Kaname Akamatsu. Biography and Long Cycles Theory

Almanac: Kondratieff waves:Cycles, Crises, and Forecasts

Abstract

The paper considers the biography of Kaname Akamatsu. In Akamatsu's theory, there are important links between his ‘flying geese’ model and Kondratieff's ideas. The author establishes the relationship between the economic cycle and the cycle of income convergence in the World System.

Keywords: Kaname Akamatsu, ‘flying geese’ model, biography, economic cycles.

Kaname Akamatsu was a contemporary of Nikolay Kondratieff, only four years younger than he. So they observed many of the same economic and political events – though from different angles of the World System. However, due to the fact that Kondratieff started his scientific carrier quite early and that his theory was published in English and German, it happened that Akamatsu became a follower of Kondratieff. The latter was slowly dying in the Suzdal prison while his ideas were finding new supporters. It seems deeply symbolic that a year before Kondratieff's death the famous work of Akamatsu in Japanese was published and that a year after Kondratieff's death Schumpeter published his book in which long cycles received the name of Kondratieff.

So there was a great admirer of Nikolay Kondratieff in distant Japan. What do we know about him? How long was the ‘pilgrimage’1 of the son of an impoverished rice retailer from the southern Japanese island of Kyushu to his intellectual encounter with the great Kondratieff, at a time when Nikolai Dmitrievich already suffered in the cold of the Gulag, and when Akamatsu, a critical spirit, well familiar with European philosophy and economics, especially with Marx, had to work under the stifling intellectual atmosphere of expansionist and imperial Japan which already started its policies of occupation in Asia?

Kondratieff cycle research must be grateful to Korhonen (1994) who presented some biographical facts about this important2 follower of Kondratieff, whose life, very much like Kondratieff's own life, was not free from bitter experiences. So Kaname Akamatsu was born in 1896 into a very poor family in what was then the poorest part of the Japanese archipelago. As Korhonen could establish from documents only accessible in the Japanese language, Kaname was so poor that during his student days at Kobe he ‘wore the same clothing for four years until they turned to rags and a friend replaced them, which aroused in Akamatsu an interest in Marxism’ (Korhonen 1994: 93). Besides Marxism, Akamatsu studied mainstream economics, and became interested in German philosophy, especially in the work of Nietzsche, Schopenhauer and Kant. He became a University teacher, and in 1924 he went to Germany to continue his studies there. In early 1926 Akamatsu left Heidelberg and, as Korhonen shows, ‘travelled to London to pay his respects at the grave of Karl Marx. He was shocked to find it neglected; indeed, he even had trouble locating it’ (Korhonen 1994: 94). Respect for the ancestors is one of the deepest layers of Japanese culture, and the visit to Highgate Cemetery must have deeply impressed the researcher, who was now 30 years old. He had a chance to visit later on during his foreign trip the Harvard Bureau of Economic Statistics in Boston in the same year, studying the new approaches in empirical and statistical economic research; a visit, which should radically change his scientific approach. After his return to Nagoya, Akamatsu began to study empirically the mechanisms of import substitution and the history and development of the Japanese woolen and cotton textile industry. Akamatsu's statistical investigations established, as Korhonen shows, a pattern of economic development in one product category after the other.

From there on, a process of the ladder of success set in, which was not without dangers, perils, and temptations of its own. While Kondratieff had the bad luck that the powerful political elite in the person of Joseph Stalin himself contradicted his theories, it was Akamatsu's bad luck that Imperial Japan fully endorsed his theories and even used it as a justification of its expansionist and brutal policy of occupation in many Asian countries to an extent unforeseen and not wished by Akamatsu. In 1939 Akamatsu became professor at the Tokyo University of Economics; in 1940 he was elevated to the post of Director of Research in the East Asian Economic Research Centre. In 1943 Akamatsu was finally conscripted into the military and was placed under military command and sent to Singapore to direct research on the economy of Southeast Asia under Japanese rule. As Korhonen states:

The flying geese theory had meanwhile become part of Japanese war propaganda aimed at nations of the Greater East Asian Co-prosperity Sphere as a way of lending intellectual legitimacy to Japanese claims of bringing freedom, development and prosperity to the nations of Asia. It seems that Akamatsu himself did not write such papers, but confined himself as much as possible to the academic field as a scholar. In his autobiography he recalls that in this respect life was easier in Singapore than in Tokyo. If he had stayed in Tokyo he would probably have been drafted to write propaganda for the war effort, whereas in Singapore he was able to concentrate relatively freely on research. It is true that Akamatsu was a nationalist, and once the nation had chosen a warlike course he contributed to the war effort, even though as a scholar he was well aware of the economic realities in respect to Japan's ability to win the war. On the other hand, Akamatsu seems to have had nothing against the principle that Asia should free itself from Western colonialism. He travelled around the area and became acquainted with Malay and Indonesian leaders such as Sukarno and Hatta (Korhonen 1994: 94).

In 1946, Akamatsu was even interrogated as a possible war criminal, but partly because of his troubles with the authorities in the context of his doctoral dissertation, where some of his words were interpreted by his censors as being disrespectful against the Emperor himself in person, and which were considered to be subversive in 1943, charges against him were dropped.

