The Tiger and the Dragon. Development Models and Perspectives of India and China

Journal: Journal of Globalization Studies. Volume 4, Number 1 / May 2013

In the coming decades in the process of globalization the position of the USA and Europe will weaken, while the role of developing countries will increase. The role of the two largest emerging economies – China and India – will be of special significance. What future will these fast-growing giants face? The demographers agree that pretty soon India will lead the world in population and thus surpass China, while China will encounter serious ageing population problems. But economic and political scenarios of the future are quite different: from resounding success and world leadership to collapse caused by demographic and socio-political troubles. Which of them is more feasible? In the present article I analyze the Chinese and Indian development models separately and comparatively and make a forecast of their perspectives in the 21st century. Such an analysis could be helpful for understanding Russia's ways of development.

Keywords: China, India, globalization, the Third World, East Asian model, Chinese model, Indian model, emerging economies, struggle against poverty, authoritarianism, democracy, centre, periphery.

Introduction: globalization closes the developmental gap between the states

It is obvious that in the next decades the global political landscape will undergo dramatic changes. The role of the USA and Europe will diminish while that of the developing countries (especially of the large ones) will increase. Numerous reasons determining this process have been defined (see, e.g., Frank 1997; Arrighi 1994, 2007; Todd 2003; Buchanan 2002; Mandelbaum 2005; The USA National Intelligence Council 2009; NIC 2012; Korotayev et al. 2011). They have been analyzed in other works of mine (Grinin 2009b, 2011, 2012a, 2012c; Grinin and Korotayev 2010, 2011). In any case the diversity of opinions cannot suppress the fact that it is globalization that makes this tendency inevitable. Having emerged in the world with a deep developmental gap between rich and poor countries, later it contributed to closing this gap. I think that globalization itself presupposes that developing countries should advance faster than the developed ones,1 because it strengthens economic openness which, in turn, brings into effect a kind of ‘law of communicating vessels’. As a result, the development of the periphery has accelerated, and that of the core has slowed down.2 No doubt, this is one of the most significant results in the past two decades. The gap will keep on narrowing (of course, to a certain extent) in the next decades. It will involve economic expansion, as well as poverty reduction and rapid growth of the middle class in the developing countries (see, e.g., NIC 2012).

In the 1960s and the 1970s, many economists had no illusions that in the near future the Eastern and South countries would overcome backwardness and depression. They fairly considered those peoples' unwillingness to have a better life as the main obstacle. Poverty did not oppress them; they did not consider it as an unbearable state (see, e.g., the book by the Nobelist Myrdal [1968]; one can find a similar view in Braudel 1981–1984). Such a mentality is still typical for peoples in the underdeveloped regions, especially in Tropical Africa.

But in many developing countries the situation has changed, and now the inert Third World is turning vibrant. One of the main transformations seems to be the change of life priorities of hundreds million of people who increasingly aspire to break out of poverty and illiteracy to a different life.

Thus, to waken population of poor countries to activity (that demands great efforts for initial modernization and education) appears to be the major obstacle to a breakthrough. When the desire for better living conditions eventually appears in the undeveloped countries, there starts to work a sort of ‘engine’. It may lead to a qualitative result (though such a ‘Brownian motion’ always entails all kinds of iniquities, abnormalities, nonsense, and injustice etc.). Once started, the movement for the better will generate social energy for many decades. Furthermore, if people's and authorities' efforts are consolidated, the emerging synergy may bring a resounding success. That was the case in China, India and a number of other developing countries. In wealthy societies with all their advantages in culture, education and qualification, this resource of development ran short long ago. With the account of population aging, opportunities for rapid development are seeping away. This state of affairs defines the system of globalization ‘communicating vessels’. In order to reduce production costs, the developed countries move their capital and production capacities to the developing ones where millions of young people seek for jobs. The engine of the world economic growth, consequently, moves from the core to the periphery. Thus, the role of developing countries in the world economy (especially in its surplus production) grows.

At present, the role of the two largest economies – China and India – is especially significant, and their impact will continue to grow in coming decades. It is not surprising, as in 2030 these two countries will account for one third of the world population and, perhaps, 35 per cent of world energy consumption (see, e.g.,BP 2012: 45). In the present article I analyze the Chinese and Indian development models separately and comparatively. Such analysis allows detecting some commonalities of all the fast growing countries whose joint influence in 2030 will be great as well.

1. The Chinese Model. Three Drivers: Investments, Export, and Competition between Provinces

1.1. The Chinese Model: General and Specific Features. Growth Factors3

The East Asian model of economic development. Many analysts suppose that China generally follows the East Asian development path (see, e.g.,Selischev A. S. and Selischev N. A. 2004: 166–175; Popov 2002; Anderson 2008). This model originated in post-war Japan and then it was implemented in the so-called ‘Asian Tigers’ – South Korea, Taiwan, Singapore and Hong Kong. Later it spread to South East Asia and to the Pacific Basin.

Despite various peculiarities, the following features of the model are inherent in each country and fully realized in China as well: a) export-oriented economy, especially industry; b) cheap labor force; c) mobilization of foreign investments and creation of favorable business environment, as well as an active import of technology; d) high investment rates (accounting for 30 to 40 per cent of GDP and even more); e) an active participation of a more or less authoritarian state in economic development; f) creation of special economic zones (in China and some other countries).

This model generally provides a high economic growth rate over a long period, while the involvement of capital and technologies allows raising technological level and labor productivity. However, some analysts assume that after per capita GDP in the country reaches $10,000, China's development rate will slow down as it was the case in Japan and other countries (see Eichengreen 2011; Anderson 2008).

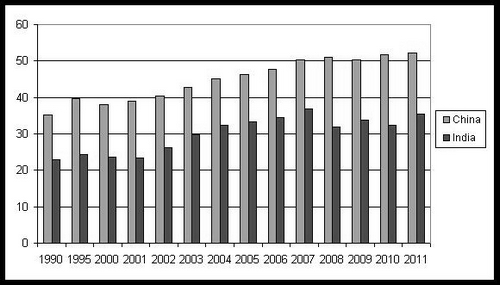

Specific features of the Chinese model. In comparison with other countries following the East Asian pattern, China has unique (and at the same time fundamental) features of the development model such as enormous population and the greatest (if compared with other countries) role of the state governed by the Communist Party. In China, it is just the great role of the state that provides an extra high savings rate in GDP (see Diagram 1) and makes it possible to invest huge capital and maintain high growth rates.

The Chinese overseas capital, accumulated mainly in states and administrative districts with the ethnic Chinese populations (Hong Kong, Macao, Taiwan and most of Singapore) also plays an important role. This capital is the source of the vast majority of FDI.

Factors and sources of China's growth (at present their potential is depleting, so these factors can also be considered as potential weaknesses).

· A huge pool of cheap labor and the so-called demographic dividend (connected with reducing birth rate and ‘young’ structure of population). The policy of birth control also reduces expenditures on the growing generation;

· low-cost social policies introduced when there was a young age structure (an opportunity for the state to disregard its obligation with respect to pensions and benefits for a huge part of the population; paid education and medical service for the population; low level of safety at work etc.);

· plentiful supplies of some mineral resources (coal, iron, oil, rare metals etc.);

· ‘cheap ecology’ (lack of proper care for environmental protection);

· low exchange rate of yuan, favoring export.

The driving forces of the Chinese development. In China a unique system of forces driving development has emerged in which, unlike in developed countries, it is not domestic private capital but foreign business, local authorities of different levels of administrative division and national corporations that play the major role.

The role of foreign investors in the Chinese economy is extremely significant, and in this very sector, dealing with foreign capital, a major part of export and innovative goods are produced. China has become the world workshop for the processing of raw materials and for the assembly of finished products. This means that local and foreign manufacturers import into China enormous amounts of raw materials, accessory parts, intermediate goods etc. and, after processing or assembling, the finished or semi-finished products are exported. This specialization explains the fabulous figures of the Chinese export and import reaching four trillion dollars. There are only few large corporations in the world that are not represented in China. Foreign capital activity is essential to understanding the sources of China's miracle.

