences.

Jenner, K., Walker, A., Close, C., and Saunders T. 2018. Mining Investment Beyond the Boom. RBA Bulletin, March.

Kirchner, St. 2022. The Canadian-Australian Productivity Gap: Comparative Institutions and Policy Settings. Lessons for Canada from Down Under. Fraser Institute. URL: https://www.fraserinstitute.org/sites/default/files/essay3-canada-australia-productivity-comparative...

Lipscy, Ph. Y. 2020. COVID-19 and the Politics of Crisis. Cambridge University Press.

Lockie, S. 2015. Australian Council of Learned Academies. Australia's Agricultural Future: The Social and Political Context. Report to SAF07 – Australia's Agricultural Future Project. Melbourne: Australian Council of Learned Academies.

McDougall, D. 2018. The Commonwealth: A Modern Role for an Imperial Relic. Australian Outlook. URL: http://www.internationalaffairs.org.au/australianoutlook/commonwealth-modern-role-imperial-relic/.

Ng, M. C. 2016. Are Globalization and Governance Interrelated? Evidence among World Economies. Journal of Globalization Studies 7 (2): 49–61.

Nguyen, A. N.2017. The Impacts of Trans-Pacific Partnership on Australia. Australian institute for business and economics (AIBE). URL: https://aibe.uq.edu.au/files/1060/Impacts_Trans-Pacific_Partnership_Australia_Nguyen.pdf.

Nikkei Asia. 2020. Eyes on Biden's TPP Move as China Joins Mega Trade Deal RCEP. Nikkei Asia, November 16. URL: https://asia.nikkei.com/Politics/US-elections-2020/Eyes-on-Biden-s-TPP-move-as-China-joins-mega-trad....

Petri, P. A., and Plummer, M. G. 2020. Should China Join the New Trans‐Pacific Partnership? China & World Economy 28 (2): 18–36.

Shulgin, S., Zinkina, J., and Andreev, A. 2019. Measuring Globalization: Network Approach to Countries' Global Connectivity Rates and Their Evolution in Time. Social Evolution & History 18 (1): 127–138.

Smith, R., Spaaij, R., and McDonald, B. 2019. Migrant Integration and Cultural Capital in the Context of Sport and Physical Activity: A Systematic Review. Journal of International Migration and Integration 3 (20): 851–868. DOI: 10.1007/s12134-018-0634-5.

Sznajderska, A. 2017. The Role of China in the World Economy: Evidence from Global VAR model. NBP Working Paper. No. 270. Economic Research Department Warsaw. URL: https://ssl.nbp.pl/publikacje/materialy_i_studia/270_en.pdf.

Sterling, D. P. 2017. China's Role and Status in International Society: Should its Rise be Perceived as a ‘Threat’? Eurasian Journal of Social Sciences 5 (4): 23–33.

Tatsumi, Y. 2015. US-Japan-Australia Security Cooperation Prospects and Challenges. Stimson. URL: https://www.stimson.org/wp-content/files/file-attachments/US-Japan_Australia-WEB.pdf.

Tow, W. T. 2017. President Trump and the Implications for the Australia-US Alliance and Australia's Role in Southeast Asia. Contemporary Southeast Asia 39 (1): 50–57.

Truevtsev, K. 2016. Globalization as a Political Process. Journal of Globalization Studies 7 (1): 66–86.

Tulip, P. 2014. The Effect of the Mining Boom on the Australian Economy. The Bulletin, December: 17–22.

Tully, S. R. 2016. Free Trade Agreements with The United States: 8 Lessons for Prospective Parties from Australia’s Experience. British Journal of American Legal Studies 2 (5): 395–418. DOI: 10.1515/bjals-2016-0014.

US-Australia Enabling Technologies Technical Exchange Meeting. 2015. URL: https:// community.apan.org/wg/afosr/w/researchareas/13919/us-australia-enabling-technolo-gies-technical-exchange-meeting

Vaughn, B. 2017. The U.S.-Australia Treaty on Defense Trade Cooperation. CRS Report for Congress. URL: https://fas.org/sgp/crs/natsec/RS22772.pdf.

White, H. 2011. Power shift: rethinking Australia’s place in the Asian century. Australian Journal of International Affairs 1 (65): 81–93. DOI: 10.1080/10357718.2011.535603.