In 1953, Akamatsu became the Dean of the Faculty of Economics at Hitosubashi University, and could finish many additional works and could peacefully retire from his job at the University. Today, there is a vast debate on the ‘flying geese’ model or FGM, as it is sometimes being referred to, which can also be evidenced by the fact that none the less than over 700 articles in ‘Google scholar’ refer to Akamatsu 1961.3

‘Dual’ Structure of Cycles

In this section I would like to discuss the fact that Kondratieff long cycles should be considered in the framework of the center-periphery structure of the global economy already in respect of manifestation at the country's level. It is obvious that on this level such long waves in every country and epoch would be rather diverse as regards the length of waves as well as their strength and apparency.

Already Kaname Akamatsu hinted at the connection between ‘national’ and international center-periphery structure cycles. His most well-known tribute to Kondratieff (Akamatsu 1961) specifically links the rise and decline of the global peripheries to the larger Kondratieff cycle. His contribution, which is hardly ever mentioned nowadays in the framework of K-cycle research, is the starting point of our analysis.

Analyzing the data on convergence and divergence of real incomes of the countries of the world in the international system, it appears that mostly they do not exhibit linear upward movements of the poorer nations to catch up with the richer countries, but rather that there are strong cyclical upward and downward swings, which we call henceforth ‘Akamatsu cycles’.4

Akamatsu cycles may be defined as cycles (with a period ranging from 20 to 60 years) connected with convergence and divergence of core and periphery of the World System and explaining cyclical upward and downward swings (at global and national levels) in the movements of the periphery countries to catch up with the richer ones.

In fact, these ‘Akamatsu cycles’, analyzed in our research (Grinin, Korotayev, and Tausch 2016) on the basis of the well-known Maddison data series are even stronger and seem to be more devastating than the national, 50 to 60 years Kondratieff waves. This leads us to the discovery of what might be termed a ‘double-Tsunami wave structure’ of economic cycles.

It is important to use the most relevant and accurate data for such a research question. Our Maddison data are for the following countries: Argentina; Australia; Austria; Belgium; Brazil; Canada; Chile; Colombia; Denmark; Finland; France; Germany; Greece; India; Indonesia; Italy; Japan; Netherlands; New Zealand; Norway; Peru; Portugal; Russia; Spain; Sri Lanka; Sweden; Switzerland; UK; Uruguay; USA; and Venezuela.5 They present a fairly comprehensive picture of the world in terms of continents (with the salient exception of Africa), cultures, global trade and global production over the last 130 years, and currently make up approximately 40.8 % of global population and 57.8 % of global purchasing power.

In the framework of our re-analysis we found new empirical evidence on the existence of such Akamatsu cycles of around 20 years length or less in Australia; Chile; Denmark; Germany; Norway; Spain; Sweden; Switzerland; and Uruguay. Akamatsu cycles of around 30–40 years length were found in Belgium; Brazil; Canada; Denmark; Finland; France; Germany; Greece; India; Indonesia; Japan; Netherlands; New Zealand; Norway; Peru; Portugal; Sri Lanka; Sweden; Switzerland; and the UK. Akamatsu cycles of around 60 year's length were found in Colombia and Russia.

Our re-analysis of standard world industrial production growth data since 1741 as well as standard global conflict data since 1495, all presented in Appendix B (see Grinin, Korotayev, and Tausch 2016), cautiously support the earlier contentions of world-system research with evidence tested by spectral analysis and auto-correlation analysis.

In this book (Ibid.) we concentrated on what this ‘dual’ or even ‘triple’ structure of cycles – global ups and downs, national ups and downs, and ups and downs in the relative position of countries in the global economy – mean for the future of the analysis of international economic relations.

Our re-analysis of these entire sets of questions also sheds some light on the question why cycles (Kondratieff or Akamatsu) in some countries are shorter or longer than in other countries. We also try to show why in some countries, Akamatsu cycles seem to have priority, while in the other countries, the Kondratieff cycle seems to have priority.

Our analyses (see Grinin, Korotayev, and Tausch 2016: Ch.4, Appendix B) show one single, overriding, and strong tendency: richer and more resilient countries of the center with well-established social safety net, and appropriate efforts to develop mechanisms of what Amin so aptly called ‘auto centered development’ (Amin 1994) tend to have shorter cycles, while the peripheries with long-run tendencies to suffer from a lack of sustainable development are characterized by longer cycles (though since the late 1980s this pattern has been altered substantially by the mounting Great Divergence processes [Grinin and Korotayev 2015]).

Richer, more resilient countries also tend to be characterized by the priority of the Akamatsu wave over the Kondratieff wave. The United States, Germany, France, and the Netherlands are the four nations, singled out in this work, to show our case.

Our analytical research program also aims to be a fairly comprehensive test of the hypotheses about the issue of long cycles with the issue of economic convergence and divergence. The matter is that the startling discovery which one makes upon closer inspection of the trajectories of economic convergence in the 31 countries with the newly available Maddison data set since the 19th century (Bolt and van Zanden 2013) is that there are very strong cyclical ups and downs of the relative convergence of these countries in relationship to the real GDP per capita at the world level and in the capitalist system's leading economies, such as the United Kingdom and the United States of America, and not just in their own ‘national’ growth rates and national economic cycles.

There is also a long-run trend with a turning point for many countries taking place in the recent decades. We think that the most important message for future world-systems research from our researches (see Grinin and Korotayev 2015; Grinin, Korotayev, and Tausch 2016) is the realization that convergence processes in many nations of the world are discontinuous and have a salient cyclical component. Several semi-peripheries in Asia, Africa, and Latin America are ascending nowadays at the expense of the sharp downward trend in the European Southern periphery. But the rightward indented S-curve of income convergence and divergence now also affects the European center.