As regards a pure Chinese constituent of the miracle, one should point out the special and extremely effective mechanism of state participation for achieving such a high economic growth rate in production development – that is, a strong competition for investments and high annual growth rates at all provincial and local levels (see, e.g., Berger 2006, 2009). According to the estimates of economist John Lee, domestic investments make up 40 per cent of China's growth, while export sector and foreign direct investments contribute approximately 30 per cent (see Berthelsen 2011). In my opinion, the successful stimulation of the administrative machinery's interest in economic growth is the key explanation of Chinese development phenomenon. Another powerful source of growth comprises large-scale (including monopolistic) national corporations, tending to invest their benefit in new projects.

Limitations and drawbacks of the Chinese model. In spite of the fact that its technology and innovative level is increasing, the Chinese economy remains generally extensive, based on extremely huge resources and capitals involved. At the same time it still remains: a) too resource-intensive; b) too energy-intensive; c) extremely polluting; and d) too export-oriented. Despite a proliferation of patents (see, e.g., The World Bank… 2012: 177; Boeing and Sandner 2011: 17; WIPO 2012; Nasibov 2012) the economy generally remains non-innovative.

The Chinese leaders are quite aware of the drawbacks of the existing developmental model. They continue to set the objectives of its transformation and make some efforts in this direction. Nevertheless, despite a certain progress the results fall short.

1.2. Growth Limits

Within the current model of development the constraints on China's extreme economic growth have clearly shown up.

1. Scarcity of energy resources and raw materials sharply manifests as China is unable to supply itself with energy and raw materials any more and depends heavily on import. At the same time, the increasing import of fuel, mineral and other resources drives the world prices which raise the cost of Chinese export products. Within the current unprofitable export-led model the reliance on energy and resources consumption will only increase.

2. The coming labor shortage and its increasing cost. Despite high unemployment rates one can also observe labor shortages. After 2013–2016, labor shortage is supposed to gradually increase, while work-force size – to decrease by 2 million people a year (see, e.g., NIC 2012: 15). Due to the existing unemployment and number of rural migrants, the labor shortage will not be sharply perceived at once, but even now in some provinces it leads to a continuing rise in wages. With a limited labor force and wage-push, it will be very difficult to maintain rapid growth.

3. An inevitable appreciation of export production and risk of capital inflow reduction. The severe restrictions like the costs of energy, raw materials, labor, and other expenditures, a probable revaluation of the yuan and rivalry of the states with cheaper labor force will be an obstacle for sustaining export growth. But once growth decelerates, the investment flow will also decrease, as it is mainly joint ventures with foreign capital participation that are engaged in export. In 2012, one could observe the export growth deceleration and reduction of foreign investments. Foreign direct investment (FDI) in China declined by 3,7 per cent. Moreover, FDI in the production sector fell by 6 per cent (see Mereminskaya 2013). The cause is in the growth of labor cost, protests against environmental pollution and, perhaps, anti-Japanese sentiments, forcing Japanese companies to move out to other countries. This tendency continues in the beginning of 2013.

4. The decline of return on investment. Today the investment rate in China approaches and even exceeds 50 per cent of GDP (see Diagram 1). This provides a huge share of growth. Since the early 2000s, the investment return has sharply declined and, despite all efforts, remains generally low. At the same time the burden of maintaining unprofitable facilities and the value of potentially unrecoverable debts is increasing. China has an enormous number of excessive facilities in almost all sectors of its economy. The government quite often forces closures of excessive facilities; nonetheless, their number keeps growing. This results both in wasted expenditures and in excessive competition which reduce profit. Of course, this cannot go on endlessly, and sooner or later the investments will decrease, accompanied by a lower growth rate.

5. Environment. China takes the lead in the whole world with respect to water, air and soil pollution, acid rains, and the number of sick people suffering from pollution effects (see Zitan 2013). The 12-year plan proposes considerable efforts for a better environment, but the solution to these problems requires huge funding over a long period which will raise the production and export values and affect the growth rate.

6. The increasing social expenditures. The population ageing, rising living standards, necessity to maintain social peace and to prevent the development of an extreme gap in living standards and an abnormally high Gini coefficient (see Yu 2013), as well as concern for an increase of domestic consumption will lead to the growth of the state's responsibilities. Every year China will have to spend more on social needs; that has already had a certain impact, and in medium- and especially in long-term perspectives it will become a heavy burden.

7. Growing disproportions and the necessity to restrain the growing inequality and to control inflation have a severe impact on economic policy and growth rates because they constantly threaten the stability of the Chinese society. A too wide income gap contradicts the very idea of ‘building a harmonious society’. Permanent changes of monetary policy in connection with inflation risks also lead to business loss.

The inevitability of the growth slowdown. It isdifficult to change the existing growth model due to influential forces interested in its maintenance, namely, different authoritative levels and large-scale state corporations. For decades they have made great progress in production expansion as well as in manipulating statistic figures. Moreover, the Chinese bureaucratic and social system is actually unprepared to switch to a new development model. For example, there is the only instrument to avoid overinvestment that every year creates additional excessive capacities in China – the restrictive directives. But this means to tie the provinces' hands, and, in fact, to stop the major engine for growth.

Taking into account the above-mentioned limitations, one can suppose that despite all the Chinese authorities' efforts, the growth rates will gradually decelerate. Even under favorable conditions within the next three years the growth rate will not exceed 6–7 per cent. And after 2016, it will fall to 4–6 per cent. Although, objectively speaking, such a deceleration can be considered positive for China, the Chinese government has a very different view.4

2. The Indian Model: A Synthesis of Three Worlds

2.1. The General Description of the Model

The Indian model substantially differs both from the East Asian pattern in general and from the Chinese one in particular. It bears no resemblance to any other model; this is a peculiar type of development model. India has a unique social and cultural setting. All its aspects are specific, starting from the fact that the subcontinent lies on a separate tectonic plate. For example, India's attitude with respect to cultural globalization differs in essential ways from that of China's. China's government attempts to control diverse global influences, especially the cultural ones (Yan Yunxiang [2002] gives an adequate definition for this phenomenon – ‘the controllable globalization’). India is much more open. This country itself is an exporter of a number of different cultural patterns, which have become the heritage of the world, for example, yoga, meditation, Tantrism, etc. (for details see Srinivas 2002; Mondal 2012).

A unified and controversial transitional society. India is a world with a population surpassing that of some continents. In political terms it is founded on the principles of modern national federal state, and at the same time represents a model of a multicultural world where diverse religions, ethnic groups, classes and castes coexist. With respect to cultural, linguistic and religious diversity, India trails only Africa. For almost seven decades, India has been actively transforming from an agrarian, patriarchal and almost illiterate society to an urban, industrial and information-oriented one. Today India is actually an integration of several types of social systems. That said, the old agrarian system, adherent to caste ranking and community structure, on the one hand, provides the modern system with a steady social energy resource in the form of an abundant labor force. On the other hand, the traditional system becomes a source of major problems, as Indians themselves now consider poverty, illiteracy and lack of qualification incompatible with modern standards.

In short, we observe a great transitional economy with distinct contrasts. In particularly, a high educational level and a large share of high-skilled specialists coexist with hundred millions of illiterate people; a large middle class (which is not characteristic of all emerging economies) – with mass poverty. Perhaps, one fifth of the population already lives close to the European standards, but a huge part of India's population lives below the poverty line (this line is set too low at that). Of course, there are strong regional imbalances. A true (not imitation) and established democracy – quite a rare case for the Third World countries – goes together with high (for similar states) corruption and inequality. The European-style democracy and the middle class, consisting mainly of graduates, go hand in hand with specific Indian prejudices, including those connected with caste system. At the same time, it is the caste traditions that serve as an important damper to suppress discontent with social inequality. The caste system preaches that inequality is a natural state and people belonging to different castes should live in different ways. That is why an ultimate decay of caste's ideology and psychology can lead to increasing social tensions (see, e.g., Khoros 2009: 93). Today the number of people belonging to the lowest castes and tribes is much more than 250 million (Yurlov 2007: 9). The share of the poor among them is especially large.

All these and other issues (which are discussed later on) represent the current challenges as well as threats to India's future. Nevertheless, one can hope that the country will cope with them so that they would not be the source of irreparable perturbations.

