Patents in the Long Run: Theory, History, and Statistics

Almanac: History & Mathematics:Investigating Past and Future

This paper examines the structural and spatial dynamics of patents in France, Germany, Japan, the United Kingdom and the United States. The time series are extracted from international, comparative and historical databases on the long-term evolution of patents in 40 countries from the 17th century to 1945 and in more than 150 countries from 1945 to present (Diebolt and Pellier 2010). We have found strong evidence of infrequent large shocks resulting essentially from the major economic and political events formed by the two World Wars in the 20th century. Our results question the autonomous process, i.e. the internal dynamic of the patent systems. Wars seem to drive innovation and, finally, the very process of economic growth. We further investigated the role of innovation in economic growth through a causality analysis between patents and GDP per capita. Our major findings support the assumption that the accumulation of innovations was a driving force only for France, the United Kingdom and the United States during the post-World War II period.

Keywords: database, cliometrics, shock analysis, patents, causality, outliers, comparisons in time and space.

While eminent social scientists have made significant and sophisticated use of patent statistics, such data are a far cry from what one would like to have. […] Unable, at least for the present, to study what we want, we can perhaps still learn something by studying what we can.

J. Schmookler (1966: 23)

[…] Patents are not a constant-yardstick indicator of either inventive input or output: moreover, they are ‘produced’ by a government agency […], that goes through its own budgetary and inefficiency cycle.

Z. Griliches (1989: 291)

1. Introduction

Since the Industrial Revolution economists and historians have paid less attention to comparisons of national systems of innovation than on measurement of differences in economic performance (Maddison 1991). Nevertheless, international comparisons of innovation dynamics may provide additional information and perspective for the analysis of national economic situations. The data used for this must be reliable and valid and also meet specific criteria. They must be standardised so as not to compare information that cannot be compared statistically. In addition, national specificities must be taken into account in order to understand, wie es eigentlich gewesen ist, what apparently similar data can mean in very different contexts, and to avoid meaningless analyses making daring comparisons of figures representing different realities.

Innovations are those events where new ideas will progressively lead to economic and institutional changes. An innovation exists if an elaborate idea is developed. Innovative ideas can emerge from a variety of impulses: market needs, the legislation, broadening of the product range, maintenance of the market share as well as entering new markets, etc. An important systematization is the differentiation between product innovations as the production of new products or their qualities and process innovations, meaning the introduction of new production methods or the re-organization of a specific industry. Another important systematization is the classification of innovations according to their intensity. Basic and improvement innovations are frequently dissociated (Mensch 1975). Basic innovations are radical introductions with macroeconomic effects. Improvement innovations in contrast correspond to further development and perfection of those fundamental introductions that were established by basic or radical innovations. In this context, an important problem that systemically arises relates to the question to what extent innovation processes, basic, of improvement or even pseudo innovations (that in reality are not innovations at all), can be understood and explained in a scientific way like path dependence phenomena for example or, alternatively, as merely lucky or unlucky circumstances, i.e. random walks.

Lerner's influential work (2002, 2009) gives important answers to this question. It focuses on the impact of changes in the policies devoted to innovation on the basis of the analysis of changes in the protection level of patents in 60 countries over a period of 150 years. Lerner examined 177 political changes and showed that the impact of these changes were much more important on patent applications by foreigners than on patent applications by nationals.

Our paper must be distinguished from Lerner's seminal approach. On the one hand, from the methodological point of view; on the other hand, through the historical database used. Our aim here is to undertake a fresh examination of the factors which, in the long run, governed the structural and spatial dynamics of patents and, in extension, that of the national systems of innovation in France, Germany, Japan, the United Kingdom and the United States.[1]

Section 2 specifies which sample is used. Outlier tests are implemented in Section 3. Causality relations are analysed in Section 4. Section 5 provides conclusions.

2. The Data

From the pioneering work of Schmookler (1966) until the recent survey on the economics of patents by Hall and Harhoff (2012) in the context of a knowledge-based economy, the need for and resort to such indicators in economic analyses of technical change have grown continuously. Today a patent is the most widely used indicator of technical result. Several studies focused on the best ways to use these data and to underline their main strengths and weaknesses (see especially Pavitt 1985; Basberg 1987; Griliches 1990). One of the major advantages of these data on patents is linked to their availability both in time and space as well as their various aggregation levels.[2] A patent has another major advantage, namely its rich information content (OCDE/OECD 2009). On the basis of the technical characteristics of the invention, of the ownership of the invention and the history of the application, it is possible to build multiple – simple or more complex – indicators and to use them in very varied studies.

Statistics on patents can be used, for instance, to analyse the technological performances of countries or firms, to model knowledge flows[3] or to assess the technical value of innovations,[4] etc. But the use of patents as an indicator of inventive activity has also its drawbacks. On the one hand, all inventions are not and cannot be patented. There are alternative ways to appropriate the revenues of innovation, such as secrecy or speed to market strategies. Moreover, the propensity to patent an innovation varies from one firm, one country or technological sector to another and all patents do not have the same economic and technical importance. Therefore, the calculation and interpretation of indicators based on patents require some precautions in order to avoid statistical biases linked to the counting of patents. It is particularly important, when using patents, to have a good knowledge of patent systems and users' strategies (Grupp and Schmoch 1999). It is also possible to apply some rules and statistical methods to calculate better quality indicators, especially to allow international comparisons.

In this article we use, according to the previous work (Diebolt and Pellier 2009a),[5] original statistical series out of the ClioData database (Idem 2010) updated in 2012.[6] This database contains not only data on patents but also various indicators on the economy and demography for a group of countries, mostly from the 18th century to the present time. The database applies a relational model which guarantees the conservation of this type of data and makes it easier to prepare them for the desired calculation techniques (Ibid.).

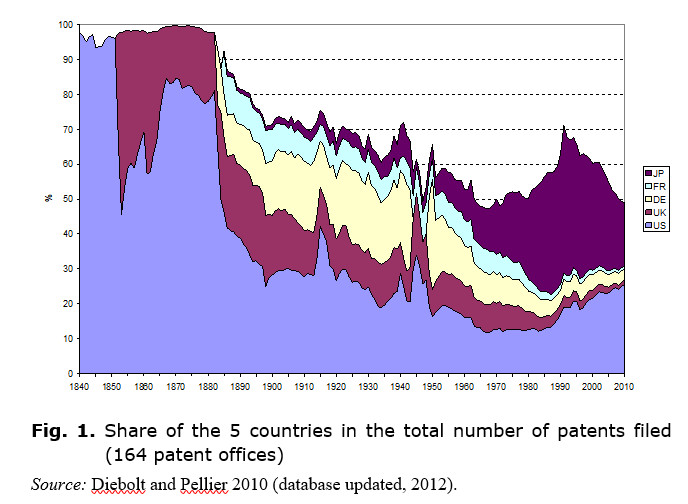

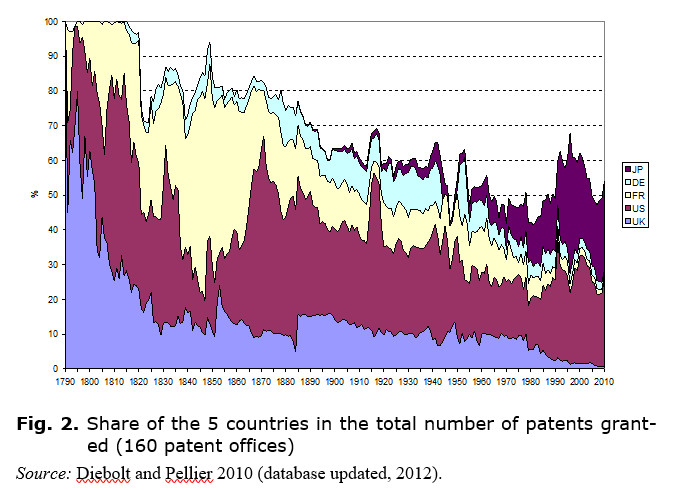

Five countries (France, Germany, Japan, the United Kingdom and the USA) were selected, mainly because many patent data were available for them over very long periods of time. These countries are also among the very first ones who implemented a modern system for the protection of inventions through patents. For instance, for the United Kingdom we can avail of data series going back to the early 17th century. Our choice can also be explained by the fact that until the 1960s France, Germany, the UK and the USA were the countries with the densest inventive activity. Japan is particularly interesting because it is one of the Asian countries which experienced a high growth rate of the filing of patents since the 1960s (see Figs 1 and 2).

