The Supreme Kondratieff: Exponentiality, Teleology and the DNA of Economic History (The Future Balance of Wealth and Health)

Almanac: Kondratieff waves:The Spectrum of Opinions

Exponentiality is a naturally and physically new learning experience for the human mindset, which is by evolutionary patterns used to geometric quantities of information processing, for example, by linear or eventually short cubic increases of knowledge. Exponential knowledge automation will shake the very fundamentals of classical political economy, since a limited number of private banking corporations does decide about the fiat credit (monetary) flow, that is backed by the extremely concentrated land value in natural resources and real estate as a transaction collateral, which has now entered even the speed of cyberspace. The great transition and transformation of the capitalist welfare system are possible only if a new societal deal is worked out which would provide all citizens with more quantitative access to education, health care and social security in the economic jackpot of human living chances. A capital-based economy, which taxes economic rent as public revenue, can achieve exactly this societal goal of basic mutual existential guarantees. An earth sharing economy will be the best insurance for a non-killing policy on this planet. Therefore, the Sisyphean accounts of society should be radically reformed in terms of a sustainable taxation system.

Keywords: exponentiality, knowledge automation, political economy, taxation, rent, new societal deal, capitalist welfare system.

Never make a calculation until you know the answer.

J. A. Wheeler

The Nature of the Human Learning Curve

Exponentiation is the rise of a quantity to a power. Exponential curves are geometrically very different from linear or cubic forms of growing natural forces in space. We use the cultural convention of ‘time’ as a mathematical tool to order events in a chronological manner, since we are chrono-biological and light-processing clocks, and we have consequently invented the technical clock for ‘time-keeping’, work discipline and economic interaction. On top of all these evolutionary human systems evolutions, we use (since Sumer and Babylon) money as a civilizational tool for the accounts of society. The first economic transactions of land for money, in terms of private legal transfer, are recorded in the ancient city-states of Sumer, but money had a clear-cut ratio of barley to silver. Our brain is used to linear changes and improvements in technological evolution, but not to exponentiality. Thus, we are facing great transitional and transformative asynchrony of the technical, economic and human learning curve, i.e., exponential technology in manufacturing, medicine and finance is shaking the very economic fundamentals of modern global society and the human learning response implies a generational challenge, because this ‘time’ the traditional learning gap is not linear or cubic. This is much more than a psychophysiological existential test in selection pressure and adaptive procedure, it is the political humus for human extinction and total authoritarianism, because ‘time-tested’ value systems are no more applicable in the human economy as events are turning more than rapid. Data, information, knowledge and even wisdom are rotating in the twinkling of an eye, only creative intelligence and strategy can help to bring the ship into a safe harbor, but the comfort zone of archived ‘knowledge’ must be left; new skills are in high demand.

The Sustainable Regulation of the Physical Energy Circuit

In terms of teleology, ‘time’ can be considered as the set of all human actions towards a redemptive stage of economic history, i.e. ending the (Sisyphean) economic fight of human existence or to make a living. Such an exponentiation of mutual human living chances is strongly connected to the ecological sustainability of the physical energy circuit within human societies; we cannot exit the physical energy circuit, but we can reduce and cut down non-necessary entropies in the living societal organism. The original idea of the Biblical day of rest is to materially exit the physical energy circuit (economic consumption) and to spend at least one day exploring our inner self (spiritual evolution). In addition, the prophets are not expecting to ‘create’ some few exceptional ‘holy’ persons, but to establish a human fraternity that lives and works in harmony with cosmic law. According to N. Kondratieff and M. I. Tugan-Baranovsky (Grinin et al. 2014: 405), the teleological solution of the great political problem of economic conjuncture depends on precise human thought and will (Nazaretyan 2017); it is not only an economic matter of objective evolution, it is also a subjective question of human consciousness (preferences). This ongoing great historical transition and development of industrial into information capitalism (the supreme Kondratieff) by exponential technology (2000–2050) requires a corrective economic model of a capitalist welfare system which can balance human freedom (dignity), private property (wealth) and basic monetary income (social security) for all citizens. The scientific method and truth can never become disconnected, if applied by pure passion and reason, i.e. it is economically not wise to degrade scientific labor to the production assembly line which implies a spiritual devaluation of the human moral potential (Feyerabend 1982). The cosmic universe (Popper 1988) is an exact accounting system and there is no physical foundation for the economic argument that it runs on profit alone. Furthermore, the viability of any market economy is based on monetary liquidity (an economic term, introduced by Baron J. M. Keynes 1933) and not on asset concentration for a few accounts.