2.2. Three Worlds Combined in a Single Model

Contrasts are typical for all fast emerging countries with a transition economy. But India has its own distinct feature. I would rather call it ‘a combination of three worlds’. The matter is that India's model is a peculiar and still a harmonic mixture of important features of the developed capitalist, socialist and developing countries, that is of all three worlds (the First, the Second and the Third one) of the modern world map.5 In my opinion, no other country has such a unique combination, which in many respects determines the peculiarity of the Indian development model. Let us consider it in detail.

It is clear that the Third World is associated with poverty and population pressure that drives young people to leave villages for cities. The share of peasants in India's demographic structure is still dominant, the shortage of land and gradual growth of labor productivity in farming generate rural overpopulation, poverty and high unemployment rates. One should also mention widespread adult illiteracy especially among females6 (see Table 1). The Indian ethnic and civilizational peculiarity, including a modern version of community self-government in villages (officially these self-governing bodies are called ‘panchayats’) and vivid remnants of the caste system, is also important.

The Second World manifests in an active state policy in the sphere of infrastructure and economic development on the basis of five-year plans. The state regulates economic activity and social life. It results, for instance, in supporting small business through regulation, licensing and setting quotas, in the protection of workers' rights by special laws, in attempts to provide the peasants with minimal means of subsistence (e.g., through their involvement in paid public works, including land reclamation), quotas for women and members of lower castes in representative self-government bodies and so on. Here one should also mention the vigorous struggle against poverty and illiteracy, as well as efforts in demographic regulation.

The First World. The positive features of the First World (which imply democratic traditions and high level of development) are uncommon for developing countries. Meanwhile, India is considered a well-established democracy; it has a mature institution of private property and other important institutions of non-state economy such as large private corporations and financial market. The social stratum of self-employed people and high-skilled specialists engaged in private business has also been formed. Some of these features were introduced already in the colonial period. At present other peculiarities supplement them, including achievements in the field of innovations and fundamental science. India has the third largest scientific and technical labor force in the world. About 200 of the Fortune 500 companies use Indian software services (O'Neill and Poddar 2008; Planning Commission 2008, Vol. 3: 251). Alongside with China, India has its own space program.7

There is no such a singular combination of three worlds in any other developing country. China combines only two worlds: the Third and the Second one. The features of the First world are only emerging on the basis of the Western technology. In Asia, even in the former provinces of British India (such as Pakistan and Bangladesh), democracy can hardly take roots. We can speak about a kind of combination of three worlds in some Latin American countries (especially in Argentine, Chile or Mexico), with the qualification that the institution of private property was formed there long ago. As for Mexico, its development is a result of its active relations with the USA. But the level of democracy there is much lower than in India, and the number of high-tech specialists is quite limited.

In my opinion, the synthesis of the three worlds gives advantages to India in terms of adjustment to different phenomena (see below).

For the purposes of this article it is very important to view all achievements, advantages and problems through the lens of an Indian harmonic combination of the three worlds. Firstly, the features of the First World manifest in India's economic structure with its prevailing services sector (including high-tech services) as is the case in developed economies.8 Secondly, they are evident in its export structure where the high-tech services also predominate.

The features of the Second World result among regulations and other things in government's plans of economic transformation, in particular, in the development of innovative industries, agricultural productivity growth, infrastructure and medicine development (see Planning Commission 2011). The features of the Third World constantly show up while in the field of demographic resources they will even sharpen.

Table 1

Adult literacy rate (% of people ages 15 and above)

|

|

Both sexes | |

|

|

2000 |

2010 |

|

China |

90.9 |

94.3 |

|

India |

61.0 (2001) |

62.8 (2006) |

|

| ||

|

|

Female | |

|

|

2000 |

2010 |

|

China |

86.5 |

91.3 |

|

India |

47.8 (2001) |

50.8 (2006) |

|

| ||

|

|

Male | |

|

|

2000 |

2010 |

|

China |

95.1 |

97.1 |

|

India |

73.4 (2001) |

75.2 (2006) |

Source: ADB 2012.

2.3. Characteristics, Peculiarities, andAdvantages

The main features and purposes of state economic policy. The role of the state in India's economic growth is significant (but the state intervenes in quite a different way than it does in China), so it makes sense to consider some of its aspects. The Indian state initially aimed at creating a powerful economy and pursuing social policy. That is why most objectives as well as the means for their achievement (governmental planning and investments, control and regulations) remain consistent. However, in the course of time, especially after the 1991 reforms, the attitude to foreign investments drastically changed. In addition, the problem of growth acceleration was solved and a breakthrough in India's export potential was achieved. As a result, according to the WTO data, India's openness ratio is about 30 per cent (see Ministry of Economic Development of the Russian Federation 2012), it is several times larger than it was in the 1970s. And the contribution of foreign trade to India's total GDP is growing. It has considerably come close to the share of international trade in the Chinese GDP (see Syed and Walsh 2012). However, India's dependence on the world economy is also increasing.

The state's main economic objectives and the means for their achievement are as follows:

1. Achievement of high economic growth rates (up to 8–10 % per year) by means of: a) federal and regional planning and government investments; b) infrastructure improvement; c) attraction of FDI; d) development of high technologies; e) development of the education sector; f) import substitution and creation of necessary economic sectors; g) export promotion; h) other measures.

2. Support for small business and the peasantry through restrictions on large-scale business and foreign capital, different privileges, organization of public works etc. In addition, in India such support combines with recognition of corporate giants' special role and necessity to attract foreign investments. Thus, for instance, large foreign retailers cannot expand today, because there are fears that they will drive out small traders. But they are likely to enter the Indian market under certain conditions.

3. Fight against poverty and illiteracy.

The general description of the model. The modern Indian development strategy has many features similar to those of other more or less successful emerging economies. At the same time there are some indigenous features that will be scrutinized below. In the present section I will try to formulate and comment the most important characteristics of the Indian development model.

The main features of the Indian economic model are the following:

1. The large role of the state in all spheres which, however, has diminished since 1991 (see Vijay Joshi and Little 1996; Malyarov 2010; Braghina 2010; Mahajan et al. 2011).

2. The state control over banking sector and quite strict currency regulations, which are gradually loosening (see Malyarov 2010).

3. The large role of large multi-sectoral private and state companies which coexist with abundant (up to 45–50 million) small and smallest businesses in industry and especially in services (see Braghina 2010; Malyarov 2010; The Main… 2012).

4. Predominance of the services sector, including financial and other ones, in the economic structure (see paragraph 5), accompanied with a rapid growth of industry (Ministry of Finance 2010; Braghina 2010; Malyarov 2010).

5. Large export high-tech sectors and professional services (information and communication technology (ICT), software engineering, outsourcing) which allowed India to occupy a special place in international labor division.9

6. Active attraction of foreign investments and technologies (see Revina 2009; Galischeva 2012).

7. Rather high savings rate, attention to infrastructure, scientific and technological innovations (see Scientific and Technological Achievements 2008; Lunyov 2009; Akimov 2010а).

8. Emphasis on domestic consumption, which serves as an engine of growth, in addition to export stimulation, import restriction and development of import substitution (Braghina 2010).10

9. An important role of the overseas Indian communities (see Cheshkov 2009; Akimov 2010a11).

Resources and advantages (presented in two aspects).

Among the advantages, which are India's historical peculiarities or achievements, are the following:

· The widespread use of the English language, especially among well-educated Indians, and dissemination of English literature and information: many books and periodicals are published simultaneously in Great Britain, India and the USA.

· A considerable level of higher education in India and attention to fundamental sciences that allows for training specialists in different areas (engineers, doctors, and economists, etc.) with sufficient competence and with a good command of English.12

· A large number of high-skilled workers in innovative fieldsas a benefit of the first two advantages combined with the Indian government's special efforts (see Planning Commission 2008, Vol. 3: 255–256). First of all, this allowed creating a huge high-tech services sector (software, engineering, banking, management, accounting, legal, consulting, auditing and other business and information services; see Kurbanov 2012: 11),13 which exceeds 100 billion dollars. It also provides the export of high-tech production of knowledge economy. This is a rare and even a unique phenomenon for the Third World. Second, the fact that such specialists are low-paid (by international standards) provides the demand for their work in the USA and all over the world, realized both through recruitment in India and immigration. Of course, this involves a shortage of specialists in India, but at the same time promotes creation of large overseas community which is an important source of currency earnings, advanced concepts and contacts.

