Global Aging and Demographic Policies: A Reconsideration

Journal: Journal of Globalization Studies. Volume 16, Number 1 / May 2025

DOI: https://doi.org/10.30884/jogs/2025.01.04

Vadim Ustyuzhanin, HSE University, Moscow, Russia

Julia Zinkina, HSE University, Moscow, Russia; Lomonosov Moscow State University, Moscow, Russia

Andrey Korotayev, HSE University, Moscow, Russia; Lomonosov Moscow State University, Moscow, Russia; Institute of Oriental Studies, Moscow, Russia

Population aging is expected to affect large parts of the world in the coming decades, leading to profound changes in various social, economic and financial institutions and infrastructure networks. Raising the old-age retirement (pension) age has been the most common response of the affected countries to this challenge, but it has proven neither sufficient nor popular with the respective populations. In this paper we analyze the projected magnitude of global aging under different fertility trajectories. It is shown that the sustainability of national pension systems will become untenable for many countries of the world unless they manage to achieve substantial increases in fertility. Thus, these countries should implement effective fertility-supporting measures in the near future in order to avoid major social crises. As we can see, fertility-supporting policies have the potential to be a remarkably powerful tool for offsetting some of the most adverse consequences of population aging.

Keywords: global aging, demographic policies, fertility, pension system, demographic forecasting.

Introduction

The United Nations has declared the current decade (2021–2030) the Decade of Healthy Aging.1 Global aging, its consequences, and methods to counteract its most adverse effects are currently attracting the attention of many researchers and policymakers in high-income countries, but their importance in low- and middle-income countries is also growing. Grinin's thorough review of population projections fr om academics and major research institutions and think tanks reveals that they ‘unanimously anticipate the dramatic global aging in the coming decades’ (Grinin, Grinin, and Korotayev 2024: 236; see also Grinin, Grinin, and Korotayev 2023). By 2050, for the first time in human history, people aged 65 and over will outnumber children (Grinin, Grinin, and Korotayev 2024: 230). However, global aging is a truly global challenge not only because of its scale, but also because of its speed. While it took many developed countries about a century (or even longer) to experience an increase in the share of people aged 65+fr om 7 to 14 per cent of their population, many developing countries will make that shift in just 20–30 years (Gilroy 2007: 250; see also Korotayev et al. 2023). As might be expected, a global challenge of this magnitude is multifaceted in nature; Johnson and associates (2005) identify three dimensions of aging that relate to the aging person themselves (aging body, aging mind, and aging self), and two ‘external’ dimensions of aging, namely relationships and society. Some of the institutions and types of infrastructure that are likely to experience the greatest strain and most profound changes to accommodate the changes associated with population aging are briefly described below, along with some global issues that are likely to be exacerbated.

National pension systems are probably the first area that comes to mind when one thinks of the adverse consequences of population aging. World Bank analysts identify two main purposes of pensions fr om an individual point of view, namely ‘(a) consumption smoothing over the life cycle and (b) insurance against risks, notably the uncertainty of life expectancy after retirement’ (Holzmann and Hinz 2005: 27). Two objectives from the society's point of view include ‘(c) poverty alleviation among the elderly and (d) income redistribution by using the public pension scheme to achieve a more equal distribution of income through transfers from the rich to the poor’ (Ibid.). All four objectives are likely to become more difficult to achieve as the proportion of people of working age declines, leading to lower contributions to pension systems, while the growing proportion of people beyond working age increases the demand for pensions. These two simultaneous processes are bound to put severe strain on existing pension systems, especially those with a significant pay-as-you-go component (Colin and Brys 2019: 17).

Population aging is not confined to high-income countries, but is expected to occur in a significant number of middle-income and some low-income countries (Powell and Khan 2013), many of which have yet to establish comprehensive old-age pension systems (Bloom et al. 2015) as only one-third to two-thirds of their elderly people are currently covered (Amaglobeli et al. 2019: 12). Their ability to support the growing age group of retired people seems doubtful at best, a dire prospect given that family-based care of the elderly is declining with modernization. This has been the case since the late nineteenth century, when pensions began to emerge ‘when the process of industrialization and urbanization eroded the family networks that originally served as social safety nets for the elderly’ (Grünewald 2021: 101; see also Hinrichs and Lynch 2012; Zinkina et al. 2019: 171–178). China, for example, has attempted to legally secure the responsibility of adult children to support their parents in various ways, but the implementation of this law faces many obstacles (Hu and Chen 2019). Indeed, even in the best case, family-based care is unfeasible in a society characterized by the lowest-low fertility and high life expectancy, as a married couple would have to take care of two pairs of parents and four pairs of grandparents, i.e. 12 elderly people. At the same time, when a society views elderly care as a family matter and the field of paid care services is underdeveloped, women who provide unpaid care for their relatives are more likely to be pulled out of the labor market, exacerbating the shortage of workers who contribute to pension systems and pay taxes (Ince Yenilmez 2015).