The patent series were constructed on the basis of the different national archives and international data available for the present time. The series of the United States come from the United States Patents and Trademark Office (USPTO 2011). For the United Kingdom we used the patents data from Mitchell (1988). Data for France and Germany come from Federico (1964). For Japan as well as for recent data of France, Germany and the United Kingdom, we used the WIPO statistics database (2011). When building the database and the specific sample related to this article, we proceeded through two main phases: collection of documents and analysis of the data collected. The first phase was mainly descriptive and of exhaustive data control. In the second phase, the data were assembled in statistical tables and classified according to a previously established nomenclature.

Patent applications and grants are the two types of statistics most frequently used for the long-term analyses. Each has its advantages and drawbacks which will have to be taken into account when interpreting the results. The trends arising from the series linked with these two types of statistics are not strictly identical due to their structural characteristics. The patents granted are usually considered to be a better indicator of the quality of patents because only innovations respecting the patenting requirements may be granted as a patent. These series are extremely interesting because of the number of observations they contain. Since the granting of patents is the first operation which gave rise to listings by offices, these are the longest available series we have. For a large number of countries, one can note that the availability of statistics is often linked to the first law on patents to be promulgated. However, these data are characterised by a very high sensitivity to a number of factors endogenous to the national patent systems. The number of patents granted each year has a tendency to be correlated to the internal functioning of the patent offices (staff, budget, etc.). The type of examination procedure followed by each country and later the legislative amendments may have a significant influence on the statistics. For instance, those countries which demand a stricter examination of the applications are in a way ‘under-rated’ in international comparisons. Some countries look thoroughly into the patenting criteria (it is the case in the UK, the USA, Japan and Germany), whereas others, such as France over a long time span simply registered the applications.[8] Furthermore, there is a delay between the realisation of an innovation and the granting of a patent which varies from one country to another according to the examination procedures. Therefore, the number of patents granted any year does not reflect the number of innovations which took place the same year.

In order to limit the costs linked with each application, the applicants take into account the requirements in terms of examination procedures and specifically the application fees. They also have to arbitrate between the return expected from the granting of the patent and the costs of filing a patent. Statistics on patent applications are probably less sensitive to administrative procedures than to the number of granted patents. In fact, we note that the variances are smaller between the series of patent applications than the series of patents granted, which partly explains why these series are often used for international comparisons. Moreover, the application filing date is closer to the date of realisation of the innovation, as it is expected that the inventor wants to patent his innovation as soon as possible. It provides therefore a more accurate evaluation of the innovation date. The main drawback of these series is that they are always shorter than the series of granted patents.[9]

These two types of statistics which are calculated by patent offices are therefore under the influence of various factors connected with patent systems (patenting requirements, duration of the procedure, fees and costs, etc.).

The methodology of outliers, applied to each of them, aims at analysing and comparing their sensitivity to real shocks. Moreover, identifying outliers is primarily aimed at promoting understanding of the historical evolution of patents in each country, where endogenous factors connected to patent systems, together with exogenous factors linked to economic and political events, exerted a significant influence on the qualitative development of patents. Sufficient knowledge of the differences between national legislations and their changes over time can be considered as an essential pre-requisite to a relevant interpretation of analyses aimed at international comparisons. From that point of view a historical summary of the evolution of patent systems in the five selected countries is presented in Appendix 1 (see also Diebolt and Pellier 2009b).

3. Outliers

3.1. Definitions

On the basis of the institutional and legal landmarks and in line with the methodological approach developed by Darné and Diebolt (2004), the following section aims at showing that rare events, shocks, may have various effects on patent time series.

Generally speaking, when economic history takes an interest in the analysis of shocks, two econometric methodologies can be used. Following the traditional approach, one can study shocks as impulse response functions. In that case the analysis is based on the estimation of a vector autoregressive (VAR) model and is part mainly of an analytical and forecasting approach as the envisaged shocks are simulated and hence fictitious. Following the most recent works in historical econometrics, one can also analyse shocks as outliers. In that case, the analysis of shocks is a part of an analytical and historical approach as the shocks are real.

Our research approach is a part of this latter research path. In other words, we resort to the method of outliers.[10] But how can these events, rare or extreme, be identified?

In statistical theory, when an observation departs strongly from the mean value or tendency, it is considered as exceptional. It is defined by a specific, non-representative value and their number usually does not exceed 1 % of the time series. However, the definition of these values, based solely on their size and rareness, is not operational. It is too vague and requires that size and frequency thresholds should be established beforehand and those will help define whether a value can be called exceptional. After specifying the measurement scale and the reference period, we consider that an observation is of an exceptional character when its value (positive or negative) is very high and when its frequency is very low. Although this definition is subjective from a literal point of view, it allows to sort out these values into two categories: rare and extreme events. A rare event, also called outlier, differs from an extreme event from the point of view of the frequency of occurrence. Whereas extreme values are grouped together, outliers are isolated. Hence, if events cannot be put into a homogeneous series, their nature changes and they become atypical (outliers). In that respect, if they are isolated, they are outliers and if not they are extreme.

Within the framework of this article, four main outliers are classified as: Additive Outliers (AO) that affect only a single observation at some points in time series and not its future values; Innovational Outliers (IO) which produces a temporary effect for a stationary series, whereas it produces a permanent level shift for a nonstationary series; Level Shifts (LS) that increase or decrease all the observations from a certain time point onward by some constant amount; Temporary Changes (TC) that allow an abrupt increase or decrease at the level of a series which then returns to its previous level exponentially rapidly. It is considered that AOs and IOs are outliers which are related to an exogenous and endogenous change in the series, respectively, and that TCs and LSs are more in the nature of structural changes (see Appendix 2).

3.2. Results

We use the outlier theoretical and methodological framework to analyse the genesis and the development of statistics on filed and granted patents in France, Germany, Japan, the United Kingdom and the USA from 1617 to 2010. More precisely we determine whether rare events which might bring along significant changes in the patent time series are the cause or rather the consequence of institutional and economic changes.

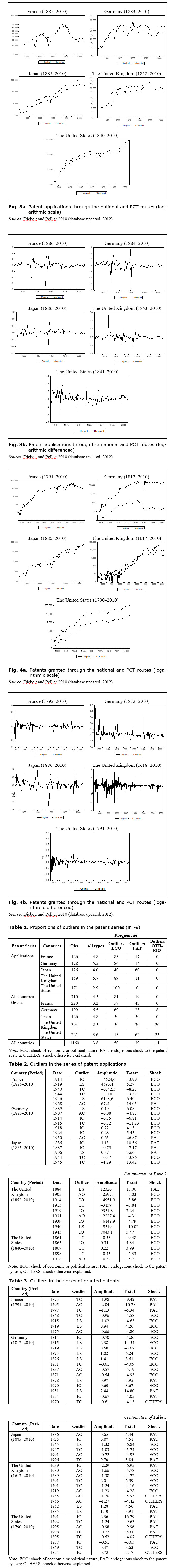

Figs 3a and 3b, 4a and 4b aim at offering an easy reading of our econometric treatments. The unbroken line corresponds to a series before the singular values are corrected, whereas the dotted line systematically represents the series adjusted for the outliers. This latter series was obtained using the TRAMO programme (Time Series Regression with ARIMA Noise, Missing Observations, and Outliers), developed by Gómez and Maravall (1997).