Problems as a downside of advantages. In developing countries (India is not an exception) many advantages can bring about problems as well. With respect to India these are: 1) demographic resources which are a source of unemployment, poverty and large-scale rural-to-urban migration; 2) low living standards which attract manufacturers. Butpoverty impedes progress, that is why elimination of poverty is the most important, complicated and expensive task. It is vitally important to solve it. But the solution will make the country's advantages disappear as well; 3) large territory, the development of which requires significant investments in infrastructure (according to some estimates, up to a trillion dollars); 4) receptive domestic market which plays a much more important role in India than in any other developing countries. But along with the market development the problem of protecting the small and smallest businesses from destructive competition of foreign and large-scale capital is rising.

To summarize, the most important peculiarities of the Indian model are as follows:

· comprehensive state-led development strategy which regulates financial flows, investments and support of different sectors (large, small and foreign business);

· developed high-tech services sector and industry which are the basis of the Indian export;

· focus on development of domestic consumption rather than an intensive development of export sectors;

· significant role of overseas Indian communities with a large number of high-skilled workers;

· mineral wealth, particularly large deposits of iron ore and other metals, as well as coal, etc.

2.4. Limitations of the Indian Model

The limitations are integral with advantages, first of all, with the extraordinary demographic resources. Besides, one should also take into account that in the near future an unprecedented number of young people will flood the Indian economy.

The social aspect. Rapid population growth makes issues of poverty, unemployment and illiteracy rather challenging. Besides, one should note that social tensions often exacerbate just at the moment when there appear opportunities to solve the problems in the short term. This circumstance can become the most important reason for social crisis and even collapse.14 One can clearly perceive that in India the growing expectations exceed capabilities and increase discontent, which is typical of countries with fast catching-up development (see, e.g., Mehta 2012; Volodin 2008: 346–347). However, social unrest often causes the growth of ethnic, regional and separatist sentiments and movements.

The democratic government and traditions are India's advantages as they help to achieve a consensus and quell discontent when changing government and governing parties. But under certain circumstances they can give rise to political weakness, uncertainty, growth of the populist and nationalist movements impact, conflicts, etc. (for an analysis of the current political situation see Mehta 2012).

So the future of the Indian economy and India as a powerful state depends on solidity of its social and political system. In my opinion, such strength is guaranteed to a degree by its current state system which is based on both the constitutional regulations confirmed at practice and on old traditions (e.g., the elite's conviction in the necessity of seeking appropriate balance of power distribution between its different levels or views that consensus and ideological tolerance are more preferable than struggle). Mahatma Gandhi liked to emphasize ‘the beauty of compromise’ that allows achieving moral victory with the help of the opponent himself. All this holds out a hope that India has a safety margin and will not collapse when facing challenges.

The resource aspect. Enormous population will keep on growing over a long period and together with a planned rapid industrial and urban growth this will aggravate the urgency of old problems including the shortage of farmlands and fresh water (see Government… 2011; Rastyannikov 2010; Goryacheva 2010). This requires agricultural intensification and investing in augmentation of water resources. India greatly relies on energy imports whose amounts will continue to grow (see Government… 2011: 29ff.; BP 2012; Malyarov 2010; Volodin 2008; Skosyrev 2007).

Environmental protection is the country's most vulnerable problem. In this respect India follows China – the planet's leading environmental polluter (Melyantsev 2007). The necessity to substitute coal as the main fuel and energy resource will greatly aggravate Indian reliance on energy imports. Ecological problems are closely connected with the shortage of fresh water and farmlands, which are also included in the industry's sphere of interest (see Government … 2011).

Bureaucratic and political aspects. India has a strong state power, but bureaucracy puts severe obstacles on progress; corruption also tends to impede progress. We have already mentioned some political risks. In some cases the democratic form of government hampers decisive measures and reforms as the leaders have to consider voters' opinion. The political impasse is also quite frequent when a political party fails to take an advantage and then political (legislative) process stagnates. There is also a danger of strengthening foreign policy ambitions which can involve the country in unnecessary confrontation.

Overall, in spite of all dangers, India has no limitations to confound its hopes for successful development and becoming a leader. Of course, there is a possibility of the middle-income trap, when a country attains a per capita income of US $10,000–15,000 and then cannot make a further decisive breakthrough. But India has not reached that level so far.

3. China and India: Common Features, Differences, Relative Advantages and Forecasts

India and China have always been compared to each other. Lately, this tendency has even intensified (see Syed and Walsh 2012; Zeng 2006; Winters and Yusuf 2007; Bardhan 2010; sections about these countries see in Khoros 2010) because the future of global economy depends on these countries' development. Not without reason, these countries have been often called to exchange experience (see Syed and Walsh 2012; Cong Liang 2012).

3.1. Similarities and Differences

In many respects, the common points are determined by similar tasks and problems the two countries face: maintenance of high growth rates, necessity to provide employment opportunities for youth, rapid urbanization, fight against poverty, agriculture underdevelopment, shortage of resources; poor environmental conditions, reliance on energy imports etc., as well as limited means of solving these problems, which include attraction of investments, innovations, infrastructure development and so on. The differences naturally stem both from historical, cultural and geographical settings and from different strategies.

Common features:

· large demographic resources;

· high savings rate;

· a big role of the state and public sector in economy and in regulating different spheres; stimulation of national corporations development; a big role of the state in infrastructure development;

· active attraction of foreign direct investments which are, however, regulated and canalized; a significant role of companies with foreign participation;

· export expansion and specific position in the international division of labor;15

· striving for technological progress, innovations and education development;

· rapid agricultural development which provides these countries with major food resources, though the productivity of agricultural labor is still rather low and there are a number of problems to solve;

· a lot of similar problems (in addition to those mentioned above are increasing income and regional inequality,16 poverty, permanent danger of inflation; insufficient political reforms; heavy national debt etc.);

· each country has some important advantages promoting its successful development but all of them are quite specific (they have already been mentioned above);17

· both countries implemented the reforms without a full break with the past as happened in Russia, the CIS, and some countries of Eastern Europe. It is supposed to be a positive factor promoting high growth rates, whereas in Russia and some European countries the reforms were marked by a severe fall in GDP;

· the population of both countries positively evaluates major government's efforts and favors the high growth course and aspiration for leadership (about India see Mehta 2012; Rogozhin 2009; about China see Selischev A. S. and Selischev N. A. 2004; Berger 2006, 2009). Their leaders' ability to pursue a flexible policy and to alter the strategy is also important, although the possibilities for maneuver are limited by the peculiarities of their political systems.

Differences

· Although the reforms in both countries followed the path of reducing government control, in China the role of the state is traditionally more important, particularly in the banking and credit spheres. This determines many other differences.

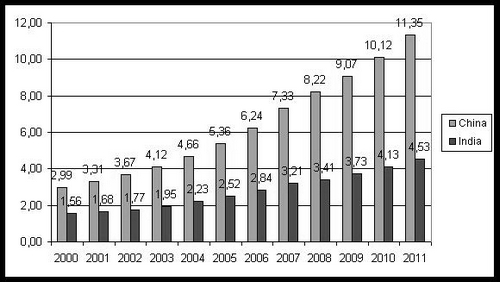

· China's savings rate is higher than India's: in 2007–2011 in China it exceeded 50 per cent, in India it was in the range between 32 and 36 per cent (see Diagram 1). This probably contributes to China's higher growth rates and larger GDP (see Diagram 2).

· In China, the economy is generally more export-oriented with a larger role of foreign investment than it is in India.

· The Indian economy is evidently more based on domestic consumption as a source of growth.

· The structures of the economy and export are different: in China industry and export of goods prevail, while in India this role belongs to services sector and export of services.

· Due to its export orientation, China always has a positive balance of foreign trade, while India – a negative one.

· In India the role of private capital and small business is larger than in China;

· Indian companies are more often listed on stock exchanges;

· Each country has its own economic mechanisms to drive the development – a kind of hallmarks of their success (in China these are special economic zones, in India – technological parks).

Diagram 1. Gross domestic saving (% of GDP)

Source: ADB 2012.

Note: Data for India, 2011, are quoted from http://be5.biz/makroekonomika/capital_ formation/capital_formation_india.html.