National health systems are likely to face pressures similar to those faced by pension systems, as older people bear the greatest burden of disease and disability. However, the impact of global aging on health care goes beyond this direct effect. For example, health care systems may need a fundamental redesign to reduce their dependence on contributions from the labor market, which are likely to shrink as the large cohorts of older workers retire and the emerging labor force vacuum cannot be filled by the smaller groups of younger workers. Profound changes in tax policy will be needed to compensate for these losses (Cylus et al. 2019). In addition to ‘quantitative’ changes in health care, ‘qualitative’ changes can also be expected, such as a reallocation of health care resources towards research, prevention, and treatment of the disabilities and disorders that are more common among the elderly, such as ‘cancer, fractures, cardiovascular diseases, depression, and dementia’ (Bloom et al. 2015: 652; Klug et al. 2021; see also Grinin, Grinin, Korotayev 2024).

Fiscal policy will have to undergo serious changes to cover increased spending on pension systems and health care. For European countries, ‘tax revenues would have to be between 14 and 28 per cent higher than they are today … just to offset the increased costs of aging populations’ (Amaglobeli et al. 2019: 12; see also Lee and Mason 2017). Again, apart from the direct impact of population aging on taxation (fewer tax-paying workers, more elderly people dependent on government spending from tax-funded budgets [Yoshino et al. 2019: 25]), there are some other important effects. For example, the population is aging in the context of ongoing technological progress, which includes, among other things, automation and digitalization of the economy. This may imply ‘a shift in the tax mix away from taxes on labor, which are often levied at high rates, towards taxes on capital, which are often levied at lower rates’ (Colin and Brys 2019: 17).

Capital and savings. Population aging is likely to deplete the savings that aging people have accumulated during their working years and will spend on health care and long-term care in their old age (Amaglobeli et al. 2019: 10). Meanwhile, the demand for capital will increase to compensate for the shrinking labor force. The situation will be exacerbated by the fact that aging investors ‘tend to prefer “safe,” but unproductive, government debt instruments over more productive, but volatile, equity in high-growth sectors. … The result can be an alarming collapse of capital productivity’ (Hewitt 2002: 479). The aging population is also likely to be slower to learn new technologies, which can hinder overall productivity (Yoshino et al. 2019: 25). Scholars suggest that the internationalization of capital markets can at least partially mitigate some of these effects (Börsch-Supan and Ludwig 2009; Attanasio et al. 2016; Barany et al. 2023). Other scholars emphasize the importance of endogenous human capital formation (Vogel et al. 2017).

Inequality. Older people may face inequalities across countries; for example, those living in high-income countries may face a lower burden of disease, have more financial security in retirement, and have a greater variety of elderly care services available to them than their counterparts in low- and middle-income countries (Higo and Khan 2015: 144). However, even within OECD countries, there is considerable variation in measures of ‘healthy aging’ (Rapp et al. 2022). Within a given society, differences in education and other socio-economic parameters can exacerbate inequalities in living standards, health, and life expectancy among the elderly (Bjursell et al. 2017). Income distribution also becomes more unequal with age due to the decreasing share of labor income and the increasing share of capital income, as the former tends to be more equally distributed than the latter (Luo et al. 2018: 885).

Given the global challenges posed by global aging, it is not surprising that researchers and policymakers around the world are interested in the ways to offset or, at least mitigate, the burden of aging on various types of institutions and infrastructure. Probably the most actively discussed (and not infrequently very much opposed) means of addressing these challenges relates to various increases in the retirement age; such increases are justified by the longer and healthier life expectancy of populations around the world (Sanderson and Scherbov 2005, 2010, 2019), but can also provoke massive protests.Along with reduced mortality and increased life expectancy, fertility decline is widely recognized as one of the primary factors contributing to the growth of the elderly population (Coale 1964; Kinsells and Phillips 2005; Lee 2011; Powell 2010). Moreover, many researchers have indicated the possibility that increased life expectancy itself contributes to fertility decline (for a review see, e.g., Yakita 2017: 3–4; see also Acemoglu and Johnson 2007). In this paper, we aim to analyze global aging under different fertility trajectories and to illustrate the potential impact of fertility on this issue in order to contribute to the discussion on whether fertility-related policy interventions can be useful in mitigating the most profound effects of global aging.