Table 1 summarises our results. Tables 2 and 3, given below, report on the series of patent applications and patents granted using the national and PCT routes, their detection date, the outlier type, the size and critical value of the likelihood ratio (T-Stat).[11] The last column specifies the nature of the shock which resulted in each outlier. We created a new typology and gathered all shocks into three categories. The first category ‘ECO’ refers to shocks of an economic nature such as wars or crises but also shocks of a political nature. They are considered as exogenous to the patent system in our model. The second category ‘PAT’ shows all institutional changes related to patent systems (new laws, closing of offices, etc.). They are considered as endogenous to the patent system in our model. And finally, the third category ‘OTHERS’ deals with any other explanation. It concerns, for instance, outliers the origin of which is still to be determined as well as purely statistical artefact.

As for the series of patent grants, they appeared to be more sensitive to endogenous shocks than patent applications (39 % of observed shock as opposed to 19 %). This result seems to be quite logical considering the structural specificities of the two types of series. The statistics on granted patents have a tendency to be more closely linked to the granting procedure chosen by each country. One can also imagine that the patents granted annually depend at least partly on the internal organisation of the offices. The shocks which cannot yet be explained or which might result from statistical errors are a minority. They represent 0 % of the patents filed and 11 % of the patents granted.

A more detailed look at the results shows that endogenous shocks (PAT) to patent systems are due to the first patent laws, the functioning of offices and the major legislative changes in patent laws (see Tables 2 and 3).

The strong concentration of outliers, which can be observed at the beginning of the period, might be due to a statistical effect connected with the low number of patents granted and to the relative fluctuation of the number of patents granted. But we note that outliers often appear when the first year of data availability corresponds to the first patent law. The progressive implementation of national patent systems with all the necessary adjustments could be another explanation why these shocks appeared.[12] At the same time, we note that half of the endogenous shocks to patent systems occur close to the date when the first laws passed and that all the countries have at least one outlier connected to the first promulgated law on patents. For Germany (1878), Japan (1886), the United Kingdom (1852)[13] and the United States (1791) these shocks had a positive and permanent impact on the series.

Some shocks are linked to re-opening or abrogation of the patent system. In Germany the two outliers of positive impact in the filings (1950) and grants (1951) show a resumption of work resulting from the re-opening of the Patentamt (patent office) in October, 1949[14] and the progressive rebuilding of its numbers, half reduced after its shutting from 1945 to 1949. In England, the abolishment of the patent system from 1640 to 1660 at the eve of a Civil War (1641–1649) explains the negative shock in the grants series in 1639.

New laws

about examination procedures also had some impacts on the series. This was the

case with the re-establishment of

the patents examination in Germany in 1952 and in the United States in 1836

which pulled the number of granted patents down in 1954 and 1837. In France,

the addition of a requirement for ‘inventive activity’ to the prior

requirements of novelty and industrial character in 1968 has rather led to a +8

% rise in the filings during this year. This rise may be caused by a possible advance

of applicants to fill their patent applications before the change was

effective. Other major legislative changes had some positive impacts in the

patenting activity of some countries. Japan was particularly affected by these

changes. Indeed, the nearly quasi doubling of the filings in 1906[15]

seems to be linked with the introduction of a German-based system of protecting

utility models in 1905 in order to complete the Japanese patent system.[16]

Then, the positive and permanent impact that occurred in 1925 may be related to

several institutional changes in 1920.[17] Finally, the outlier

revealed in 1996 can be explained by a set of modifications[18] brought to the Japanese

patent system in the middle of the 1990s. In the United Kingdom,

the two positive and permanent shocks in 1884 for filings and in 1885

for grants

match a date where the patent system was amended. Obviously, the change

observed in the levels of the series can be explained by an increase in the patents

activity resulting from the tax reduction and simplification of procedures with

the law amendment act of 1883.

The five countries were also impacted by some exogenous shocks (ECO), i.e. shocks of economic or political nature. In the patent applications series, we observe that most of these shocks were linked to wars (they represent 80 % of the observed shocks) and had an impact both permanently and temporarily. As for patents granted series, wars are not the main determinant, as they represent only 27 % of the shocks of an economic nature. Economic crises (oil shock, speculative bubbles) or political crises are the main causes of the outliers of negative impact identified in these series. Moreover, most of these shocks had only a transitory character impact on patent series. We noted for France an outlier for the Revolution of 1848 and another one in 1975 following the first oil shock. In Japan, the speculative bubble burst in 1990 seems to have had some negative and one-time consequences in patent grants in 1991. The economics and politics of England experienced particularly turbulent periods during the 17th – 18th centuries. The outlier in 1680 and one-time negative impact occurs during a period of political crisis (1679–1681). The point of 1689 appears in the context of the Glorious Revolution, which marked the end of the absolute monarchy and the establishment of a constitutional and parliamentary monarchy. This shock also occurs during the war of the League of Augsburg (1688–1697). The 1691 shock, of temporary and positive impact is likely related to the first peak in the number of patents observed in the last decade of the 17th century.[19] Finally, the two outliers in 1701 and 1719 seem to follow the bubble bursting. Very few patents were issued during two decades that followed the crisis because of the bad renown of patent.

Another

observation concerns the identified type of outliers. All the countries were affected by major shocks with a

permanent impact, i.e. outliers of IO or LS types. The main

causes of this type of shocks were wars, first laws and legislative changes. We

also observe that exogenous shocks such as wars had a stronger impact on the

patent filings than on the patent grants.[20]

Shocks appeared at the beginning and the end of war periods. The points which appeared

at the end of a war usually had a positive and permanent impact on patents. It

was the case for the United Kingdom and France for both world wars, for

the United States at the end of the Civil War.[21] In

Germany, there is a point at the end of World War I. For Japan, the temporary negative

shock of 1945 followed the defeat of the country in World War II.

Presence of shocks at the end of wars is an important result which opens up a number of research prospects for the future. On the one hand, it complements Mensch's idea (1975), taken up again later by Kleinknecht (1987): according to this idea, the phase of economic slump induces the massive introduction of innovations, i.e. patents and creative activities as a whole. On the other hand, following Sombart's (1913) pioneering work on war and capitalism, Ciriacy-Wantrup's (1936) on wars and economic cycles, and Goldstein's (1988) brilliant synthesis, emphasizes the crucial role played by the wars in the social and economic dynamics. More generally, the analysis of graphical representations of the original and corrected series of outliers confirms our hypothesis about the impact of wars. Indeed, for most of the countries we observe that the adjusted series are below the original ones (see Figs 3a, b, 4a, 4b). These graphs give rise to a counterfactual interpretation, because they clearly show that in the absence of these major events (mainly wars and first laws) the quantity of patents would have been smaller.

4. Causality

This section is based on our outlier results. We found that the shocks which appeared at the end of a war usually had a positive and permanent impact on the patent filings. The accumulation of innovations, ideas and especially the patent filings during the wartime may therefore play a major role as a possible driving force for the following post-war periods. The following causality analysis attempts to clarify this point.