From Kondratieff Waves to Akamatsu ‘Flying Geese’ Model

In Akamatsu's theory, there are important links between his ‘flying geese’ (Gankō Keitairon) model and Kondratieff's ideas. This ‘flying geese’ model was first proposed in a far-reaching and long tribute to Kondratieff's theory published internationally in 1961, but it was originally published in imperial Japan already in 1937 (shortly before the onset of the Second World War). It specifically links the rise and decline of the global peripheries to the larger Kondratieff cycle. The very essence of the ‘flying geese’ and the K-cycle is that the two processes are intractably linked together, and that one cannot separate the two.

Now let us briefly relate the basic connection between Akamatsu's theory and the contribution by Kondratieff.

The clearest link to his own theory is then the following quotation, which also refers to an article written by Akamatsu in Japanese in 1937, where he already established the statistical pattern of ‘flying geese’ in Japanese import substitution:

In the foregoing pages, I have discussed how innovations in advanced industrial nations bring about differentiation of the world economy and cause expansion and liberalization of international trade; how these innovations are at length diffused to other industrial nations, resulting in uniformization of the world economy and leading to stagnation of international trade and protective policies; and how new innovations arise from this stage. I have shown how the international economy has grown by describing structural waves. Nevertheless, in the process by which underdeveloped countries which have not yet reached the level of industrial nations grow, a somewhat different pattern is found. I call this the ‘wild-geese-flying pattern’ of economic growth, which is a literal translation of a term coined in Japanese […] Wild-geese are said to come to Japan in autumn from Siberia and again back to north before spring, flying in inverse V shapes, each of which overlaps to some extent […] (Akamatsu 1937 [1961]: 205–206).

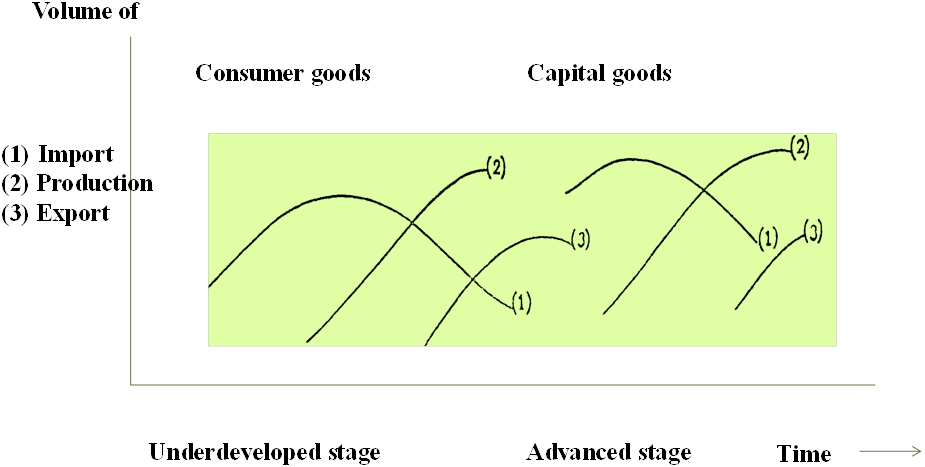

Fig. 1 describes the original scheme, as it was presented by Akamatsu in his publications, all referring to the sequence of development stages along Kondratieff cycles. We have adapted the graph for the purpose of the present article.

Fig. 1. The Akamatsu model of ‘flying geese’

Source: our own adaption from Akamatsu 1961: 206.

Akamatsu's new input into the Kondratieff cycle debate is that he puts the ‘differentiation’ of the world economy into the center of his theoretical developments (Akamatsu 1961, 1962). The differentiation of the world economy leads to the rapid diffusion of new techniques to rising industrial nations, which starts with the import of new commodities by these nations. In time, techniques and capital goods are imported as well, and homogenous industries are being established. According to Akamatsu, the uniformization of both industry and agriculture gave rise to the fierce and conflictive competition between Europe, the United States and Japan in the last quarter of the 19th century. When an innovation occurs in some industry in an advanced nation, investment is concentrated there, causing a rise in the trade cycle. Innovation leads to an increase in exports, and the nation's prosperity creates and increases the import of raw materials and foodstuffs. Akamatsu sees a counter-movement in other parts of the world, centered on the rising production of gold, which, according to him, leads to an increase in effective demand and further stimulates exports of the innovating nation. In that way, world production and trade expand, prices increase and a world-wide rise in the long-term trade cycle results (see Arrighi, Silver, and Brewer 2003; Kasahara 2004; Krasilshchikov 2014; Ozawa 2004, 2013; Schroeppel and Nakajima 2002).

Quite similarly to Kondratieff (1935: 111), for Akamatsu, innovations occur mainly at the end of an old and waning economic cycle, and are put into practice during the new emerging economic cycle. Akamatsu notes that innovation occurs first in an industry of an advanced industrial nation, investment is concentrated there, causing a rise in the trade cycle. Innovations increase exports. Increased prosperity, due to rising exports of the advanced nation, causes an increase in the import of raw materials and foodstuffs. Increased gold exports from other regions increase effective demand and further stimulate exports of the innovating nation.