Data and Methods

For population estimates and projections (UNPD 2024), we use the World Population Prospects (WPP) 2024 dataset. This United Nations-led initiative provides estimates of a range of demographic indicators from 1950 to 2023 for all countries, as well as projections for different scenarios up to 2100. In this study, we use three fertility-dependent scenarios of population projections calculated by the United Nations Population Division to illustrate the issue of global aging in relation to fertility. These scenarios include a medium projection, a low projection (–0.5 child per woman at the end of childbearing years), and a high projection (+0.5 child per woman at the end of childbearing years).

It is important to note that this type of projection does not show the probabilistic trajectories of future population growth. The lower and upper bounds of future population estimates overestimate the uncertainty. However, the purpose of this paper is not to present the most likely demographic future with a certain level of confidence. Rather, it aims to analyze global aging under different scenarios and to illustrate the potential impact of fertility on this issue.

To illustrate the projected demographic trajectory of the world's population, we have aggregated data from the WPP using a number of well-established demographic indicators, such as the old-age dependency ratio defined by the Organization for Economic Cooperation and Development (OECD) as ‘the number of individuals aged 65 and over per 100 people of working age defined as those at ages 20 to 64.’2 Using this indicator, we propose a methodology for estimating a potential retirement age that assesses the impact of global aging on national pension systems.

It is assumed that in 2023, the latest year for which population data are available, the retirement age is the same in all regions and for both sexes, with an average age of 65. While this estimate is not entirely accurate, it is reasonably close to the actual situation. For example, according to Trading Economics,3 the average retirement age for men is 64.85 in the European Union, 65 in Mexico, 60 in Turkey, and 67 in Israel. Over the projection period (2024–2100), the potential retirement age is the lower age of the old-age group that keeps the old-age dependency ratio at the level of 35 elderly persons per 100 persons of working age. This cut-off point is broadly in line with the level in Western Europe (37.7 in 2023), whereas a number of Western European countries have recently implemented reforms to raise the retirement age,4 suggesting that this level of burden on the pension system is critical and requires a reduction in the share of pensioners by increasing the working population. Moreover, the projections assume that this age will not be lowered in the future (which is highly probable).

Thus, the potential retirement age (for ease of notation, we will refer to this variable as Age) can be written in the following form:

.png)

.png)

where function g provides an output in the form of an old-age dependency ratio with respect to a specified lower age of the elderly population Age for a given Population. If the calculated old-age dependency ratio exceeds the reference level of 0.35, then the Age is increased by n years in order to maintain an old age dependency ratio below or equal to the reference level. Conversely, if the old-age dependency ratio is below the reference level, the potential retirement age remains unchanged.

Results

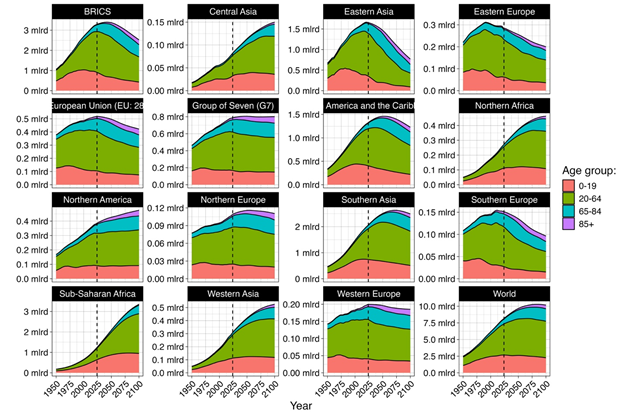

Figure 1 shows the estimated and projected demographic structure of the world's major regions and political/economic unions. The population is divided into four age groups: youth (under 20 years old, at the bottom), people of working age (20–64 years old, second area from the bottom), elderly people (65–84 years old, third area from the bottom), and the new, gradually growing group of people aged 85 and over (at the top). It is clear that the world population will start to decline in the middle of the twenty-first century. East Asia and Europe are already experiencing rapid population decline and aging, as evidenced by the increasing proportion of people aged 85 and over and the decreasing proportion of young people. The only regions projected to experience significant population growth are Sub-Saharan Africa, North Africa, West Asia, Central Asia, and South Asia. However, these regions will also experience a significant increase in the elderly population and the onset of population decline in the second half of the century. By the end of the century, the number of people aged 65 and over is projected to increase tenfold, reaching about 25 % of the world's population. In other words, about one in four people on the planet will be 65 or older by the end of the century.

Fig. 1. The estimated (1950–2023) and projected (2024–2100) demographic structure

of the world and some regions

Data from UNPD 2024, the forecast is according to the medium scenario.