The DNA of Human Economic History

So far, as our empirical records reveal, the economic history of humankind was disrupted by meta-cycles of economic rent-seeking and technical innovation (human progress vs. poverty). We will later discuss and develop cognitive tools of human economic emancipation, with respect to the true nature of human behavior. In the 3rd volume of Capital Marx reveals that all extra-profit or surplus value disappears into economic rent, when the economic return on capital decreases; this corresponds to the traditional investment prudence that the success of small business and real estate is based on the freedom from rent. Rent is the ‘killer’ of growth, i.e., the increase of productive labor and entrepreneurship in any human society. Some of these basic insights were already captured by the Hebrew Bible (Leviticus, Ch. 25), Baruch Spinoza, David Ricardo and Henry George, but more profound applications will be offered in this methodical exploration of our ‘time’, which follows no doctrine of economic faith. All canonizations of economic creed can be regarded as no more valid. However, our foundations will be built on saving the many details of the economic discourse that can be integrated and combined into a higher cognitive order of understanding the toils and travails of human beings to find employment and to search for opportunities, in an ethical manner, i.e. without exploiting the human living chances of others. Having said this, one should now come to terms with economic theories that factually deceive human fraternity to reach brotherhood and free association in equality. It is ‘time’ to clarify rent-seeking economic behavior, from the bottom and from the top, the real DNA of human economic history. The human economy is much more a reflection of socio-ethical relationships than a simple statistics of ownership structures; social conditioning is much more than some economic Pavlov reflex, it is built upon a complex social and mental prison machinery, based on the deep mass psychology of fear, guilt and lack of proper knowledge. In other words, we will be able to leave the animal kingdom of territorial possessions and to enter a historical economic phase (earth sharing economy) of mutual existential guarantees (stewardship).

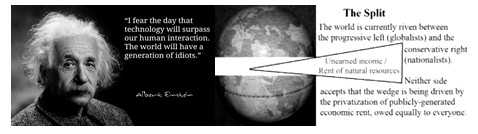

Economic Rent is the Missing Link between Conjuncture and Monetary Value

The interplay of the conjunctural motion and the monetary value in human economies is principally checked by the quantity of rent that is extracted from the labor and entrepreneurial productivity circuit. ‘But having put forward this extremely original idea, he unfortunately failed to give it a consecutive development and justification, did not find the mechanism connecting the fluctuations of conjuncture with the value of money’, Nikolai D. Kondratieff reflects here about his teacher M. I. Tugan-Baranovsky and the missing link or mechanism of conjunctural motion (see Grinin et al. 2014: 401). This economic rent problem (Arnott and Stiglitz 1979; Kavanagh 2001) which mainly covers the land value of natural resources and real estate (and today even many virtual transactions in cyberspace) is basically an accounting technique that equates land (rent) and capital (interest). It is factually a deep Sisyphean circuit (trap) of human civilizational history which expands private wealth by land value as collateral for credit. Whenever the economic quantity of rent (r) exceeds (r > g) the power of growth (g), we are facing a stoppage of labor and capital development, i.e. the great portions of the surplus value of innovation waves (like K-Waves) are (were) absorbed by the monopolistic claim of economic rent (privatization of gains, socialization of loss). The future of a capitalist welfare system (free and social market economy) will have to come to terms with these false accounts of societal production and to recapture (tax) the extracted value as public revenue, i.e. demand and consumption will direct production and supply. Some technical measures and tools for this healthy re-direction of wealth and value creation will be introduced and discussed later. In any case, an earth sharing strategy will be a peaceful remedy for this exponential wave pattern. The decreasing economic meta-curve, which started around 2000, will turn into an increasing one around 2025. Therefore, it is decisive to correct the accounts of society until that date or period by new book-keeping techniques. It is all about the right awareness (alertness) and creative consciousness to rectify age-old mischief (habit is a despot) and to avoid economic history repeating, i.e. total authoritarianism or (the heaven forbids) even human extinction.

Science as Systematic Classification of Human Experience

Economics, like medicine or pedagogics, is an empirical profession where long-term human experiences are formulated into action rules; the body of knowledge is far from scientific, despite the methodical use of math and physics. Neither as a profession for the management of wealth, nor as an emerging science of human economic activity can it claim to be value-free or ethics-free, i.e. most of the models and theories are a methodical reflection of policy options on the broad political spectrum of ideas and ideals. The approach of a natural science of human society (physics of social systems evolution; Beg 1987) cannot be based on such personalized or collective valuations of the working body economic; the emotional tie, for example to inherited wealth, must be cut. Here comes the analogy to medical research which has scientifically to elaborate the best treatments and healing methods, e.g., there is no empirical evidence that cancer cannot be treated with herbal medicines. The supreme Kondratieff is accompanied with an exponential Copernican revolution in new cybernetic processes, and it is very probable that it will be the final K-wave. We are witnessing a fundamental change of the economic DNA, but the patient (humanity) is in a dangerous state. New economic thought for manufacturing, medicine and finance is in great demand, but this great transition requires creative management, i.e. it is not important to be always right, it is decisive to not being boring and to ask the right questions. In classical pedagogics, however, this learning behavior is not reinforced and academia is very much influenced by this model of archiving knowledge. A new balance of the wealth and the health of human societies can only be found by a new interplay of learning (earning) and knowledge, i.e. learning that pays back and the accounts of society should be modified accordingly.