Diagram 2. Gross domestic product at PPP (current international dollars, billion)

Source: ADB 2012.

3.2. Advantages over each other. Some Forecasts: Difficult Thresholds on the Way to Mature Economy

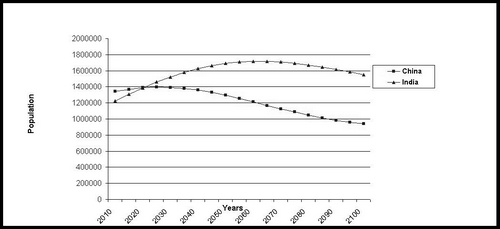

The above analysis shows that both countries possess great opportunities and face great challenges. One should distinguish between medium-term (i.e. the next one-two decades – roughly up to 2030) and long-term prospects (i.e. over the next three to five decades – approximately up to 2050–2060). In the medium-term, it is worth considering growth rates, the present level of development and immediate tasks. In this respect China has considerable advantages. However, different crises and explosive aggravation of problems can occur, which will significantly change the situation. As regards the long-term prospects and dangers, the change of demographic situation will be of critical importance (fast population ageing and labor shortage in China and, on the contrary, India's still unexhausted demographic dividend and the fact that the Indian population will exceed the Chinese one [see Tables 2–3 and Diagram 3]). Besides, in our opinion, it is the state system's capacity to transform and cope with major problems that will be more important, rather than average annual growth rates. The latter will substantially decrease in both countries by that time. In other words, it is important who will be able to avoid catastrophe and/or overcome problems with less losses.

Advantages over each other: Indian democracy versus Chinese authoritarianism. One can mention the following advantages over each other.

Political aspects. In the short run the necessity to consider the electorate's opinion, to seek political compromise and similar problems associated with the peculiarities of democratic power will be India's vulnerability. In this respect, the Chinese leaders have more opportunities, as they can ignore the voters' expectations. But in the long term, the democratic regime and different political powers' influence can turn to be India's definite advantage over China. First, with all shortcomings of India's government no one in the world doubts the foundations of its state system or calls for sweeping political reforms. There are no problems with observance of human rights and political persecution which are typical for China. Thus, as compared with China, India will not have to undertake extensive political reforms, as its political system generally conforms to the modern standards. On the contrary, China's political system which has greatly contributed to its success will be more and more frequently criticized at home and abroad. The criticism will intensify coupled with growing living standards and increase of the middle class. In the situation of diminishing resources for economic growth and increasing government liability to citizens, substantial or radical changes in China's political regime are undesirable. The transition from authoritarianism to democracy is not only problematic but also very dangerous and can cause destabilization, extension of populism and the country's disintegration (in this respect, the USSR is a very instructive example). Nevertheless, it is quite possible that some circumstances, social expectations or internal political struggle (combined with outside pressure) will make leaders take that direction. The fact that the Chinese people have never lived under democracy can lead to a severe government crisis and affect economic development.

Of course, India also has certain obstacles on its political pathway. As literacy grows and poverty reduces, new voters will play an increasing role in determining a political party to rule, and this can significantly change the political landscape. There is a danger that India will stumble over political scandals, crisis of the ruling party etc. before even reaching China's current level.18 On the other hand, China also has chances to gradually transform its political regime.

Political and ideological openness. India's another advantage is its greater openness and (in comparison with China) political-ideological resemblance to the West, despite all India's uniqueness. Besides, in the leading countries there are large Indian diasporas through which Western culture can penetrate into India.

Separatism threatens both countries. Dozens of ethnic groups populate China. But Han Chinese make up the vast majority of population. Therefore, the country's ethnic composition is more homogeneous than it is in India. With respect to the number of ethnic groups (more than 700), India is a unique country. In addition, it is a federation, whose states, according to the States Reorganization Act of 1956, were reorganized on linguistic basis. In short, given an appropriate public mood, there is a perfect opportunity for separation, as growth of living standards and literacy often awakes local nationalism. That is why India's disintegration on the basis of nationality and language is quite possible, though the traditions of consensus will most likely keep the country together. At present, separatist movements are active in the border territories of India and China (Tibet and Xinjiang in China, northwestern Jammu and Kashmir, Punjab, as well as northeastern states – in India19). The dangers connected with hypothetical separation of restive states are difficult to assess. But I think the consequences of the separation of Punjab would not be as drastic for India as the separation of the western areas for China. Besides, one should take into account that separatism in western China enjoys much more international support than that in India. There is a real danger of separation of the western Chinese provinces during the transition to democracy. In China the transition to democracy can also generate various forms of nationalism due to the striking difference of the southern and northern provinces' dialects which distinguishes Han Chinese from other groups. On the other hand, community traditions are very strong in China.

In short, there are a number of different scenarios for the future of India and China. Both countries risk drifting into political and social crisis which may lead to a collapse. Still they have a chance to achieve economic maturity without disastrous consequences. But in general, if one estimates the potential of both countries to resist perturbations, India's chances seem better.

The demographic aspect. In the following decade, India will most likely catch up and overtake China in terms of population number; by that time each of these countries will have about 1,4 billion people. Then, India will lead the world in population (see Diagram 3). By 2050, India's population will probably reach 1,7 billion people (or a bit less), while in China, even if birth control (the one-child policy) is abolished, population will start declining (as forecasted by the UN, as early as in 2030).20 China's population by that time will reach 1,3–1,4 billion people (depending on the demographic policy). Consequently, by the second half of the 21st century India's population will be 20–30 % larger than China's. But the most important factor is that the difference in the size of economically active population will be much larger: in India it will be 30–40 % larger than in China. However, by that time both countries will face an ageing population problem, but China will suffer from it much more (see Table 2 and 3). According to the estimates, by 2050 about 30 % of China's population will be aged over 60 (United Nations 2002), while in India – only 15 % (or a bit more).

Table 2

Population Growth Rates (%)

|

|

1990 |

1995 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

|

China |

1,4 |

1,1 |

0,8 |

0,7 |

0,6 |

0,6 |

0,6 |

0,6 |

0,5 |

0,5 |

0,5 |

0,5 |

0,5 |

0,5 |

|

India |

2,1 |

2,1 |

1,8 |

1,8 |

1,5 |

1,6 |

1,6 |

1,5 |

1,4 |

1,5 |

1,4 |

1,4 |

1,4 |

1,3 |

Source: ADB 2012.

Table 3

Population aged 0–14 years (% of total population)

|

|

1990 |

1995 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

|

China |

27,8 |

27,0 |

25,2 |

24,6 |

23,8 |

23,1 |

22,3 |

21,6 |

21,0 |

20,5 |

20,0 |

19,6 |

19,2 |

19,1* |

|

India |

37,8 |

36,4 |

34,5 |

34,1 |

33,7 |

33,3 |

32,8 |

32,4 |

32,0 |

31,6 |

31,2 |

30,8 |

30,4 |

30,2* |

Source: ADB 2012.

Note: * = Provisional budget figure.

Thus, India's main long-term advantage over China is the huge demographic dividend which it can benefit for another 30 years, annually engaging in employment millions of young people. On the contrary, China will experience increasing labor shortages which will raise labor costs. Meanwhile, it will be easier for India to attract foreign capital and produce industrial capacities, taking advantage of low wages combined with rather developed infrastructure and abundance of qualified specialists in different areas. Though, as has been said above, such large numbers of potential of workers and urban dwellers threaten the country with severe trials.

Diagram 3. Population projections up to 2100 (the UN medium estimates)

Source: Population Division… 2012.

Meanwhile, by 2030 India will significantly narrow the economic gap with China and by 2050–2060 it will be able to overtake or even surpass China in terms of GDP. Still China's production per capita will be larger, because, as mentioned above, India's population by that time will dramatically increase. At present there is a considerable gap in GDP (see Diagram 2).

We have already touched upon the social aspect and resource scarcity. The growing shortage of farmland and water resources, and increasing demand for fossil fuel etc. may lead to troubles and crises in both countries. But, given the authorities' growing financial resources and increasing living standards, the problems are solvable to a certain extent.