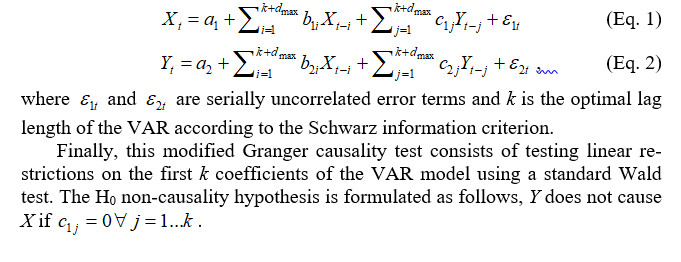

4.1. Definitions

Granger (1969) characterized the causality analysis between two time series in terms of prediction improvement. His definition of causality is based entirely on the predictability of some series: if knowledge of the history of Yt improves the prediction of Xt, then Yt is said to cause Xt. This test allows analysing short-run time series relations. In extension to the traditional Granger approach to causality testing, the Toda and Yamomoto (1995) methodology was performed in order to ascertain the direction of causality. This approach ‘has the advantage that it can be used when the order of integration is ambiguous or uncertain’ (Greasley and Oxley 2010: 991). In macroeconomic time series, unit roots and cointegration tests are known to have generally lower significance in small sample. The weakness of the classical Granger test, assuming that the variables are stationary or can be made stationary by differencing, is that incorrect conclusions can be drawn from ambiguities of the preliminary analyses. The Toda and Yamamoto testing procedure is robust to the integration and cointegration properties of the processes and therefore, avoids the possible pre-test biases. Their approach is based on an ‘augmented’ VAR system that guarantees the usual asymptotic distribution of the Wald statistic. Dolado and Lütkepohl (1996) used Monte Carlo simulations to analyse the power properties of this test and prove the same result. More recently, Bauer and Maynard (2012) have extended the surplus lag approach to an infinite order VARX setting and have shown that it provides a highly persistence-robust Granger causality test.

The starting point to perform the Toda and Yamamoto test is to determine the maximum order of integration dmax involved in the model from efficient unit roots and stationarity tests. Then, we set up and estimate a bi-variate VAR (k + dmax) model in level:

One should note that this test can be implemented as far as the order of integration of the process does not exceed the true lag length of the model.

The following section reveals the relationship between the patent filings and economic growth (approximated by the national Maddison GDP series, recently extended by Bolt and van Zanden [2013]).[22] For all the countries in our sample, the causality tests are carried out on the total observation period and by sub-periods. The sub-periods are moving periods, defined according to the positive and permanent shocks detected at the end of wars for each country in Table 2. More precisely, we employ the causality test for three sub-periods for France and the United Kingdom, and two sub-periods for Germany, the United States and Japan.[23]

4.2. Results

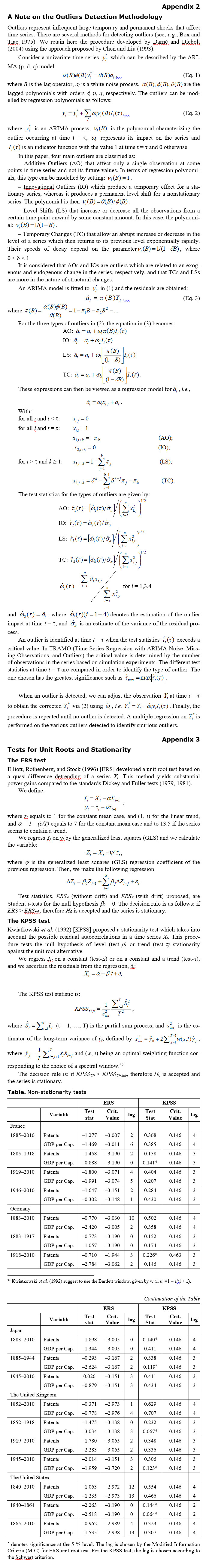

In order to find out the maximum order of integration in each series, we start by applying the efficient unit root test of Elliott et al. (1996) [ERS]. This test allows us to know if the series have a unit root, i.e. if our series follow a non-stationary stochastic process. We combined it with the stationarity test proposed by Kwiatkowski et al. (1992) [KPSS] in order to confirm the results of the previous test and thus obtain more robust measures. Test results are shown in the Appendix 3, Table 4. The efficient ERS test does not reject the unit root null hypothesis for all the series at the 5 % level, which clearly indicates that they are integrated of order 1, I(1). The stationarity test of KPSS shows somewhat mixed results because its null hypothesis of stationarity could not be rejected for eight series at the 5 % level. Nevertheless, the results of both unit root tests lead us to conclude that the maximum order of integration (dmax) is one in each system.[24] Moreover, we followed the sequential testing procedure proposed by Dickey and Pantula (1987) to make sure that our time series are at most I(1). Thus, in the next step of the test, we may just add an extra lag in estimating the parameters of the process. Finally, we ensured that the optimal lag length of each bivariate VAR model exceeds the maximal order of integration of the processes so that the Toda and Yamamoto test can be applied in all cases.

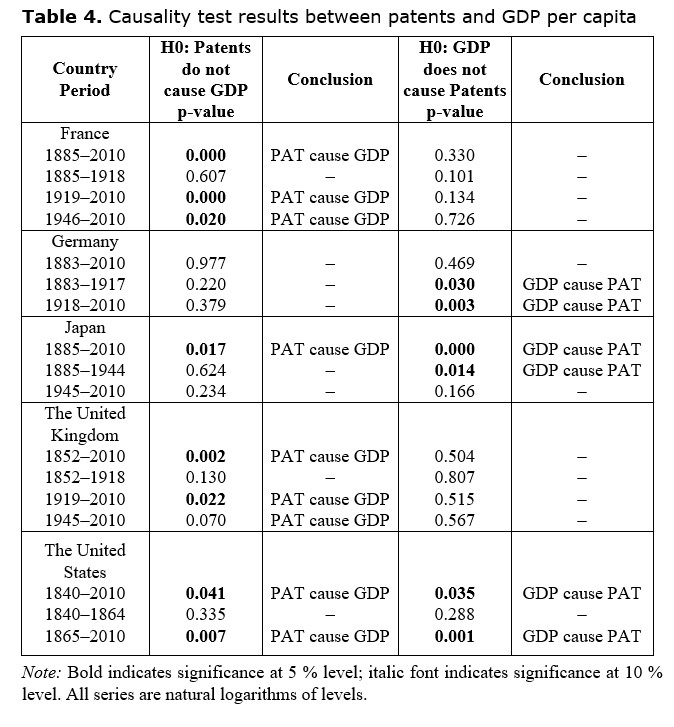

Table 4 displays the p-values and the conclusion of the short-run Granger causality test. For each country, we first tested for causality over the whole period and further examined the issue over different sub-periods. Although wars affected the structural dynamics of patents in the five countries, an overview of the results uncovers similar patterns of causal relationships between few countries as well as great divergence among other ones.