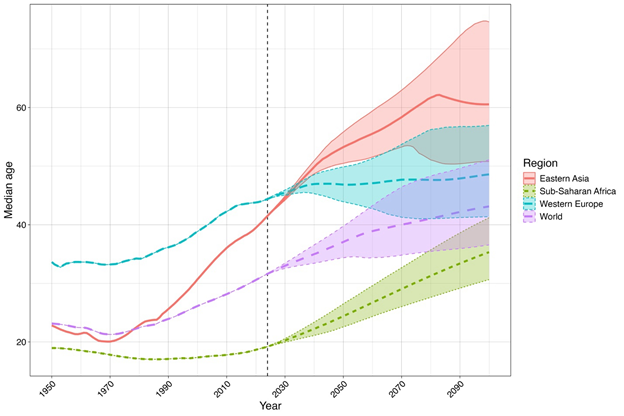

The median age, which is another reliable indicator of the aging process, is projected to increase steadily worldwide from about 30 years in 2023 to 43 years in the middle scenario and 38 or 50 years in the high-fertility and low-fertility scenarios, respectively (see Figure 2). The most significant increase is projected to occur in Eastern Asia, with a rise from 40 to 60 years by the end of the century (or to 50 or 75 years in the high and low scenarios, respectively). It is noteworthy that the projected increase in the median age in Western Europe in the medium scenario is relatively modest, rising from 45 to just under 50 years. This is mainly due to the projected large positive net migration and a slight increase in fertility rates by the end of the century.

Fig. 2. The estimated (1950–2023) and projected (2024–2100) median age

of the world and some regions

Estimates are based on data from UNPD 2024, the line is an estimate under medium scenario, bottom and top of shaded area are estimates under high-fertility and low-fertility scenarios respectively.

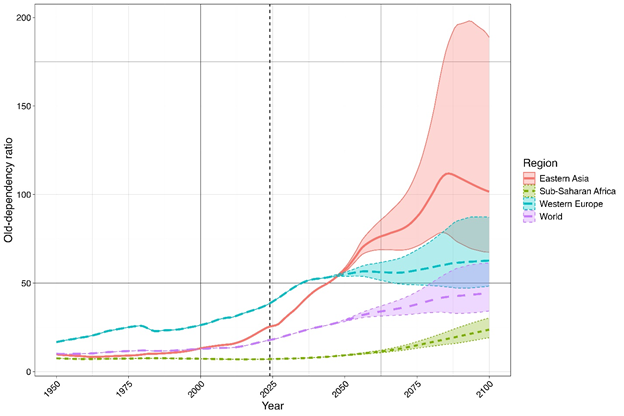

Figure 3 illustrates the projected dynamics of the old-age dependency ratio, which shows the burden on the pension system under different fertility scenarios in selected regions (for projected estimates for all regions, see Table 1). As shown in the graph, the ratio of elderly to working-age people is projected to increase dramatically worldwide, from 18 elderly persons per 100 working-age people in 2023 to 44 elderly persons per 100 working-age people by 2100 under the medium scenario. However, there is a considerable discrepancy between the high-fertility (34 per 100) and low-fertility (61 per 100) scenarios, which is entirely due to differences in fertility (+0.5 children per woman and –0.5 children per woman, respectively). The largest difference between the high and low fertility scenarios is observed in Eastern Asia. Under the high-fertility scenario, the old-age dependency ratio is projected to reach 67.5, which is close to the world average under the medium scenario. Under the low-fertility scenario, the estimated ratio is projected to reach a staggering 188.8, meaning that the elderly population will outnumber the working-age population by almost a factor of two. The lowest values are projected for sub-Saharan Africa; while the number of people aged 65 and over will increase substantially (as shown in Figure 1), the associated pension burden is expected to remain relatively modest. Moreover, the slight increase in the old-age dependency ratio in this part of the world is projected to occur mainly in the second half of the century.

Fig. 3. The estimated (1950–2023) and projected (2024–2100) old-age dependency ratio

for the world and some regions

Estimates are based on data from UNPD 2024, the line is an estimate under the medium scenario, bottom and top of the shaded area are estimates under high-fertility and low-fertility scenarios respectively.