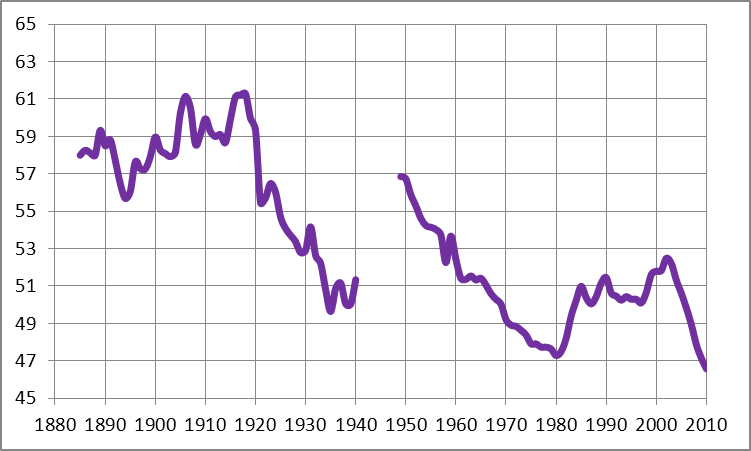

However, innovations spread from the innovating nations to other nations, leading to the development of industries in those countries, with the result of a conflictive relationship with the industries of the innovating nation. Exports of the innovating nation become stagnant, and on the world level, there is a tendency towards overproduction, prices turn downwards, and the rates of growth of production and trade fall. That what later K-cycle research tended to call the upswing A-phase of the cycle will be, according to Akamatsu, a period of differentiation in the world economic structure, while the ‘falling period’ (or B-phase of the cycle) will, Akamatsu argues, coincide with a process of uniformization in world economic structure. Fig. 2 supports the contention by Akamatsu that the A-phases of long upswings in the world economy widen international inequalities 6, while the B-phases of long decline reduce constant real international GDP per capita purchasing power differences:

Fig. 2. The coefficient of variation of constant real world GDP per capita incomes in purchasing power parity rate according to Maddison’s database (for 31 countries), 1885–2010

Note: our own compilations, based on Maddison's dataset (as documented in Bolt and van Zanden 2013). Calculated from the original data with Microsoft EXCEL 2010.

In the 19th century, Akamatsu sees the following major tendencies at work:

-

The innovations of the first wave of the Industrial Revolution and the respective differentiation in the world economy.

-

The B-phase after the Napoleonic Wars brought about a re-unifor-mization.

-

Uniformization especially of European agriculture, innovation in iron industry after 1850; England's position as a prime exporter of railroad materials and textiles. The discovery of gold in California and Australia increases global demand.

-

The beginning of the decline around the time of the Franco-Prussian War 1870, rising mercantilism and imperialism.

For Akamatsu, imperialism with its tendencies to develop ‘complementary’ economic structures instead of homogenization, together with its financial expenditures led towards the third expansion wave. New industries, such as the electric industry, and the automobile industry were born, and the center of the world economy shifted towards the United States of America. The third long-term wave began from the 1900s onwards, and again the spread of industrial innovations to other regions and the accompanying uniformization of the world economy play a major role on the path towards depression, which culminated in the 1930s. The depression of the 1930s was caused, Akamatsu argues, not only by uniformization, but also by the reduction of arms expenditures after World War I, the gold standard and the policies of deflation in force in the 1920s and early 1930s. Gold production showed a marked decrease during this era. High tariff policies, the world-wide race to depreciate the exchange rate after England's suspension of the gold standard in September, 1931 additionally deepened the recession, giving rise in turn to control measures such as exchange control and quantitative restrictions on trade.

According to Akamatsu's analysis in 1961, the fourth wave started in 1933, with the aircraft industry and the synthetics industry as the leading new sectors. Going off gold, carrying out devaluations of currencies, i.e., raising the world price of gold, were additional elements in the new upswing. Military expenditures in addition increased effective demand. In contrast to the 1920s, Akamatsu thinks that successful policies were continued by the United States after 1945, now with atomic power, electronics, and innovations in consumer durables in the lead (Akamatsu 1961). Development aid by America, and the strengthening of labor unions, the increase in military expenditures after the Korean War and the policies of full employment and social security all contributed to the stability of the Post-War economic expansion. At the end of Akamatsu's lengthy analysis of the Kondratieff cycle in 1961, he expresses the hope that national and international economic policies will prevent the recurrence of a world depression like that of the 1930s.

For Akamatsu, the characteristic structure of the Center – Periphery relationship, which he more deeply analyzes also in his publication (Akamatsu 1962), is characterized by the fact that the underdeveloped nation will export primary products and will import industrial goods for consumption (see Arrighi, Silver, and Brewer 2003; Kasahara 2004; Krasilshchikov 2014; Ozawa 2004, 2013; Schroeppel and Nakajima 2002; Grinin and Korotayev 2015). However, the role of foreign capital received little attention in Akamatsu's theory, as he worked out his theory proceeding from the observations of the textile industry development in Japan (then still a developing rather than developed country) during the period of 40–50 years starting from the late nineteenth century. Later on, an underdeveloped nation will attempt to produce goods which were hitherto imported, first in the field of consumer goods, and later on in the area of capital goods. At the fourth stage of the process, the underdeveloped nation will attempt to export capital goods. There will be a tendency of ‘advanced’ differentiation in the world economy, however, because the capital goods industries in advanced nations will still advance further, giving rise to ‘extreme differences of comparative costs’. The wild-geese flying pattern includes three sub-patterns: the first is the sequence of imports – domestic production – exports. The second is the sequence from consumer goods to capital goods and from crude and simple articles to complex and refined articles. The third is the alignment from the advanced nations to backward nations according to their stages of growth (see Arrighi, Silver and Brewer 2003; Kasahara 2004; Krasilshchikov 2014; Ozawa 2004, 2013; Schroeppel and Nakajima 2002).