For France, the Toda and Yamamoto test indicates a relationship between the two variables over the whole period characterized by one-way Granger causality running from patents to GDP per capita. We find the same causal link again for the two sub-periods after World War I[25] (1919–2010) and World War II (1946–2010). In contrast, the test does not detect any link before the First World War. The same results are obtained for the United Kingdom: the accumulation of innovations was a driving force for economic performance during the following post-war periods. Using as well patent numbers, our approach may be considered as complementary to the Greasley and Oxley's (1998) paper. Indeed, the authors investigated the causal linkages between aggregate patents and industrial production but during the British Industrial Revolution period. Their findings allow identifying a bi-directional causality between the two variables, whereas our results suggest unidirectional causality from the level of patents to the level of the whole economy during the following post-World War periods. The examination of the causality for the United States series revealed a feedback relationship throughout the period 1840–2010. Over the short period from 1840 until the Civil War, no causal influence is detected between the two variables. However, this result should be interpreted with caution due to the lack of efficiency of causality tests in small sample. On the other hand, we found again a feedback mechanism starting from the Civil War until nowadays. In France and the United Kingdom, patents appear to be a driver for economic development following the war period.

As regards Germany and Japan, the causality test results do not reveal such direction of causality after the wars. These two countries have similarities. They have experienced losses of war and they reached the technological level at the end of the 19th century. These countries benefited from the lessons to be learned from the long practice of the other big nations in the field. In particular for Japan, we found a bi-directional causality over the whole period, indicating the existence of a feedback mechanism between patents and GDP. From 1885 until the end of the Second World War, the results show that patenting activity was a response to economic growth. Japan implemented a system to protect invention at the time when the country entered a modernity phase, i.e. under the Meiji era (1868–1912). The promulgation of the ‘Statute of Monopolies of patents’ in 1885 made it possible for Japan to acquire a real patent system originally inspired by the French and American laws and later by the German model in the 1920s. The Japanese patent system was amended on several occasions at the beginning of the 20th century, possibly indicating that the system was adjusted in order to fit better with the needs of the economic change of the period. Due to its modernisation efforts, to a system of innovation promotion and a culture in which industrial development prevails over individual interests, Japan experiences an amazing increase of the number of patent applications since the 1960s. Notwithstanding, in the second sub-period starting with the defeat of Japan in 1945, we do not observe any connection between patents and GDP. For Germany, no causal relationship was found between these two variables from 1885 until 2011. As for the two sub-periods around the First World War, the results reveal unidirectional causality from economic development to patenting. Therefore, the patenting activity seems to have responded to the dynamics of the output for both time periods.

This article provides a new type of analysis of the historical evolution of patents, based on a cliometric approach. Our research clearly shows that events of a rare nature but of specific importance have influenced the dynamics of patents series in France, Germany, Japan, the United Kingdom, and the United States from the early 17th century until the present time. Wars, the promulgation of new laws, the functioning of offices and other economic or institutional events provided long-term norms for the filing and granting of patents. Our research on the structural and spatial dynamics of patents is also an original way of questioning the endogenous and exogenous factors which have conditioned over time the heartbeats of history.

Lerner's pioneering work (2002, 2009) suggested three factors which could determine the intensity of the protection provided by patent systems: (1) the nation's stage of development; (2) the impact of the distribution of political power on property rights; and (3) the implications of the initial design of a society's institutions.

Our analysis specifies the preliminary results by showing the proportions of outliers by origin for each country (economic or connected with the patent system) as well as their sign and impact on the long-term evolution of patents. Lerner's presentation was mainly focused on repercussions of changes in the patent regimes on innovation. By sorting out the shocks by types (endogenous or exogenous), our analysis provides more specific results by considering the possible interactions between the patent system and the economic system as a whole. In other words, this article provides a new approach of Lerner's work by analyzing institutional events, then by shedding light on the major role played by wars in the structural dynamics of patents.

This last finding leads us to deepen our analysis and address the question whether the accumulation of innovations, through the patent filings, was a driving force for the economic growth of these five countries. This issue was tackled with modified Granger causality tests. According to our results, the patterns of causal relationships are far from being similar between countries and periods: sometimes the level of patents drove the level of the whole economy; sometimes patenting activity responded to the general economic context. Concerning particularly the following post-war periods, the results show that France and the United Kingdom have the same causal relationship, where patents were a causal force for economic performance of both countries. Germany and Japan, which are countries that have experienced losses of war, exhibit different relationships. German economy experienced the development of patents while no connection was found for Japan. Finally, the United States is the only country where one can see a feedback mechanism between patenting activity and economic performance after the Civil War period.

Acknowledgements

Financial support from the Centre National de la Recherche Scientifique (CNRS): PEPS-La cliométrie du brevet, Institut des Sciences Humaines et Sociales (INSHS) is gratefully acknowledged.

References

Basberg B. 1987. Patents and the Measurement of Technological Change: A Survey of the Literature. Research Policy 16: 131–141.

Bauer D., and Maynard A. 2012. Persistence-Robust Surplus-Lag Granger Causality Testing. Journal of Econometrics 169: 293–300.

Beltran A., Chauveau S., and Galvez-Behar G. 2001. Des brevets et des marques. Une histoire de la propriété industrielle. Paris: Fayard.

Bolt J., and van Zanden J. L. 2013. The First Update of the Maddison Project; Re-Estimating Growth Before 1820. Maddison Project Working Paper 4.

Box G. E. P., and Tiao G. C. 1975. Intervention Analysis with Applications to Economic and Environmental Problems. Journal of the American Statistical Association 70: 70–79.

Charles A., and Darné O. 2011. Large Shocks in U.S. Macroeconomic Time Series: 1860–1988. Cliometrica 5: 79–100.

Chen C., and Liu L. M. 1993. Joint Estimation of Model Parameters and Outlier Effects in Time Series. Journal of the American Statistical Association 88: 284–297.

Ciriacy-Wantrup S. von. 1936. Agrarkrisen und Stockungsspannen. Zur Frage der langen Welle in der wirtschaftlichen Entwicklung. Berlin: P. Parey.

Clark J., Freeman C., and Soete L. 1981. Long Waves, Inventions, and Innovations. Futures 13: 308–322.

Darné O., and Diebolt C. 2004. Unit Roots and Infrequent Large Shocks: New International Evidence on Output. Journal of Monetary Economics 51: 1449–1465.

Dickey D. A., and Fuller W. A. 1979. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 74(366a): 427–431.

Dickey D. A., and Fuller W. A. 1981. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica: Journal of the Econometric Society: 1057–1072.

Dickey D., and Pantula S. 1987. Determining the Order of Differencing in Autoregressive Processes. Journal of Business & Economic Statistics 5: 455–461.

Diebolt C., and Pellier K. 2009a. La convergence des activités innovantes en Europe. Les enseignements de l’économétrie spatiale appliquée à l’histoire du temps present. Série AF – Histoire Economique Quantitative. Economies et Sociétés 40: 805–832.

Diebolt C., and Pellier K. 2009b. Cliometrics of Patents. Brussels Economic Review 52: 204–375.

Diebolt C., and Pellier K. 2010. La cliométrie du brevet. Rapport de recherche: Projet Exploratoire / Premier Soutien (PEPS) du CNRS. Janvier.

Dolado J. J., and Lütkepohl H. 1996. Making Wald Tests Work for Cointegrated VAR Systems. Econometric Review 15: 369–386.

Elliott G., Rothenberg T., and Stock J. 1996. Efficient Tests for an Autoregressive Unit Root. Econometrica 64: 813–836.

Federico P. 1964. Historical Patent Statistics. Journal of the Patent Office Society 46: 89–171.

Freeman C. 1995. The ‘National System of Innovation’. Cambridge Journal of Economics 19: 5–24.

Goldstein J. S. 1988. Long Cycles. Prosperity and War in the Modern Age. New Haven: Yale University Press.

Gómez V., and Maravall A. 1997. Programs TRAMO and SEATS: Instructions for the User (Beta version: June 1997). Working Paper, 97001, Ministerio de Economía y Hacienda, Dirección General de Análisis y Programación.