Table 1

Old-age dependency ratio in the world, estimates and projections

under different fertility scenarios

Region | 2023 | 2050 | 2100 | ||||||

Estimate | High | Medium | Low | High | Medium | Low | |||

Eastern Asia | 24.9 | 56.2 | 57.5 | 58.7 | 67.5 | 101.6 | 188.8 | ||

Southern Europe | 37.7 | 69.5 | 71.1 | 72.7 | 55.7 | 75.7 | 113.9 | ||

BRICS | 17.6 | 36 | 36.7 | 37.5 | 48.6 | 67.7 | 106 | ||

Latin America | 16 | 31.6 | 32.2 | 33 | 45.2 | 62.9 | 97.7 | ||

European Union (EU: 28) | 36.5 | 56.1 | 57.3 | 58.5 | 50.2 | 66.3 | 94.9 | ||

Northern Europe | 33.9 | 45.2 | 46.1 | 47 | 48.6 | 63.5 | 88.9 | ||

Western Europe | 37.7 | 53.8 | 54.9 | 56.1 | 48.3 | 62.7 | 87.1 | ||

Eastern Europe | 29.6 | 47 | 48 | 49.1 | 43.5 | 57.9 | 84.4 | ||

Group of Seven (G7) | 36.6 | 50 | 51 | 52.1 | 46.7 | 60 | 81.6 | ||

Southern Asia | 11.4 | 21.9 | 22.3 | 22.8 | 38 | 50.6 | 73.4 | ||

Northern America | 30.1 | 41.2 | 42 | 42.9 | 43.5 | 55 | 72.6 | ||

World | 17.5 | 28.3 | 28.8 | 29.4 | 34.3 | 44.4 | 61.3 | ||

Northern Africa | 10.3 | 19.2 | 19.6 | 19.9 | 31.5 | 40.5 | 55.4 | ||

Central Asia | 10.8 | 19.2 | 19.5 | 19.9 | 28.8 | 37 | 50.2 | ||

Western Asia | 10.5 | 19 | 19.3 | 19.6 | 30.2 | 37.9 | 49.6 | ||

Sub-Saharan Africa | 7 | 9.1 | 9.2 | 9.4 | 19.2 | 23.7 | 30.3 | ||

Data from UNPD 2024.

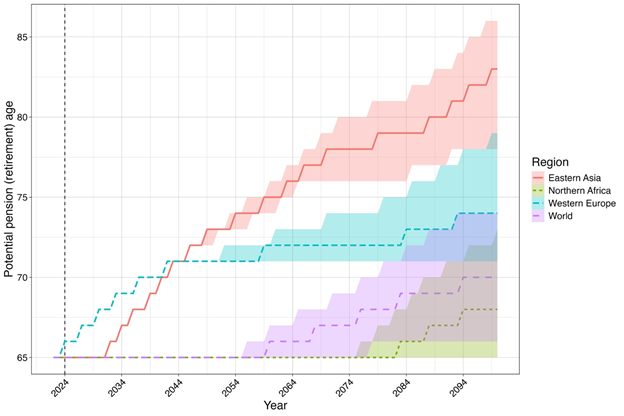

To facilitate the interpretation of these abstract indicators in a more practical manner, the figures and potential retirement ages in the different regions under the specified scenarios are presented (see Figure 4 and Table 2). Let us remind here that we assume the retirement age to be the same in all regions in 2023, i.e. 65 years. Over the projected period (2024–2100), the potential retirement ages represent the lower age of the elderly strata that maintains the old-age dependency ratio at 35 or fewer old-age dependents per 100 working-age people.

Fig. 4. Potential pension (retirement) age in the world and some regions

Estimates are based on data from UNPD 2024, the line is an estimate under the medium scenario, bottom and top of shaded area are estimates under high and low scenarios respectively.

The largest increase in the potential retirement age is projected for Eastern Asia, wh ere it exceeds that of any other region of the world in all scenarios. However, the values of the potential retirement age vary considerably depending on the fertility scenario. By the end of the century, it will be 83 years in the medium scenario and 78 and 86 years in the high-fertility and low-fertility scenarios, respectively. On the contrary, sub-Saharan Africa will not experience an increase in the potential retirement age under any of the scenarios, largely because of the incomplete demographic transition. As regards the world average, the potential age of retirement is projected to remain at the baseline level of 65 years until the beginning of the second half of the century, after which it gradually increases in all scenarios. In the medium scenario, the potential age of retirement reaches 70 by 2100. In the high-fertility scenario, it will be only 66 years, hardly different from the current level. Meanwhile, in most of the selected regions, the retirement age is projected to be much higher than 65 years: on average, it will exceed 70 years by the end of the century even under the high-fertility scenario.