However, there is a darker and more somber nature of these cycles as well – the condition of discrepancy will be met, Akamatsu argues, by means of imports, leading to discrepancies in the balance of payments, and the pressure to increase exports of primary products to improve the balance. Discrepancies will also lead to a shift of production away from domestic industries in the underdeveloped country towards the export sector; leading, in the end, also to problems of excessive supply capacities in the underdeveloped country, etc. (see Arrighi, Silver, and Brewer 2003; Kasahara 2004; Krasilshchikov 2014; Ozawa 2004, 2013; Schroeppel and Nakajima 2002).

At the end of the day, Akamatsu believes in a Hegelian dialectic between the three basic discrepancies, characterizing the process of development: the discrepancy of development, the cyclical discrepancy between the rich and the poor countries, and the structural discrepancy. At this stage however, Akamatsu does not formalize his arguments any further.7

We test the crucial relationship of the Akamatsu cycles of convergence and the cross-correlation relationship between the Akamatsu cycle and the Kondratieff cycle. In Argentina, Austria, Italy, and Venezuela there are either clear linear overall convergences (Austria) or divergences (Argentina), and in Italy and in Venezuela, as well as in Russia, convergence had the shape of an inverted ‘U’. Akamatsu cyclical oscillations are shortest in Spain, and longest in Russia. Cross correlation analysis also reveals that in Spain; Denmark; Finland; Australia; Greece; Netherlands; and Argentina there is a clear priority of the cyclical Akamatsu movements over the economic growth rates, while in the other countries of the 30 nations with available data the Kondratieff cycle determines the Akamatsu cycle. Only further research can clarify whether these differences are to be explained by the structure of exports, the role of raw material exports in the economic processes, etc.

Our research also sheds some light on the question why cycles (Kondratieff or Akamatsu) in some countries are shorter or longer than in the other countries, and why in some countries, Akamatsu cycles seem to have priority, while in the other countries, the Kondratieff cycle seems to have priority.

The hypothesis, why there are such differences in cycle length between the various countries of the world, has to be found: a simple center – periphery or machinery exporter versus raw material exporter dichotomy does not apply, and also other factors, such as GDP per capita, or education also would not explain the difference alone. An interesting hypothesis could be the application of Bornschier's dependency theory, centered around penetration by transnational capital in the different economies of the world and the weakness or strength of ‘national capital’ (Bornschier and Chase-Dunn 1985; Tausch 2010). By and large, the role of transnational capital in the countries with longer Kondratieff cycles seems to be historically more pronounced than in the countries with shorter cycles, and the strength or weakness of the national bourgeoisie seems to determine the shortness or length of cycles. Typical cases, supporting such an interpretation would be the short cycles in France, Germany, Japan, the Netherlands, and Switzerland versus the long cycles in Argentina, Canada, Chile, Greece, India, New Zealand, Spain and Russia.

Our following Tables (Table 1 to Table 3) and the supporting online maps8 show us the differentia specifica of the countries with longer Kondratieff cycles, Akamatsu cycles, the priority of the Akamatsu cycle over the Kondratieff cycle, and the long-term determination of the trend of the Akamatsu cycle by polynomial expressions of higher order (as shown in Electronic Appendix 59). For lack of comparative cross-national data since the 1880s, we used a freely available standard cross-national development studies dataset based on international standard international statistics. To make a long story short, all these analyses show one single, overriding, strong and unidirectional tendency: richer and more resilient countries of the center with well-established social safety nets, and appropriate efforts to develop mechanisms of what Samir Amin so aptly called ‘autocentered development’ tend to have shorter cycles, while the peripheries with long-run tendencies to suffer from a lack of sustainable development are characterized by longer cycles. Richer, more resilient countries tend to be characterized by the priority of the Akamatsu wave over the Kondratieff wave. With the plausible outliers of two countries, where insurgents controlled a large part of the national territory for parts of the 20th century, only countries of the center in addition could escape the high degree of statistical determination in their convergence trends over time since 1885. The United States, Germany, France, and the Netherlands are the four nations, singled out in our Electronic Appendix Map 18b. The two exceptions to this rule are quickly explained. One country is Greece, whose Maddison per capita income data might be not too reliable at any rate, and which suffered severe historical upheavals in the aftermath of the First World War right through to the end of the Greek Civil War in 1949. The other country is Colombia, which also suffered from large scale political violence to make historical income data hardly reliable (‘la violencia’, 1948–58; Colombian guerrilla wars, 1964 to the present). It is still true that typical center countries exhibit a large R2 in their convergence trends, analyzed in Appendix B (Grinin, Korotayev, and Tausch 2016) and summarized in Electronic Appendix Map 18b.10 The United Kingdom, Japan and Sweden (the latter two were still semi-peripheries by 1885) are such cases. But by and large, the tendency holds that only the United States, Germany, France, and the Netherlands present convergence trends which seem to be not too strongly affected by the time factor. In a sense, only their historical development exhibited a stronger ‘degree of freedom’ from the tidal waves of the Akamatsu cycles.