Granger C. W. J. 1969. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 37: 424–438.

Greasley D., and Oxley L. 1998. Causality and the First Industrial Revolution. Industrial & Corporate Change 7: 33–47.

Greasley D., and Oxley L. 2010. Cliometrics and Time Series Econometrics: Some Theory and Applications. Journal of Economic Surveys 24: 970–1042.

Griliches Z. 1989. Patent: Recent Trends and Puzzles. Brookings Papers on Economic Activity. Microeconomics: 291–330.

Griliches Z. 1990. Patent Statistics as Economic Indicators: A Survey. Journal of Economic Literature 28: 1661–1707.

Grupp H., Dominguez-Lacasa I., and Friedrich-Nishio M. 2002. Das deutsche Innovationssystem seit der Reichsgründung. Indikatoren einer nationalen Wissenschafts- und Technikgeschichte in unterschiedlichen Regierungs- und Gebietsstrukturen. Heidelberg: Physica-Verlag.

Grupp H., and Schmoch H. 1999. Patent Statistics in the Age of Globalisation: New Legal Procedures, New Analytical Methods, New Economic Interpretation. Research Policy 28: 377–396.

Hall B., and Harhoff D. 2012. Recent Research on the Economics of Patents. Annual Review of Economics 4: 541–565.

Jaffe A. B., Trajtenberg M., and Henderson R. 1993. Geographic Localization of Knowledge Spillovers as Evidenced by Patent Citations. Quarterly Journal of Economics 108: 577–598.

Khan Z. 2009. War and the Returns to Entrepreneurial Innovation among U.S. Patentees, 1790–1870. Brussels Economic Review 52: 239–273.

Kleinknecht A. 1987. Innovation Patterns in Crisis and Prosperity. Schumpeter's Long Cycle Reconsidered. London: The Macmillan Press Ltd.

Kwiatkowski D., Phillips P., Schmidt P., and Shin Y. 1992. Testing the Null Hypothesis of Stationary against the Alternative of a Unit Root: How Sure are We That Economic Time Series Have a Unit Root? Journal of Econometrics 54: 159–178.

Lerner J. 2002. 150 Years of Patent Protection. American Economic Review 92: 221–225.

Lerner J. 2009. The Empirical Impact of Intellectual Property Rights on Innovation: Puzzles and Clues. American Economic Review 99: 343–348.

Machlup F., and Penrose E. 1950. The Patent Controversy in the Nineteenth Century. Journal of Economic History 10: 1–29.

MacLeod C. 1988. Inventing the Industrial Revolution. The English Patent System, 1660–1800. Cambridge: Cambridge University Press.

Maddison A. 1991. Dynamic Forces in Capitalist Development. A Long-Run Comparative View. Oxford: Oxford University Press.

Mensch G. 1975. Das technologische Patt. Innovationen überwinden die Depression. Frankfurt am Main: Umschau Verlag.

Metz R. 2010. Filter-Design and Model-Based Analysis of Trends and Cycles in the Presence of Outliers and Structural Breaks. Cliometrica 4: 51–73.

Metz R. 2011. Do Kondratieff Waves Exist? How Time Series Techniques Can Help to Solve the Problem. Cliometrica 5(3): 205–238.

Mitchell B. R. 1988. British Historical Statistics. Cambridge: Cambridge University Press.

Nuvolari A., and Taratari V. 2011. Bennet Woodcroft and the Value of English Patents, 1617–1841. Explorations in Economic History 48: 97–115.

OCDE/OECD. 2009. Manuel de l'OCDE sur les statistiques des brevets. Paris.

Pavitt K. 1985. Patent Statistics as Indicators of Innovative Activities: Possibilities and Problems. Scientometrics 7: 77–99.

Plasseraud Y., and Savignon F. 1983. Paris 1883. Genèse du droit unioniste des brevets. Paris: LITEC.

Plasseraud Y., and Savignon F. 1986. L’état et l’invention: histoire des brevets. Paris: INPI, La Documentation Française.

Schankerman M., and Pakes A. 1986. Estimates of the Value of Patent Rights in European Countries During the Post-1950 Period. Economic Journal 96: 1052–1076.

Schmookler J. 1966. Invention and Economic Growth. Cambridge: Harvard University Press.

Sombart W. 1913. Krieg und Kapitalismus. München: Leipzig Duncker & Humblot.

Toda H., and Yamamoto T. 1995. Statistical Inference in Vector Autoregressions with Possibly Integrated Processes. Journal of Econometrics 66: 225–250.

The United States Patent and Trademark Office (USPTO). 2011. URL: http://www. uspto.gov/web/offices/ac/ido/oeip/taf/h_counts.htm. Date accessed: 12.09.2011.

WIPO Statistics Database. 2011. URL: http://www.wipo.int/ipstats/fr/statistics/atents/. Date accessed: 05.02.2012.

Appendix 1

Historical Overview of National Laws on Patents

From the very beginning,[26] patents never ceased to evolve to become today a complex instrument to serve innovation. The first modern patent systems were created in the late 18th century in England, the USA and France, which were the main industrial powers at the time. At the end of the 19th century, one can consider that most industrialised countries had adopted a patent system.[27] It was the case in particular of Germany and Japan which also implemented their own laws: Germany when the German Reich was created and Japan under the Meiji era. The five national laws had one point in common, namely to have been mutually inspired and to have developed later and evolved to adapt to their respective economic and social contexts linked to their respective stages of development. These different patent systems did not evolve linearly.[28] They experienced cycles with some slackening phases and some reinforcement phases. However, if their existence was sometimes threatened,[29] in the long run the general trend was towards harmonisation. Especially since the early 1980s, in most countries one can observe a common evolution towards an expansion of the patentable coverage and an extension of the rights granted to the patent owner, which shows the growing role played by this instrument in the innovation policy and also its potential strategic dimension.

The United Kingdom

One of the first fundamental laws on the right of inventors was voted by the English Parliament in 1623. This law, known as the Statute of Monopolies, forbade the Crown to grant monopoly privileges to anyone but the first and true inventor of ‘any manner of new manufactures’ in the kingdom. It excluded all arbitrary decisions in issuing patents even if the actual granting remained the monarch's prerogative. The patented inventor received a positive right, namely to make use of his invention. Patents were granted for a period of 14 years to English as well as foreign applicants. An importation patent did not exist as such but the specific concept of ‘novelty’ in the English legislation, which was required only at the local level, allowed naturalizing inventions of foreign origin. Later various amendments were made to improve the system, such as applicants' responsibility to provide a detailed description of the invention (1734) or to examine the novelty of the invention (1833). However, no important changes were made in the British system until 1852. At that time there took place a major revision of the Statute. The changes brought about by this law provided for a rationalisation of the granting procedure, and in particular a decrease of the taxes. Moreover, after 1852, the patents granted offered protection all over the United Kingdom. The consequences of these two reforms were an immediate and significant increase of the number of patents granted. There was another remarkable modification of the system in 1884, the year the United Kingdom became a member of the Paris Convention for the Protection of Industrial Property. A new law was implemented which, once again, was aimed at simplifying procedures and reducing tax rates.

Considering how long the British model had existed and the pre-eminence of the country at the time, this model was a source of inspiration for many legislators, in particular in France and the USA.