Conclusion. New Economic Leaders in the World without a Leader

The analysis of the two giant states' development strategies and their potentials argues for the fact that in the next decades their role (and that of the developing countries as well) will increase, while the influence of the West will diminish. China and India will be certainly among the world leading economies in terms of GDP, but not always in terms of growth rates. As has been said above, China's growth rates will inevitably decelerate (among other things this will be caused by demographic problems). In long-term perspectives, India has more resources to maintain a high growth rate; however, in this respect it will be constrained to yield to some fast-growing emerging countries.

It is easily arguable that we will face several upsurges in the peripheral countries, while the current leaders' growth rates will decelerate. Besides, globalization will launch a leveling process among developing countries. In other words, new states, currently representing an example of poverty and underdevelopment, could occasionally take the lead in terms of economic growth rates. Today scholars often speak about (and in the next decades will constantly discuss) a number of new fast-growing economies, including Vietnam, Bangladesh, Turkey, Indonesia, and Nigeria etc., which already deprive China of foreign investments and a part of the export market. In addition to the familiar acronyms BRIC and BRICS, many new acronyms appear, formed of combinations of different states. The common point for the states included in such combinations is the forecast of their fast economic growth (though one can find some states almost in every such a list, e.g., Indonesia and Turkey). For example, already in 2005 the Goldman Sachs said about ‘Next Eleven’21 that this group of rapidly developing middle-tier countries would collectively overtake the EU-27 in global power by 2030 (Wilson and Stupnytska 2007; NIC 2012; O'Neill et al. 2005). In 2009, Robert Ward coined a new acronym CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa). These countries are favored for several reasons, such as ‘a diverse and dynamic economy’ and ‘a young, growing population’ (Russell 2010).

In his article Jack Goldstone (2011) introduced an acronym TIMBI (Turkey, India, Mexico, Brazil, and Indonesia). Their combined GDP has already exceeded China's and will be growing much faster in the coming decades. The economist Jim O'Neill, who in 2001 invented the acronym BRIC, a decade later, coined a new one – TIMS – for the four fast-growing markets (Turkey, Indonesia, Mexico and South Korea). Of course, it is not the matter of more or less suitable acronym or economists' fancy for this game. This phenomenon actually reflects the growing importance of developing countries.

The analysis of the Indian and Chinese models, as well as those of other successfully developing countries, allow speaking about common features of all fast-growing countries (though with wide divergence of their development models), including the following characteristics: 1) state's active economic policy, including public provision for education; 2) a tendency of high gross domestic savings rate; 3) active FDI and technological flows; 4) export orientation (with simultaneous tendency for import substitution); 5) exploitation of cheap labor; 6) in many cases, aggressive exploration and extraction of mineral resources. Sometimes it is supplemented with country's benefits of diaspora engagement (e.g., the Turkish diasporas in Germany) or geographical proximity to a developed state, for example, in Mexico etc.

Finally, we can conclude that due to all transformations the world will face a fundamental reconfiguration. The USA position in the world will weaken at that. But those who suppose that another leader, for example China, will supersede the USA are quite mistaken. The weakening of the USA hegemony will not lead to the emergence of a new leader capable of substituting the USA in a comparable number of functions (Grinin 2009a, 2011, 2012a, 2012b; Grinin and Korotayev 2010; see also NIC 2012: IV). Neither China, nor India will be able to assume the burden of such leadership because of economic limits and factors (the problem of poverty, social discontent etc.), the lack of experience and required alliances, as well as the intolerable burden imposed by such leadership. So, despite the tendencies, a new absolute world leader will not emerge in the next decades. But a number of countries and associations will start dominating in different spheres. In short, we will have to live in a new situation and adapt to new realities.

NOTES

* The present article is in a way a continuation of another article of mine (Grinin 2011).

1 It is impossible to substantiate this idea within the present article. We hope to do this some other time. But it is evident that it would be more difficult to narrow the gap without this process.

2 Thus, developing countries generally benefit globalization despite all the statements about the growing disparity between developing and developed states. We should note that Jagdish Bhagwati appears to be right when advocating globalization against its critics (Bhagwati 2004).

3 For the detailed analysis of the Chinese development model see Grinin 2011.

4 In my opinion, the development model cannot be changed if at the same time to pursuit the extreme growth rates at any cost. To change the pattern, one should slow down in order not to swerve. If unchanged, the model raises a possibility for a deep crisis in the future. That is why the growth rates deceleration, though causing problems and social discontent, is a better alternative to a structural crisis.

5 The Second (that is the socialist) World, though having reduced its representation, still persists in some Asian countries and (in some spheres) in the CIS countries and also in Europe. It is worth noting that, according to the constitution, India is officially named a socialist secular democratic republic.

6 The law on universal primary education for children has already been passed. But there are many problems here.

7 It is important to mention that according to the government (Planning Commission 2008, Vol. 3: 251), the unprecedented progress in IT-technology was achieved through the realization of the Government Resolution on software technology parks which was adopted in 1993 (Software Technology Parks) (Ibid.: 255–256).

8 In the GDP structure services account for 59 %, industry – 27 %, agriculture – 14 %. At the same time, the industry's share remains the same for 30 years, while the services sector considerably increased at the expense of agriculture declining share.

9 See, for example, Dahlman and Utz 2005; Dossani 2008; Raychaudhuri and De 2012; Cong Liang 2012; on outsourcing see Ashmyanskaya 2007, 2008. In 2000–2006, this sector grew more than four times: from 7 to 30 billion dollars (Idem 2007: 7). Whereas in 1999 it amounted to 1,2 % of GDP, in 2008 it was already 7 %. (Idem 2008: 20). The pharmaceutical industry based on production of the so-called generics, that is drugs with expired patent protection, is one of the most important industries in India. The world production of such drugs is supposed to double and reach 230 billion dollars by 2018.

10 Footwear industries can serve an example here. It is export-oriented in many developing countries, in particular in China, while in India only 5 per cent of its product goes for export (see Akimov 2009: 9). Already in 1993, a famous Indian sociologist Rajni Kothary (1993: 77) pointed (though with sharp criticism) that India has formed a consumer society which has adopted an ultra-modernization model.

11 It is slightly reminiscent of the situation with Turkish communities in Germany in the 1960s, with the Mexicans – in the USA, except that the Indian emigrants are high-skilled and well-educated unlike Mexican semiliterate day-laborers and uneducated Turkish workers.

12 The Indian specialists studied in Europe and especially in England for a long time. Since the 19th century that was an Indian advantage over China as the latter was for a long time a closed country or in a state of war. Independent India from the very beginning paid much attention to the level of higher education and the quality of trained specialists. It is indirectly confirmed by the fact that many specialists from India have been working in international organizations.

Certainly, the Indian system of higher education has many problems, including the task to increase the number of universities and improve their quality of work (O'Neill and Poddar 2008).

13 According to the IT Department of Ministry of communications and information technologies, in 2011 the IT production and electronics output in India amounted 88.1 billion dollars (i.e. a 19 percent increase from that in 2010), including software and services – 76.1 billion dollars (Kurbanov 2012: 15).

14 On the nature of such modernization crises that tend to occur in many countries see Grinin 2012a.

15 Here one should also mention the expansion of capital export (see Pakhomov 2012; Galischeva 2011; Lebedeva 2011; Kuznetsov 2012; Leksyutina 2012), although in China this is a more powerful process.

16 In China, the inequality between rural and urban population (as well as other regulations including different rights to retirement pension) is legalized, which helps to restrain the increasing discontent and endure privations, while in India this function is performed by the caste system.

17 Including the role of overseas ethnic diaspora. For comparison of Chinese and Indian diasporas' peculiarities see Valeyev 2011.

18 According to some estimates, India can reach this level roughly by 2030 (e.g., see NIC 2012: 15).

19 In the 2000s, Assam, Manipur, Nagaland were the most volatile states in North-East India (Likhachev 2011).

20 Two demographic scenarios, the first of which implies a preserved restriction and the second – its abolition, will differ not in the expected maximum of China’s population number (in the first case it will not achieve even 1,4 billion people, in the second one it will slightly exceed the number), but rather in the rate of the population decrease (drastic – in the former case and less dramatic in the latter one). Consequently, the size of the working-age population in two cases can be very different.

21 Next Eleven consists of Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, The Philippines, South Korea, Turkey, and Vietnam.