All the other countries were characterized in their historical development by some variants of Akamatsu cycles.

Table 1. Correlates of the maximum length of Kondratieff cycles

|

|

Pearson corr. maximum length Kondratieff cycle |

Slope maximum length Kondratieff cycle |

|

Military expenditures per GDP |

0.430 |

0.070 |

|

Carbon emissions per million US dollars GDP |

0.373 |

5.516 |

|

Carbon emissions per capita |

0.296 |

0.119 |

|

Tertiary enrollment |

0.243 |

0.004 |

|

MNC PEN – stock of Inward FDI per GDP |

0.228 |

0.184 |

|

Quintile share income difference between richest and poorest 20 % |

0.219 |

0.101 |

|

Net exports of ecological footprint gha. per person |

0.214 |

0.049 |

|

Civil and political liberties violations |

0.209 |

0.019 |

|

Avoiding net trade of ecological footprint gha. per person |

–0.200 |

–0.243 |

|

Life expectancy (years) |

–0.211 |

–0.078 |

|

Comparative price levels (US=1.00) |

–0.216 |

–0.006 |

|

Population density |

–0.218 |

–1.974 |

|

Social security expenditure per GDP average 1990s (ILO) |

–0.239 |

–0.162 |

|

FPZ (free production zones) employment as % of total population |

–0.303 |

–0.014 |

Table 2. Correlates of the maximum length of Akamatsu cycles

|

|

Pearson corr. maximum length Akamatsu cycle |

Slope maximum length Akamatsu cycle |

|

Civil and political liberties violations |

0.704 |

0.083 |

|

Combined failed states index |

0.558 |

1.406 |

|

Carbon emissions per million US dollars GDP |

0.509 |

10.136 |

|

Total unemployment rate of immigrants (both sexes) |

0.489 |

0.134 |

|

Military expenditures per GDP |

0.422 |

0.094 |

|

ln (number of people per mill inhabitants 1980-2000 killed by natural disasters per year+1) |

0.335 |

0.020 |

|

Comparative price levels (US=1.00) |

–0.320 |

–0.013 |

|

Social security expenditure per GDP average 1990s (ILO) |

–0.352 |

–0.329 |

|

Economic growth in real terms pc. per annum, 1990–2005 |

–0.360 |

–0.037 |

|

Closing political gender gap |

–0.360 |

–0.005 |

|

Human development index (HDI) value 2004 |

–0.379 |

–0.004 |

|

2000 Economic Freedom Score |

–0.401 |

–0.328 |

|

Democracy measure |

–0.437 |

–0.112 |

|

Overall 35 development index |

–0.454 |

–0.004 |

|

Overall 35 development index, based on 7 dimensions |

–0.455 |

–0.004 |

|

Female survival probability of surviving to age 65 female |

–0.470 |

–0.345 |

|

Life Expectancy (years) |

–0.530 |

–0.277 |

|

Rule of law |

–0.532 |

–0.054 |

|

Corruption avoidance measure |

–0.538 |

–0.061 |

Table 3. Correlates of the priority of the Akamatsu cycles over the Kondratieff cycles

|

|

Pearson corr. |

|

1 |

2 |

|

Life Satisfaction (0–10) |

0.353 |

|

UNDP education index |

0.342 |

|

Happy life years |

0.339 |

|

Global tolerance index |

0.338 |

|

Gender empowerment index value |

0.328 |

|

Tertiary enrollment |

0.307 |

|

Human development index (HDI) value 2004 |

0.298 |

|

Years of membership in EMU, 2010 |

0.279 |

|

Female survival probability of surviving to age 65 female |

0.252 |

|

Overall 35 development index |

0.245 |

|

Democracy measure |

0.238 |

|

Closing of global gender gap overall score 2009 |

0.237 |

|

Closing political gender gap |

0.234 |

|

Life expectancy (years) |

0.233 |

|

Absolute latitude |

0.225 |

|

Social security expenditure per GDP average 1990s (ILO) |

0.224 |

|

Infant mortality 2005 |

–0.233 |

|

ln (number of people per mill inhabitants 1980–2000 killed by natural disasters per year+1) |

–0.240 |

|

Total unemployment rate of immigrants (both sexes) |

–0.243 |

|

Combined Failed States Index |

–0.275 |

References

Akamatsu K. 1961. A Theory of Unbalanced Growth in the World Economy. Weltwirtschaftliches Archiv – Review of World Economics 86 (2): 196–217.

Akamatsu K. 1962. A Historical Pattern of Economic Growth in Developing Countries. The Developing Economies 1: 3–25.

Akamatsu K. 1975. Gakumon henro [Academic Pilgrimage]. Gakumon henro. Akamatsu Kaname sensei tsuitо ronshu [Academic pilgrimage. Commemorating volume on Professor Akamatsu Kaname] / Ed. by K. Kojima et al., pp. 1–68. Tokyo: Sekai Keizai Kenkyu Kyokai.

Amin S. 1994. Re-reading the Postwar Period: An Intellectual Itinerary. New York: Monthly Review Press.

Arrighi G., Silver B. J., and Brewer B. D. 2003. Industrial Convergence, Globalization, and the Persistence of the North-South Divide. Studies in Comparative International Development 38 (1): 3–31.