Table 2

Potential pension (retirement) age in the world, estimates (2023)

and projections under different fertility scenarios (2050, 2100)

Region | 2023 | 2050 | 2100 | ||||||

Estimate | High | Medium | Low | High | Medium | Low | |||

Eastern Asia | 65 | 72 | 73 | 73 | 78 | 83 | 86 | ||

Southern Europe | 65 | 74 | 74 | 74 | 75 | 77 | 82 | ||

BRICS | 65 | 67 | 67 | 67 | 72 | 76 | 81 | ||

European Union (EU: 28) | 65 | 72 | 72 | 72 | 72 | 75 | 80 | ||

Latin America | 65 | 65 | 65 | 65 | 70 | 75 | 80 | ||

Eastern Europe | 65 | 70 | 70 | 70 | 72 | 75 | 80 | ||

Northern Europe | 65 | 70 | 70 | 70 | 71 | 76 | 80 | ||

Western Europe | 65 | 71 | 71 | 71 | 71 | 74 | 79 | ||

Group of Seven (G7) | 65 | 70 | 70 | 71 | 70 | 74 | 78 | ||

Northern America | 65 | 69 | 69 | 69 | 70 | 73 | 78 | ||

Southern Asia | 65 | 65 | 65 | 65 | 67 | 71 | 76 | ||

World | 65 | 65 | 65 | 65 | 66 | 70 | 74 | ||

Northern Africa | 65 | 65 | 65 | 65 | 65 | 68 | 73 | ||

Western Asia | 65 | 65 | 65 | 65 | 65 | 67 | 72 | ||

Central Asia | 65 | 65 | 65 | 65 | 65 | 67 | 71 | ||

Sub-Saharan Africa | 65 | 65 | 65 | 65 | 65 | 65 | 65 | ||

Estimates are based on the data from UNPD 2024.

Discussion

Increasing the statutory retirement age has been the most common response to the aging-related challenges for national pension systems implemented in the OECD countries. This measure can be complemented by a range of policies aimed at promoting active aging, longer working lives, and stricter early retirement provisions (OECD 2015; Alaminos et al. 2020). However, research on this issue shows that there is no ‘one-size-fits-all’ solution, as welfare states pursue different approaches to this problem (Aysan and Beaujot 2009).

As noted above, the extent of aging in a given population depends not only on gains in life expectancy and declines in mortality, but also on fertility dynamics. For example, Weil (1997) shows that at least two-thirds of the increase in the elderly population in the United States by the end of the twentieth century was due to fertility decline. Bloom et al. (2010) show that in the second half of the twentieth century and early twenty-first century, fertility declines in Asian countries (including China) had a much stronger impact on the age structure than gains in life expectancy.

Somewhat less attention has been paid to modeling how future fertility dynamics may affect the prospects for population aging and its consequences for social institutions and infrastructure (such as pension systems). Our research shows that the impact of global aging depends strongly on future fertility levels, as reflected in both the median age and the old-age dependency ratios. For many countries in Eastern Asia, Europe and Latin America, the sustainability of national pension systems will become untenable if their populations cannot find a way out of what has been termed ‘lowest-low fertility’ (see Kohler, Billari, and Ortega 2002 for a discussion of this phenomenon). Thus, these countries should implement effective fertility-supporting measures in the near future to avoid major social crises.

Of course, from an economic point of view, higher fertility in the context of population aging will increase the total dependency ratio and the financial burden on working-age people in the short term, but will reduce the old-age dependency ratio in the longer term (Bairoliya et al. 2017). In this case, a certain proportion of working-age women will withdraw from the labor market to care for their children. Hence, fertility support policies need to be very carefully designed and targeted to minimize these consequences (including, first and foremost, a wide range of policies to help women reconcile work and family life). It should be emphasized here that providing sound research-based policy advice in this case is a difficult challenge for researchers, since ‘assessing the welfare consequences of differences in fertility requires comparing the welfare of those not yet born to those who will never be born’ (Lee, Mason, NTA Networks 2014).

Conclusion

Global aging is a multidimensional phenomenon that is bound to affect all spheres of human life, put great pressure on many socio-economic institutions and infrastructures, and exacerbate the problems of poverty and inequality on a global scale. Many countries are already facing the challenge of mitigating the negative effects of population aging, and many more will face it in the coming decades. The most common response to this challenge has been to raise the retirement (pension) age, but this is an extremely unpopular measure that has provoked strong protests from citizens in several countries across the world, particularly in Europe. Scholars are discussing a variety of responses to global aging, and our research contributes to this discussion by showing that for many countries around the world the sustainability of national pension systems will become untenable unless they manage to achieve substantial fertility increases in the near future. Thus, these countries should implement effective fertility-supporting measures to avoid major social crises. As we can see, fertility-supporting policies have the potential to be a remarkably powerful tool for offsetting some of the most adverse consequences of population aging.

Funding

This research has been supported by the Russian Science Foundation (Project # 23-11-00160).

NOTES

1 https://www.who.int/initiatives/decade-of-healthy-aging.

2 OECD (2024), ‘Old-age dependency ratio’ (indicator), https://doi.org/10.1787/e0255c98-en (accessed on 29 August 2024).

3 https://tradingeconomics.com/country-list/retirement-age-men.

4 For example, the notorious reform in France and the less noticed reforms in Austria, Belgium or Switzerland that have been underway for several years.