REFERENCES

ADB (Asian Development Bank)

2012. Key Indicators for Asia and the Pacific 2012. URL: http://www.adb.org/ publications/key-indicators-asia-and-pacific-2012.

Akimov, A. V.

2009. India. Who is Stronger: An Elephant or a Whale? Aziya i Afrika segodnya 5: 6–9. In Russian (Акимов, А. В. Индия. Кто сильнее: слон или кит? Азия и Африка сегодня 5: 6–9).

2010а. The Project ‘Indian Republic’: A Success Story.Aziya i Afrika segodnya 1: 2–8. InRussian (Акимов, А. В. Проект «Индийская республика»: история успеха. Азияи Африка сегодня 1: 2–8).

2010b. India. One Year Later. Aziya i Afrika segodnya 6: 2–9. InRussian (Акимов, А. В. Индия. Год спустя. Азия и Африка сегодня 6: 2–9).

Anderson, J.

2008. The Economic Growth and State in China. A Lecture. Polit.ru. URL: http://www. polit.ru/article/2008/07/17/china/. In Russian (Андерсон, Дж. Экономический рост и государство в Китае).

Arrighi, G.

1994. The Long Twentieth Century: Money, Power, and the Origins of Our Times. London: Verso.

2007. Adam Smith in Beijing: Lineages of the Twenty-First Century. London: Verso.

Ashmyanskaya, I.

2007. India and Global Outsourcing, or ‘Bangalorization’ of World Economy. Aziya and Africa segodnya 1: 6–10. In Russian (Ашмянская, И. Индия и глобальный аутсорсинг, или «бангалоризация» мировой экономики. Азияи Африка сегодня 1: 6–10).

2008. Outsourcing: New Horizons for Global Economy. Aziya i Afrika segodnya 1: 18–22. In Russian (Ашмянская, И. Аутсорсинг: новые горизонты для глобальной экономики. Азияи Африка сегодня 1: 18–22).

Bardhan, P.

2010. Awakening Giants, Feet of Clay: Assessing the Economic Rise of China and India. Princeton, NJ: Princeton University Press.

Berger, Ya. M.

2006. The Results of the Tenth Five-year Plan and the Formation of a New Economic Growth Model. Problemy Dalnego Vostoka 3: 14–29;4: 81–95. In Russian (Бергер, Я. М.Итоги 10-й пятилетки и становление новой модели экономического роста в КНР. Проблемы Дальнего Востока 3: 14–29;4: 81–95).

2009. The Chinese Economic Strategy. Moscow: Forum. In Russian (Бергер, Я. М.Экономическая стратегия Китая. М.: Форум).

Berthelsen, J.

2011. Is This the China that Can't? Asia Sentinel May, 18. URL: http://www. asiasentinel.com/index.php?option=com_content&task=view&id=3200&Itemid=422.

BP (British Petroleum)

2012. World Energy Outlook 2030. URL: http://www.imemo.ru/ru/conf/2012/03022 012/03022012_prognoz_RU.pdf.

Bhagwati, J.

2004. In Defense of Globalization. New York: Oxford University Press.

Boeing, P., and Sandner, P.

2011. The Innovative Performance of China's National Innovation System. Frankfurt am Main: Frankfurt School of Finance & Management.

Braghina, E. A.

2010. Take-off in Indian. In Horos, V. G. (ed.), Modern Problems of Development. Materials of Theoretical Seminar at the Institute of World Economy and International Relations, the Russian Academy of Sciences (pp. 123–140). Moscow: Russian Academy of Sciences. URL: http://www.kavkazoved.info/images/myfls/files/razv2010.pdf. In Russian (Брагина, Е. А. Take-off по-индийски. Современные проблемы развития. Материалы теоретического семинара в ИМЭМО РАН / ред. В. Г. Хорос, с. 123–140. М.: ИМЭМО РАН).

Braudel, F.

1981–1984. Civilization and Capitalism, 15th – 18th Century. 3 vols. New York: Harper and Row.

Buchanan, P. J.

2002. The Death of the West: How Dying Populations and Immigrant Invasions Imperil Our Country and Civilization. New York: St. Martin's Griffin.

Cheshkov, M. A.

2009. From Cross Cultural to Wider Generalizations. Mirovaya ekonomika i mezhdunarodniye otnosheniya 3: 89–91. In Russian (Чешков, М. А. От страноведческих к более широким обобщениям. Мировая экономика и международные отношения 3: 89–91).

Cong Liang

2012. Insights from the Comparison of Economic Development Patterns of India and China. The paper for the conference ‘China and India: Sustaining High Quality Growth’ at New Delhi, March 19–20, 2012. URL: http://www.imf.org/external/np/seminars/eng/2012/ chinaindia/pdfs/s2liang.pdf

Dahlman, C., and Utz, A.

2005. India and Knowledge Economy: Leveraging Strengths and Opportunities. Washington, D.C.: World Bank.

Dossani, R.

2008. India Arriving: How This Economic Powerhouse is Redefining Global Business. New York: AMACOM.

Eichengreen, B.

2011. Slowing China. Project Syndicate. URL: http://www.project-syndicate.org/com mentary/eichengreen28/English.

Frank, A. G.

1997. Asia Comes Full Circle – with China as the ‘Middle Kingdom’. Humboldt Journal of Social Relations 76(2): 7–20.

Galischeva, N. V.

2011. India is a New Financial Donor. Aziya i Afrika segodnya 8: 16–22. InRussian (Галищева, Н. В. Кандидат экономических наук. Индия – новый финансовый донор. Азия и Африка сегодня 8: 16–22).

2012. What Attracts Foreign Investors to India? Aziya i Afrika segodnya 1: 29–35. In Russian (Галищева, Н. В. Чем Индия привлекает иностранных инвесторов. Азияи Африка сегодня 1: 29–35).

Goldstone, J. A.

2011. Rise of the TIMBIs. URL: http://www.foreignpolicy.com/articles/2011/12/02/ rise_of_the_timbis.

Goryacheva, A. M.

2010. What Future will the Asian Giant Face? Vostok3: 107–115. In Russian(Горячева, А. М. Какое будущее ожидает азиатского гиганта? Восток (Oriens) 3: 107–115).

Grinin, L. E.

2009a. Will the Global Crisis Lead to Global Changes? Vekglobalizatsii 2: 117–140. InRussian (Гринин, Л. Е. Приведет ли глобальный кризис к глобальным изменением? Векглобализации 2: 117–140).

2009b. The State in the Past and in the Future. Herald of the Russian Academy of Sciences 79(5): 480–486.

2011. Chinese Joker in the World Pack. Journal of Globalization Studies 2(2): 7–24.

2012a. Macrohistory and Globalization. Volgograd: Uchitel.

2012b. State and Socio-Political Crises in the Process of Modernization. Cliodynamics: The Journal of Theoretical and Mathematical History 3(1): 124–157.

2012c. New Foundations of International System or Why do States Lose Their Sovereignty in the Age of Globalization? Journal of Globalization Studies 3(1) 3–38.

Grinin, L. E., and Korotayev, A. V.

2010. Will the global Crisis Lead to Global Transformations? 2. The coming Epoch of new Coalitions. Journal of Globalization Studies 1(2): 166–183.

2011. The Coming Epoch of New Coalitions: Possible Scenarios of the Near Future. World Futures 67(8): 531–563.

Khoros, V. G.

2009. Civilization Factors of Development in Modern India. Mirovaya ekonomika i mezhdunarodniye otnosheniya 3: 91–94. In Russian (Хорос, В. Г. Цивилизационные факторы развития в современной Индии. Мировая экономика и международные отношения 3: 91–94).

2010. (ed.). The Modern Development Problems. Materials of Theoretical Seminar at the Institute of World Economy and International Relations, Russian Academy of Sciences. Мoscow: Russian Academy of Sciences. Moscow: IMEMO RAN. URL: http://www. kavkazoved.info/images/myfls/files/razv2010.pdf. In Russian (Современные проблемы развития. Материалы теоретического семинара в ИМЭМО РАН / ред. В. Г. Хорос. М.: ИМЭМО РАН).

Korotayev, A., Zinkina, J., Bogevolnov, J., and Malkov, A.

2011. Global Unconditional Convergence among Larger Economies after 1998? Journal of Globalization Studies 2(2): 25–62.

Kothary, R.