Bolt J., and van Zanden J. L. 2013. The First Update of the Maddison Project; Re-estimating Growth before 1820. Maddison Project Working Paper No 4. URL: http://www.ggdc.net/maddison/maddison-project/home.htm.

Bornschier V., and Chase-Dunn Ch. K. 1985. Transnational Corporations and Underdevelopment. New York, NY: Praeger.

Ginzburg A., and Simonazzi A. 2005. Patterns of Industrialization and the Flying Geese Model: The Case of Electronics in East Asia. Journal of Asian Economics 15 (6): 1051–1078.

Grinin L. E. 2013. The Dynamics of Kondratieff Waves in the Light of the Production Revolutions Theory. Kondratieff Waves: The Spectrum of Ideas / Ed. by L. E. Grinin, A. V. Korotayev, and S. Yu. Malkov, pp. 31–83. Volgograd: Uchitel. In Russian (Гринин Л. Е. Динамика кондратьевских волн в свете теории производ-ственных революций. Кондратьевские волны: Палитра взглядов / Отв. ред. Л. Е. Гринин, А. В. Коротаев, С. Ю. Малков, с. 31–83. Волгоград: Учитель).

Grinin L. E., and Korotayev A. V. 2014a. Globalization and the Shifting of Global Economic-Political Balance. The Dialectics of Modernity – Recognizing Globalization. Studies on the Theoretical Perspectives of Globalization / Ed. by Е. Kiss, and A. Kiadó, pp. 184–207. Budapest: Publisherhouse Arostotelész.

Grinin L. E., and Korotayev A. V. 2014b. Globalization Shuffles Cards of the World Pack: In Which Direction is the Global Economic-Political Balance Shifting? World Futures 70 (8): 515–545.

Grinin L. E., and Korotayev A. V. 2015. Great Divergence and Great Convergence. A Global Perspective. New York, NY: Springer.

Grinin L. E., Korotayev A. V., and Tausch A. 2016. Economic Cycles, Crises, and the Global Periphery. New York, NY: Springer International Publishing.

Ito T. 2001. Growth, Crisis, and the Future of Economic Recovery in East Asia. Rethinking the East Asian Miracle / Ed. by J. Stiglitz, and S. Yusuf, pp. 55–94. New York, NY: Oxford University Press.

Kasahara S. 2004. The Flying Geese Paradigm. A Critical Study of its Application to East Asian Regional Development. UNCTAD Discussion Papers 169. April 2004, United Nations Conference on Trade and Development (UNCTAD), Palais des Nations, CH-1211 Geneva 10, Switzerland). URL: http://www.unctad.org/en/Docs/ osgdp20043_en.pdf.

Kojima K. 2000. The ‘Flying-Geese’ Model of Asian Economic Development: Origin, Theoretical Extensions, and Regional Policy Implications. Journal of Asian Economics 11: 375–401.

Kondratieff N. D. 1935. The Long Waves in Economic Life. Review of Economic Statistics 17 (6): 105–115.

Korhonen P. 1994. The Theory of the Flying Geese Pattern of Development and its Interpretations. Journal of Peace Research 31(1): 93–108. URL: http://www.links. jstor.org/sici?sici=0022-3433%28199402%2931%3A1%3C93%3ATTOTFG%3E2. 0.CO%3B2-P.

Korhonen P. 1998. Japan and the Asia Pacific Integration. London: Routledge.

Korotayev A., Zinkina J., Bogevolnov J., and Malkov A. 2011a. Global Unconditional Convergence among Larger Economies after 1998? Journal of Globalization Studies 2 (2): 25–62.

Korotayev A., Zinkina J., Bogevolnov J., and Malkov A. 2011b. Unconditional Convergence among Larger Economies. Great Powers, World Order and International Society: History and Future / Ed. by D. Liu, pp. 70–107. Changchun: The Institute of International Studies – Jilin University.

Korotayev A., Zinkina J., Bogevolnov J., and Malkov A. 2012. Global Unconditional Convergence among Larger Economies. Globalistics and Globalization Studies / Ed. by L. E. Grinin, I. Ilyin, and A. Korotayev, pp. 246–280. Moscow – Volgograd: Moscow State University – Uchitel.

Krasilshchikov V. 2014. The Malaise from Success: The East Asian ‘Miracle’ Revised. Saarbrucken: LAP Lambert Academic Publishing.

Kwan C. H. 1994. Economic Interdependence in the Asia-Pacific Region. London: Routledge.

Ozawa T. 1992. Foreign Direct Investment and Economic Development. Transnational Corporations 1 (1): 27–54.

Ozawa T. 2001. The ‘Hidden’ Side of the ‘Flying-Geese’ Catch-up Model: Japan's Dirigiste Institutional Setup and a Deepening Financial Morass. Journal of Asian Economics 12: 471–491.

Ozawa T. 2004. The Hegelian Dialectic and Evolutionary Economic Change. Global Economy Journal 4(1). Doi: 10.2202/1524-5861.1006. URL: http://www.degruy ter.com/view/j/gej.2004.4.1/gej.2004.4.1.1006/gej.2004.4.1.1006.xml?format=INT.

Ozawa T. 2005. Institutions, Industrial Upgrading, and Economic Performance in Japan: The ‘Flying-geese’ Paradigm of Catch-up Growth. Cheltenham: Edward Elgar.