The USA

In the USA, following the Declaration of Independence, Congress expressed as early as 1787 its wish to ‘promote the development of science and the useful arts, by guaranteeing authors and inventors that they would have exclusive rights over their books or inventions for a given period of time’ (Plasseraud and Sauvignon 1983: 21). Based on the provisions of the Constitution, the law of 1790 is generally considered as the first modern law in patent matters. The patent system aimed at rewarding the first and true inventor, without any territorial limits, by granting him a temporary monopoly to protect his invention while at the same time promoting technical progress. Contrary to the English law which gave the inventor the right to use his invention, the American Constitution grants an exclusive right to protect his invention. The utility and importance of patent applications had to go through a preliminary examination, but considering the complexity of the procedure and the resulting slowness of the granting of patents (only three commissioners were in charge of examining the patents), the system was soon amended by the law of 1793 which substituted a mere registration for the initial examination system. The duration of the patents was 14 years as in England, but the importer of an invention was not considered as the inventor, which meant that imported and introduced patents were not allowed. The rights of the grantee were not crippled by the obligation to exploit the invention. The main characteristics of the American system took shape during the last three decades of the 19th century, partly as a consequence of the changes introduced by the 1836 law. The main features of the American system were related to the granting of the patent to the first inventor and not to the first applicant. Another specificity of the American system referred to the publication of patent applications. Contrary to the other systems, the applications were only published once the patents had been granted. Finally, the ‘doctrine of equivalents’ implied a wide interpretation of the coverage of patents in litigation cases.[30] The changes brought about by the law of 1836 bore on the maximal duration of the patents, which was extended to 17 years, without further prolongation possibility. This law also re-introduced the examination system which concerned the novelty and the notion of inventive activity known as non-obviousness. It introduced a system of claims which had to be specified in the patent application and defined the coverage of patent protection, i.e. the characteristics of the invention on which the inventor claimed an exclusive right. On the other hand, from the beginning the American system was characterised by a strong discrimination against foreigners. To be granted a patent, foreigners had to be residents in the USA for two years at the time they applied (law of 1793), then they had to declare their intention to apply for citizenship before they could be entitled to a patent (law of 1832). In the favourable case the application led to the granting of a patent, the foreigners were obliged to exploit their invention within 6 months, otherwise they were deprived of their rights. This discriminatory treatment came to end with the 1861 law. In 1887 the USA joined the Paris Convention and later they partook of the 1978 Patent Cooperation Treaty. Few changes were added to the system by the 1980s. The USA became aware of the stakes of intellectual property in a knowledge-based economy and they were among the first countries to reform their system. The American legislation took on a stronger turn in favour of patent applications with the creation of the Court of Appeals for the Federal Circuit in 1982, which was unique for solving litigations and with the enlarged coverage of patentability to biotechnologies and software, the Bayh-Dole Act (1980) which authorised non-profit research institutions to patent their discoveries, the extension of the protection period for chemicals and pharmaceutics, etc. In 1995 the USA extended the patent validity to 17 years, starting with the granting date, to 20 years from the application date, in order to meet the international standard to be found in the TRIPS Agreement (Agreement on Trade-Related Aspects of Intellectual Property Rights).

France

The French law shares with the American law the peculiarity of having been promulgated in a revolutionary context. The French law which was adopted by the Constituent Assembly in 1791, emphasized the principle of ownership, as specified in Article 1: ‘Any discovery or new invention, in any type of industry, is the ownership of its author: consequently the Law guarantees that he has full enjoyment…’ The French law emphasized intellectual property as land property and granted inventors an ownership right limited in time. French patents which were granted for periods of 5, 10 or 15 years following the applicant's choice could be lost after two years if they were not exploited. Inventors could also be deprived of their rights if they applied for the same patent abroad. The aim of this provision was to reserve exclusive rights of the invention in France. Importation patents were possible in so far as the law provided the same advantages to the person who first brought in a discovery to France as to the inventor itself. The original feature of the French approach consisted in a simple formal examination: there was no examination of the content conditions the invention had to meet. However, this system without examination functioned rather well as major changes were introduced for the first time 170 years after the revolution law. The new law was voted in 1844: it clearly emphasized the exclusive right granted to the patentee more than the ownership right and at the same time ended the importation patent. The improvements to the legislation referred to the duration of the patent which was extended to 20 years and they provided for the full publication of applications, usually one year after they were filed. No examination of the novelty was required yet for granting a patent. However, in order to disclaim any responsibility by guaranteeing neither the merit nor the success of the invention, the State demanded that the granted patents mentioned ‘without guarantee from the Government’. Another change concerned the revocation in case a similar patent was granted later abroad. On the other hand, the patent might be revoked if the inventor imported objects covered by patents. This provision was cancelled when France adhered to the Paris Convention in 1884. France kept its specific procedure for the granting of patents without examination until the system was modernised in the late 1960s. The aim of the reforms introduced by the 1968 law was to increase the level of French patents. Hence, the new law introduced the obligation to provide a documentary opinion (research report) and demanded that all applications included claims; furthermore it added the inventive activity among the novelty and industrial application criteria. Amendments of this law in 1978 and 1984 aimed at harmonising the French legislation with the provisions of the European patent system. France joined the European Patent Organisation in 1978.

The three above models inspired numerous foreign legislations as they allowed modern patent systems to take shape and to spread during the first half of the 19th century. Among the countries where the first laws were promulgated, one can note Austria (1810), Russia (1812), Prussia (1815), Belgium and the Netherlands (1817), Spain (1820), Sweden (1834), and Portugal (1837).

Germany and Japan were the rising industrial powers at the end of the 19th century. Although they came late on the technological stage, the nations benefited from the lessons to be learned from the long practice of the other big nations in the field.

Germany

At the beginning of the 19th century the different units which formed the German Reich introduced their own legislations on patents (Prussia in 1815, Bavaria in 1825, Hannover in 1847, etc.). The specificity of these legislations was that they developed in an environment which was rather hostile to patents. Following the liberal-inspired legal texts, the granting of patents had to meet very strict requirements. While the average duration of patents was 15 years, in practice it did not exceed three years. Applications had to undergo a preliminary examination on the specificity and novelty and the patent could be revoked in case the invention was not implemented within six months of the granting. The Prussian legislation which was strongly nationalist, forced foreigners to either acquire a ‘bourgeois right’ or hand over their inventions to citizens of the Prussian states. In 1834, the creation of the Zollverein which set up a customs union between the 17 German states entailed a weakening of the patent rights in each of the states in order to limit their potential impact on the exchanges of goods. In 1877, following the creation of the German Empire in 1871, a unitary patent was set up. The strict legislation applied to patents made it possible for Germany to gain a reputation for the quality of the patents granted. Very few patent applications were actually granted. The law introduced a preliminary examination of the novelty which consisted in a precedence proceeding, not limited to German patents, and introduced a new notion, ‘inventive level’, meant to discard minor inventions, i.e. inventions which were not sufficiently distinct from existing techniques. A system of opposition was also implemented. Patents were granted for 15 years and could be withdrawn in case they were not used within three months. The rights of foreigners were recognized which meant that they could apply for a patent in their own names. Another specificity of the German legislation was the introduction of the notion of ‘compulsory licence’, i.e. the possibility to force the patentee to grant a licence to a third party, for the public's interest, otherwise they might forfeit their rights. Germany joined the Paris Convention in 1903.