REFERENCES

Acemoglu, D., and Johnson, S. 2007. Disease and Development: The Effect of Life Expectancy on Economic Growth. Journal of Political Economy 115 (6): 925–985.

Alaminos, E., Ayuso, M., and Guillen, M. 2020. Demographic and Social Challenges in the Design of Public Pension Schemes. In Peris-Ortiz, M., Alvarez-Garcia, J., Dominguez-Fabian, I. (eds.), Economic Challenges of Pension Systems: A Sustainability and International Management Perspective (pp. 33–55). Cham: Springer.

Amaglobeli, D., Chai, H., Dabla-Norris, E., Dybczak, K., Soto, M., and Tieman, A. F. 2019. The Future of Saving: The Role of Pension System Design in an Aging World. IMF Staff Discussion Note SDN/19/01.

Attanasio, O., Bonfatti, A., Kitao, S., and Weber, G. 2016. Global Demographic Trends: Consumption, Saving, and International Capital Flows. In Piggott, J. and Woodland, A. (eds.), Handbook of the Economics of Population Aging. Vol. 1 (pp. 179–235). Amsterdam: North-Holland.

Aysan, M. F., and Beaujot, R. 2009. Welfare Regimes for Aging Populations: No Single Path for Reform. Population and Development Review 35 (4): 701–720.

Bairoliya, N., Miller, R., and Saxena, A. 2017. The Macroeconomic Impact of Fertility Changes in an Aging Population. URL: https://ssrn.com/abstract=3016158 or http:// dx.doi.org/10.2139/ssrn.3016158

Bárány, Z. L., Coeurdacier, N., and Guibaud, S. 2023. Capital Flows in an Aging World. Journal of International Economics 140: 103707.

Bjursell, C., Nystedt, P., Björklund, A., and Sternäng, O. 2017. Education Level Explains Participation in Work and Education Later in Life. Educational Gerontology 43 (10): 511–521.

Bloom, D. E., Chatterji, S., Kowal, P., Lloyd-Sherlock, P., McKee, M., Rechel, B., Rosenberg, L., and Smith, J. P. 2015. Macroeconomic Implications of Population Aging and Selected Policy Responses. The Lancet 385 (9968): 649–657.

Bloom, D. E., Canning, D., and Finlay, J. E. 2010. Population Aging and Economic Growth in Asia. In Ito, T., Rose, A. (eds.), The Economic Consequences of Demographic Change in East Asia (pp. 61–89). Chicago: University of Chicago Press.

Börsch‐Supan, A., and Ludwig, A. 2009. Aging, Asset Markets, and Asset Returns: A View from Europe to Asia. Asian Economic Policy Review 4 (1): 69–92.

Coale, A. J. 1964. How a Population Ages or Grows Younger. In Freedman, R. (ed.), Population: The Vital Revolution (pp. 47–58). New York: Doubleday.

Colin, C., and Brys, B. 2019. Population Aging and Sub-Central Governments: Long-Term Fiscal Challenges and Tax Policy Reform Options. OECD Working Papers on Fiscal Federalism 30: 1–29.

Cylus, J., Roubal, T., Ong, P., and Barber, S. 2019. Sustainable Health Financing with an Aging Population: Implications of Different Revenue Raising Mechanisms and Policy Options. Copenhagen: European Observatory on Health Systems and Policies. PMID: 31820888.

Gilroy, R. 2007. Review of ‘Aging Societies: Myths, Challenges and Opportunities’ by Sarah Harper. Area 39 (2): 250.

Grinin, L., Grinin, A., and Korotayev, A. 2023. Demographic Transformations in the Light of Technological Development: Types of Demographic Reproduction in the Past and in the Future. Social Evolution & History 22 (2): 203–248.

Grinin, L., Grinin, A., and Korotayev, A. 2024. Cybernetic Revolution and Global Aging: Humankind on the Way to Cybernetic Society, Or the Next Hundred Years. Cham: Springer Nature.

Grünewald, A. 2021. The Historical Origins of Old-Age Pension Schemes: Mapping Global Patterns. Journal of International and Comparative Social Policy 37 (2): 93–111.

Hewitt, P. S. 2002. Global Aging and the Rise of the Developing World. The Geneva Papers on Risk and Insurance-Issues and Practice 27: 477–485.

Higo, M., and Khan, H. T. 2015. Global Population Aging: Unequal Distribution of Risks in Later Life between Developed and Developing Countries. Global Social Policy 15 (2): 146–166.

Hinrichs, K., and Lynch, J. 2012. Old-Age Pensions. In Castles, F.G., Leibfried, S., Lewis, J., Obinger, H., Pierson, C. (eds.), The Oxford Handbook of the Welfare State

(pp. 353–366). Oxford: Oxford University Press.