Ozawa T. 2009. The Rise of Asia: The ‘Flying-geese’ Theory of Tandem Growth and Regional Agglomeration. Cheltenham: Edward Elgar.

Ozawa T. 2010. The (Japan-born) ‘Flying-geese’ Theory of Economic Development Revisited and Reformulated from a Structuralist Perspective. Working Paper No. 291. Center on Japanese Economy and Business, Graduate School of Business, Columbia University. URL: http://www.gsb.columbia.edu/cjeb/research.

Ozawa T. 2013. The Classical Origins of Akamatsu's ‘Flying-Geese’ Theory: A Note on a Missing Link to David Hume. Working Paper Series no. 320. New York, NY: Center on Japanese Economy and Business, Columbia University. Retrieved from www.gsb.columbia.edu/cjeb/ research.

Shinohara M. 1982. Industrial Growth, Trade, and Dynamic Patterns in the Japanese Economy. Tokyo: University of Tokyo Press.

Schroeppel C., and Nakajima M. 2002. The Changing Interpretation of the Flying Geese Model of Economic Development. German Institute of Japanese Studies Yearbook 2002: 203–236.

Tausch A. 2010. Towards Yet Another Age of Creative Destruction? Journal of Globalization Studies 1 (1): 104–130.

Yamazawa I. 1990. Economic Development and International Trade: The Japanese Model. Honolulu, Hawaii: East-West Center.

1 The term ‘pilgrimage’ might be allowed here, because Akamatsu himself used it in his essay, which was published after his death in 1974 in the year 1975 (see Akamatsu 1975).

2 As Ozawa (2013) correctly remarks, it is the only Japan-born economic theory that has so far been well recognized outside Japan: ‘The “flying-geese (FG)” theory of economic development is now known the world over, having gained some respectability in the academia and wide popularity in the media – especially against the backdrop of a series of catch-up economic successes across Asia during the last few decades of the 20th century. The speech made by Saburo Okita (1914–1993), former Japanese Foreign Minister, referring to the theory at the fourth Pacific Economic Cooperation Conference in Seoul in 1985, made policymakers and the mass media aware of it. It is the only Japan-born theory that has so far been well recognized outside Japan. It is also accepted as a major doctrine of catch-up development strategy, along with the “big-push” theory and the “import substitution” approach’ (Ozawa 2013: 2).

3 The union catalogue of all Japanese research libraries – the so-called CINII books catalogue – lists today under his author name at the address URL: http://ci.nii.ac.jp/author/DA0263825X?count= 200&sortorder=2 none the less than 71 works, and only two of them are listed in Western languages; his essay in 1961 and his 1924 essay for the German Philosophical magazine Archiv für Geschichte der Philosophie und Soziologie 38/1–4, 1928 (Neue Folge 31), which appeared under the title ‘Wie ist das vernünftige Sollen und die Wissenschaft des Sollens bei Hegel möglich? Zur Kritik der Rickertschen Abhandlung “Über idealistische Politik als Wissenschaft”’, in 1924. One of the few major academic libraries in the world, where this essay is available today, is Fordham University in New York City, one of the leading Jesuit Universities in America. It is truly notable that Akamatsu could publish an original article in one of the leading German language journals of philosophy, written in German, on a central issue of German philosophy at the time. The Stanford Encyclopedia of Philosophy dedicates a lengthy article on Heinrich Rickert, for many decades a liberal German philosopher, on whom Akamatsu's essay was centered; available at URL: http://plato.stanford.edu/archives/win 2013/entries/heinrich-rickert/.

4 A special analysis turns out to be necessary to detect the trends of Great Convergence (in the recent decades) and Great Divergence (in the preceding period) pushing there way through these complex oscillations (see Grinin and Korotayev 2015).

5 Available at URL: http://www. ggdc.net/maddison/maddison-project/data.htm.

6 Note, however, that this does not appear relevant for the A-phase of the most recent, the 5th, Kondratieff cycle (see, Grinin, Korotayev, and Tausch 2016; see also Grinin and Korotayev 2014a, 2014b, 2015; Grinin 2013; Korotayev et al. 2011a, 2011b, 2012).

7 The development of Japan between the 1950s and the 1980s, then new industrialized countries (Korea, Taiwan, etc.) and later China, Thailand, and Malaysia, in which the role of foreign capital and export sector had already become fundamentally different, allowed many Japanese and foreign scientists to expand and modernize Akamatsu's paradigm. They included the factors of FDI and TNC in their analyses and demonstrated in what way the technological and financial transfers promote economic progress in developing countries (Shinohara 1982; Kojima 2000; Ozawa 1992, 2001, 2005, 2009, 2010; see also Ginzburg and Simonazzi 2005; Ito 2001; Korhonen 1998; Kwan 1994; Yamazawa 1990).

8 See Map 16, Map 17, Map 18a, Map 18b at URL: http://www.academia.edu/3742045/Korotayev_ Grinin_Tausch_Economic_Cycles_Crises_and_the_Global_Periphery_Springer_2016_-_Support ing_online_materials.

9 Ibid.

10 See Map 16, Map 17, Map 18a, Map 18b at URL: http://www.academia.edu/3742045/Korotayev_ Grinin_Tausch_Economic_Cycles_Crises_and_the_Global_Periphery_Springer_2016_-_Support ing_online_materials.