1993. Poverty: Human Consciousness and the Amnesia of Development. London: Zed.

Kurbanov, S. A.

2012. Peculiarities of Modern India's Economy Development. Ph.D. theses. Moscow: Moscow State University. In Russian (Курбанов, С. А. Особенности развития экономики современной Индии. Автореферат диссертации на соискание ученой степени кандидата экономических наук. Москва: Московский Государственный Университет имени М. В. Ломоносова).

Kuznetsov, A.

2012. Transnational Corporations of BRICS Countries. Mirovaya Ekonomika i Mezhdunarodniye Otnosheniya 3: 3–11. In Russian(Кузнецов, А. Транснациональные корпорации стран БРИКС. Мировая экономика и международные отношения 3: 3–11).

Lebedeva, N. B.

2011. Big Indian Ocean and Chinese Strategy ‘String of Pearls’.Aziya i Afrika segodnya 9: 6–13. InRussian (Лебедева, Н. Б. Большой индийский океан и китайская стратегия «нить жемчуга». Азия и Африка сегодня 9: 6–13).

Leksyutina, Y. V.

2012. The USA – China: Competition in Southeast Asia Exacerbates. Aziya i Afrika segodnya 3: 2–9. In Russian (Лексютина, Я. В. Сша – кнр: соперничество в Юго-Восточной Азии обостряется. Азияи Африка сегодня 3: 2–9).

Lihachev, K. A.

2011. Etnic Separatism in Northeast India: Old Problems in New Century. Aziya i Afrika segodnya 11: 45–49. In Russian (Лихачев, К. А. Этносепаратизм в северо-восточной Индии: старые проблемы в новом веке. Азияи Африка сегодня 11: 45–49).

Lunyov, S. I.

2009. About the Role of Scientific and Technological Factor. Mirovaya ekonomika i mezhdunarodniye otnosheniya 3: 83–84. In Russian (Лунев, С. И. О роли научно-технологического фактора. Мировая экономика и международные отношения 3: 83–84).

Mahajan, A., Datt, G., and Sundharam, K. P. M.

2011. Indian Economy. 67 ed. New Delhi: S. Chand & Company.

Malyarov, O. V.

2010. Independent India: Evolution of Socioeconomic Model and Economy Development. 2 vols. Vol. 1. Мoscow: Vostochnaya literatura. In Russian(Маляров, О. В. Независимая Индия: эволюция социально-экономической модели и развитие экономики: в 2 кн. Книга 1. М.: Вост. лит.).

Mandelbaum, M.

2005. The Case for Goliath: How America Acts as the World's Government in the Twenty-First Century. New York: Public Affairs.

Mereminskaya, E.

2013. The Epoch ‘Made in China’ is Coming to an End. Gazeta.ru. January, 17. URL: http://www.gazeta.ru/business/2013/01/17/4929661.shtml. In Russian (Мереминская, E. Эпоха Made in China завершается. Газета.ru 17.01).

Mehta, P. B.

2012. Why Does Indian Economy Make No Progress? Rossiya v globalnoi politike. October, 28.URL: http://www.globalaffairs.ru/number/Pochemu-Indiya-zabuksovala-15728. InRussian (Мехта, П. Б. Почему экономика Индии забуксовала. Россияв глобальной политике, 28 октября).

Melyantsev, V. A.

2007. India's and China's Economic Growth: Dynamic, Proportions, and Consequences. Mirovaya ekonomika i mezhdunarodnye otnosheniya 9: 18–25. In Russian (Мельянцев, В. А. Экономический рост Китая и Индии: динамика, пропорции и последствия. Мироваяэкономика и международные отношения 9: 18–25).

Ministry of Finance

2010. Economic Survey 2009–2010. New Delhi: Ministry of Finance, Government of India.

Mondal, S. R.

2012. Interrogating Globalization and Culture in Anthropological Perspective – the Indian Experience. Journal of Globalization Studies 3(1): 152–160.

Myrdal, G.

1968. Asian Drama: An Inquiry into the Poverty of Nations. New York: Twentieth Century Fund.

Nasibov, I.

2012. Scientific and Technical Potential of China: Results and Development Prospects. Mirovaya ekonomika i mezhdunarodniye otnosheniya 10: 79–83. In Russian (Насибов, И. Научно-технический потенциал Китая: итоги и перспективы развития. Мировая экономика и международные отношения 10: 79–83).

NIC – National Intelligence Council

2012. Global Trends 2030: Alternative Worlds. URL: www.dni.gov/nic/globaltrends.

O'Neill, J., and Poddar, T.

2008. Ten Things for India to Achieve its 2050 Potential. Global Economic Paper No. 169. New York: Goldman Sachs.

O'Neill, J., Wilson, D., Roopa, P., and Stupnytska, A.

2005. How Solid are the BRICs? Global Economics Paper No. 134. New York: Goldman Sachs. URL: http://www.goldmansachs.com/our-thinking/topics/brics/brics-reports-pdfs/how-solid.pdf.

Pakhomov, A. A.

2012. BRICS Countries in the World ‘Club of Investors’. Aziya i Afrika segodnya 4: 16–23. In Russian (Пахомов, А. А. Кандидат экономических наук. Страны брикс в мировом «клубе инвесторов». Азия и Африка сегодня 4: 16–23).

Planning Commission (Government of India)

2008. Eleventh Five Year Plan 2007–2012. Vols 1–3. New Delhi: Oxford University Press.

2011. Faster, Sustainable and More Inclusive Growth. An Approach to the Twelfth Five Year Plan (2012–17). New Delhi: India Offset Press.

Popov, V. V.

2002. Three Drops of Water. The Non-sinologist about China. Moscow: Delo. In Russian (Попов, В. В.Три капельки воды. Заметки некитаиста о Китае. М.: Дело).

Population Division of the Department of Economic and Social Affairs of the United Nations Secretariat

2012. World Population Prospects: The 2010 Revision. URL: http://esa.un.org/ unpd/wpp/index.htm.

Rastyannikov, V. G.

2010. Agrarian India: Paradoxes of Economic Growth. The Second Half of the 20th Century – the Early 21st Century. Мoscow: Institut vostokovedeniya. InRussian (Растянников, В. Г. Аграрная Индия: парадоксы экономического роста. Вторая половина ХХ в. – начало ХХ1 в. М.: ИВ РАН).

Raychaudhuri, A., and De, P.

2012. International Trade in Services in India: Implications for Growth and Inequality in a Globalizing World New. Delhi – Oxford: Oxford University Press.

Revina, E. Y.

2009. Direct Foreign Investment in Indian Economy. Vestnik Moskovskogo universiteta. Vol. 6: Ekonomika3: 39–47. InRussian (Ревина, Е. Я. Прямые иностранные инвестиции в экономике Индии. Вестник Московского университета. Серия 6: Экономика 3: 39–47).

Rogozhin, A. A.

2009. Unique Originality of India. Mirovaya ekonomika i mezhdunarodniye otnosheniya 3: 86–87. In Russian (Рогожин, А. А. Неповторимое своеобразие Индии. Мировая экономика и международные отношения 3: 86–87).

Russell, J.

2010. Geoghegan Digests and Delivers New Acronym. Telegraph July, 12. URL: http://www.telegraph.co.uk/finance/comment/citydiary/7886195/Geoghegan-digests-and-delivers-new-acronym.html.

Scientific and Technological Achievements...

2008. Scientific and Technological Achievements of India.Mirovaya ekonomika i mezhdunarodniye otnosheniya 5: 112–117. In Russian (Научно-технические достижения Индии. Мировая экономика и международные отношения 5: 112–117).

Selischev, A. S., and Selischev, N. A.

2004. The Chinese Economy in the 21st Century. St. Petersburg: Piter. In Russian (Селищев, А. С., Селищев, Н. А.Китайская экономика в XXIвеке. СПб.: Питер).

Skosyrev, V.

2007. India. Is it a Coal-Powered Locomotive? Nuclear Deal with the USA will not Save India from Energy Deficit.Aziya i Afrika segodnya 7: 76–77. In Russian (Скосырев, В. Индия. Локомотив на угольной тяге? Ядерная сделка с США не избавит Индию от энергодефицита. Азия и Африка сегодня 7: 76–77).

Srinivas, T.