Holzmann, R., and Hinz, R. 2005. Old-Age Income Support in the 21st Century: An International Perspective on Pension Systems and Reform. Washington, DC: World Bank Publications.

Hu, A., and Chen, F. 2019. Allocation of Eldercare Responsibilities between Children and the Government in China: Does the Sense of Injustice Matter? Population Research and Policy Review 38: 1–25.

Ince Yenilmez, M. 2015. Economic and Social Consequences of Population Aging the Dilemmas and Opportunities in the Twenty-First Century. Applied Research in Quality of Life 10: 735–752.

Johnson, M. L., Bengtson, V. L., Coleman, P. G., and Kirkwood, T. B. (eds.) 2005. The Cambridge Handbook of Age and Aging. Cambridge, UK: Cambridge University Press.

Kinsella, K., and Phillips, D. R. 2005. Global Aging: The Challenge of Success. Population Bulletin 60: 1–40.

Klug, A., Herrmann, E., Fischer, S., Hoffmann, R., and Gramlich, Y. 2021. Projections of Primary and Revision Shoulder Arthroplasty until 2040: Facing a Massive Rise in Fracture-Related Procedures. Journal of Clinical Medicine 10 (21): 5123.

Kohler, H.‐P., Billari, F. C., and Ortega, J. A. 2002. The Emergence of Lowest‐Low Fertility in Europe during the 1990s. Population and Development Review 28 (4): 641–680.

Korotayev, A., Butovskaya, M., Shulgin, S., and Zinkina, J. 2023. How Can the Global Ageing Affect the Global Value System? An Evolutionary Perspective. Social Evolution & History 22 (1): 57–76.

Lee, R. 2011. The Outlook for Population Growth. Science 333: 569–573.

Lee, R., and Mason, A. 2017. Cost of Aging. Finance and Development 54 (1): 7–9.

Lee, R., Mason, A., and NTA network. 2014. Is Low Fertility Really a Problem? Population Aging, Dependency, and Consumption. Science 346 (6206): 229–234.

Luo, Z., Wan, G., Wang, C., and Zhang, X. 2018. Aging and Inequality: The Link and Transmission Mechanisms. Review of Development Economics 22 (3): 885–903.

OECD. 2015. Pensions at a Glance 2015: OECD and G20 Indicators. Paris: OECD Publishing.

Powell, J. L. 2010. The Power of Global Aging. Aging International 35: 1–14.

Powell, J. L., and Khan, H. T. A. 2013. Aging and Globalization: A Global Analysis. Journal of Globalization Studies 4 (1): 137–146.

Rapp, T., Ronchetti, J., and Sicsic, J. 2022. Wh ere are Populations Aging Better? A Global Comparison of Healthy Aging across Organization for Economic Cooperation and Development Countries. Value in Health 25 (9): 1520–1527.

Sanderson, W. C., and Scherbov, S. 2005. Average Remaining Lifetimes can Increase as Human Populations Age. Nature 435 (7043): 811–813.

Sanderson, W. C., and Scherbov, S. 2010. Remeasuring Aging. Science 329 (5997): 1287–1288.

Sanderson, W. C., and Scherbov, S. 2019. Prospective Longevity: A New Vision of Population Aging. Harvard University Press.

UNPD – United Nations Population Division. 2024. World Population Prospects. United Nations, Department of Economics and Social Affairs, Population Division. URL: https://population.un.org/wpp/.

Vogel, E., Ludwig, A., and Börsch-Supan, A. 2017. Aging and pension Reform: Extending the Retirement Age and Human Capital Formation. Journal of Pension Economics & Finance 16 (1): 81–107.

Weil, D.N. 1997. The Economics of Population Aging. In Rosenzweig, M. R., Stark, O. (eds.), Handbook of Population and Family Economics (pp. 967–1014). Amsterdam: Elsevier.

Yakita, A. 2017. Population Aging, Fertility and Social Security. Cham: Springer International Publishing.

Yoshino, N., Kim, C. J., and Sirivunnabood, P. 2019. Aging Population and its Impacts on Fiscal Sustainability. In Kim, Chul-Ju (ed.), Aging Societies. Policies and Perspectives (pp. 21–34). Tokyo: Asian Development Bank Institute.

Zinkina, J., Christian, D., Grinin, L., Ilyin, I., Andreev, A., Aleshkovski, I., Shulgin, S., and Korotayev, A. 2019. Global Sociopolitical Transformations of the Nineteenth Century. In Zinkina, J., et al. (eds.), A Big History of Globalization: The Emergence of a Global World System (pp. 153–181). Cham: Springer.