The Danger of a Technocratic Command Economy is Real

The inevitable expansion of economic knowledge, in scientific terms, must be based on all available resources; however, if land value (Fu 2013) continues to serve as banking collateral for (fiat) credit, no workable solution for the economic problem will be at hand. Labor and entrepreneurship should not be taxed, but the extraction of rent from the body economic, i.e. the social evolution of the fiat monetary system is completely based on the maximization of land value from natural resources and real estate. Once the economic return from capital (interest) decreases, the monetary flow is directed towards the assets of the small rentier class, with wages (Standing 2011) falling under the general price level, e.g. of housing. This is what exactly happened in the post WW2 economic cycle (1950–2000), when around 1975 the fiat credit of private banks was channeled into asset hoarding which is today a global practice. Central banks do factually only control the monopolies of private banks and corporations (Vitali et al. 2011), i.e. it is the business administration of crony capitalism (‘capitalist planned economy’) with history repeating despite technological evolution. The political costs of these unreasonable practices do cut on education, health care and social security; a new societal deal is needed to master the forthcoming exponential events in the human economy. Please keep in mind that this depressive economic regression is taking place after the hype of the ‘new economy illusion’ and it is deeply connected to the real estate and housing bubble of a few monetary players (Gordon 2015). These are not social events by an objective logic, but the real reason is not correcting the cybernetic errors in a human made system like capitalism, i.e. a capital-based economy that cyclically falls back into lower stages of societal distribution although the productive forces are growing technically. If we combine economic knowledge and imagination, we will be able to remedy these accounting imbalances of the economic system and increase the mathematical probability of human living chances in the economic jackpot on planet Earth.

Conclusion

We are heading towards the final (!) Kondratieff wave, with the driving exponential force of self-learning systems and disruptive technologies. Achieving a societal balance between wealth and health (Nefiodow L. and Nefiodow S. 2014) will be feasible, if we concentrate our scientific economic efforts at a radical reform of the existing taxation system. A new capitalist welfare system (Herrmann 2014) for a capital-based economy is in socio-historical reach; therefore, we should redirect and reformulate the Sisyphean accounts (Stone 1984) of human society (Drucker 2002) which are based on economic rent-seeking since the inception of book-keeping techniques in Sumer and Babylon. The information-gap (Ben-Haim 2006) in economic decision-making can be overcome by applying scientific imagination and profound methodical rigor, in terms of recapturing economic value from rent-seeking as public revenue. Only under such human incentives, can the productivity of labor and entrepreneurship regain its full economic potential (Ternyik 2017) to better the living quality of a growing earth population up to 10 billion people.

References

Arnott R., and Stiglitz J. 1979. Aggregate Land Rents, Expenditure on Public Goods, and Optimal City Size. The Quarterly Journal of Economics XCIII(4): 471–500.

Beg M. 1987. New Dimensions in Sociology. Karachi: Hamdard.

Ben-Haim Y. 2006. Info-Gap Decision Theory. Amsterdam: AP.

Drucker P. 2002. Managing in the Next Society. NY: St. Martin's.

Feyerabend P. 1982. Science in a Free Society. Brooklyn: Verso.

Fu S. 2013. Land Value Taxation in China. Presentation. Xiamen University.

Gordon I. 2015. The Implications of the Pending Collapse of Fiat Paper Money. The Longwave Analyst 32(1).

Grinin L., Devezas T., and Korotayev A. (Eds.) 2012. Kondratieff Waves. Dimensions and Prospects at the Dawn of the 21st Century. Yearbook. Volgograd: Uchitel.

Grinin L., Devezas T., and Korotayev A. (Eds.) 2014. Kondratieff Waves. Juglar – Kuznets – Kondratieff. Yearbook. Volgograd: Uchitel.

Grinin L., Devezas T., and Korotayev A. (Eds.) 2016. Kondratieff Waves. Cycles, Crises, and Forecasts. Yearbook. Volgograd: Uchitel.

Kavanagh B. 2001. The Coming Kondratieff Crash. Geophilos 1: 84–93.

Keynes J. M. 1933. The Means to Prosperity. Macmillan: London.

Nazaretyan A. 2017. Mental Dimensions in Social Causalities: Past and Future. Philosophy and Cosmology 18: 193–207.

Popper K. R. 1988. The Open Universe. NY: Routledge.

Standing G. 2011. The Precariat. London: Bloomsbury.

Stone R. 1984. The Accounts of Society. Nobel Memorial Lecture.

Ternyik S. 2017. The Political Economy of Knowledge Automation. URL: https://ssrn. com/abstract=2920647.

Vitali S. et al. 2011. The Network of Global Corporate Control. (arXiv:1107.5728v2) (q-fin.GN).