Japan

At the time when Japan entered a modernity phase, under the Meiji era (1868–1912), the country implemented a system to protect inventions before a decree of 1721 prevented any innovation. The promulgation of the Statute of Monopolies of patents in 1885 made it possible for Japan to acquire a real patent system originally inspired by the French and American laws and later by the German model in the 1920s. In Japan an invention was patentable only if it met the novelty, technical quality and reproducibility criteria (Beltran et al. 2001). Among the main characteristics of Japanese patents, one could find the adoption of a preliminary examination system and the first-to-invent system for a maximum of 15-year duration. A patent could be forfeited if the invention was not implemented within two years after it was filed. Originally the 1871 law granted rights only to foreigners residing in the country. Only after the 1899 reform which required adhering to the Paris Convention, did Japan put an end to this discrimination against foreigners. Various modifications were generated from within the Japanese system, for instance the introduction in 1905 of utility models inspired by the German model for minor inventions. Utility models were meant to protect less important inventions for a shorter duration than patents. The Japanese patent system was amended on several occasions in 1909, 1921 and 1959. Today the Japanese industrial property system is governed by the 1959 law. This law was amended on various occasions to enable Japan to meet the requirements of international agreements. Due to these modernisation efforts, to a system of innovation promotion and a culture in which industrial development prevails over individual interests, Japan experiences an amazing increase of the number of patent applications. On the other hand, since the late 1970s Japan has been involved in a series of reforms aimed at aligning its patent system with international standards.[31] Today the Japanese Patent Office is one of the important offices together with the European Office and the US Patent and Trademark Office.

* * *

At the present time, with the continuous technical advances, the patent as an institution is confronted with new challenges. History shows that it is in constant evolution. The patent system must evolve continuously to adapt to the economic context and technological progress in order to be able to play its role as a promoter of innovation and the dissemination of knowledge.

During the last three decades, the transformations observed in the innovation process, in the economic field as well as in the patent systems led to an increased resort to patents to protect inventions. The changes in the patent systems concurred in the direction of a greater harmonisation of legislations, a reinforcement of patent law and an extension of the patentability coverage to new technologies (biotechnologies) or to technologies previously excluded (software, marketing methods). In addition to the traditional functions of invention protection and knowledge dissemination, new ones appeared in connection with the strategic dimension of patent applications. Today patent applications are not motivated solely by the wish to protect inventions from imitation, but also by strategic reasons linked in particular to sustaining a competitive advantage (via a portfolio of patents in order to block competitors) or reinforcing the power of the firm in negotiations with others, especially in the case of cross-licensing agreements.

Since the Paris Convention (1883), efforts were undertaken to facilitate technology transfers and harmonise national rights. The Treaty of Rome (1957) laid the foundations for a European patent which would ensure a unitary and uniform protection on the whole Common Market territory without hampering free circulation of goods. The European Patent Office (EPO), which was created as a follow up of the European Patent Convention (1973), ensures a centralised procedure for the treatment of applications on the basis of a unique filing procedure. However, once it has been granted, the European patent corresponds to a set of national patents which have to be ratified by the offices of the countries listed. The European patent gives the same legal rights and is subject to the same conditions as national patents granted by member states of the Convention. Other regional systems based on the same principles were established elsewhere such as the Eurasian Patent Organisation (OEAB), the Regional African Intellectual Property Organisation (ARIPO), or the African Intellectual Property Organisation (OAPI). At the international level, the enforcement of the Patent Cooperation Treaty (PCT) in 1978 created an international demand for easing filing procedures with a large number of countries. This treaty provides for the filing of a single application, in a single place and a single language. This unique international application should have the same effects as national applications filed in national offices. However, this international procedure does not lead to an international patent. Each application must be validated by the national office of the country in which protection is applied for. The WTO Agreement of 1994 on trade-related aspects of intellectual property rights (TRIPS) is another landmark in the international harmonisation of patent law. The agreement provides minimal protection norms in terms of intellectual property for the members of WTO. It foresees among others to extend the patentability coverage to almost all technical inventions and sets the minimum protection duration of 20 years. Minimal rights granted to the owner of a patent are also listed.

Other reforms have been implemented to extend the coverage of the protection offered by the patent (Japanese law on the number of claims in 1988), to develop the incentives to innovate by allowing new applicants (Bayh-Dole Act in the USA in 1980), to reinforce the respect for the rights of patentees (creation of a specialised federal court in the USA in 1982), etc.

In spite of a certain convergence of national legislations, the remaining disparities due to national specificities slow down the adoption of a true international system of industrial property. The differences between the three main offices, EPO (European Patent Office), JPO (Japanese Patent Office) and USPTO (US Patent and Trademark Office) concern the domain of patentable objects, the legal definition of patentability and the coverage of patents. There are also divergences in the granting, opposition procedures, in the grace periods, in the costs of obtaining and maintaining a patent, in the duration of the granting procedure, etc. The three fundamental patentability criteria – novelty, inventive activity and industrial application (which are now universal) – are not interpreted in the same way everywhere by jurisprudence. The USA focus on utility, novelty and evidence of concrete results from utilising the innovation, whereas Europe remains largely interested in technical applications. The USA continue to apply the rule first to invent, which means that the patent can be challenged after it has been granted by a third party claiming to be the true inventor. In Europe and in Japan the applied principle is that of first to file, which means that the patent is granted to the first person to file an application. American and Japanese legislations grant a grace period, which provides that publishing the invention within a certain period before filing an application (12 months maximum in the USA and 6 months in Japan), does not cancel the novelty character of the invention and therefore does not invalidate the claim. Some areas are debatable. The patentability of software is not yet generally agreed upon. In Europe and in Japan software-related inventions are not patentable as such, i.e. they must be of a ‘sufficient technical nature’. As for the costs, in spite of a drop during the 1990s a European patent is on average twice as expensive as an American patent. These higher costs are related to the translation costs during the treatment and validation stages. All these differences related to patent regulations are partly mirrored in the estimated levels of patent grants of the offices.

* Dedicated to the memory of Karine Pellier (1980–2018).

[1] For a critical survey of the concept see Freeman 1995 and Grupp, Dominguez-Lacasa and Friedrich-Nishio 2002.

[2] ‘The advantage of patent statistics is that they provide readily available information over rather long periods which can be easily classified by year, and which is not affected by changes in relative prices. A more important advantage is that they have been collected and examined over all these years by the same official agency, generally speaking a Patent Office’ (Clark, Freeman, and Soete 1981: 309–310).

[3] Jaffe, Trajtenberg and Henderson (1993) used patent citations as a measure of knowledge flows.

[4] Schankerman and Pakes (1986) mobilized data on inventors' decisions to renew patents as a measure for patent value. More recently, Nuvolari and Tartari (2011) proposed an indicator of the quality of English patents in the period 1617–1841, based on the relative ‘visibility’ of each patent summarized in Woodcroft's Reference Index.

[5] We investigated the impact of geographical spillovers of knowledge in the patenting activity and convergence process for a sample of 131 European regions over the period of 1981–2001. Using spatial econometrics methods, we detected spatial autocorrelation and heterogeneity in the regional distribution of patent applications to the European Patent Office. Then, we successively included these spatial effects in a convergence analysis. The first specification taking into account the spatial dependence revealed a global convergence process between European regions as also a positive effect of geographical spillovers on this convergence process. Secondly, the spatial heterogeneity was taken into account by a specification with two spatial regimes, a Core-Periphery type. Finally, our results showed that the global convergence process is hiding disparities and different convergence processes for the two regimes. Only regions that belong to the Core of the EU are converging.

[6] ClioData completes the Carolus database which compiles many data connected with the economics of education. Carolus has actually contributed numerous cliometric or econometric works. See URL: http://www.cliometrie.org.

[7] Patent Cooperation Treaty is an international treaty, administered by the World Intellectual Property Organization. The PCT aims at facilitating the acquisition of patent rights in a large number of jurisdictions.

[8] Calculated from the ClioData database, the gross grants ratios (the number of patents granted divided by the number of patents filed) show that the annual mean rate of grants is around 87 % for France (1885–2010), 34 % for Germany (1883–2010), 29 % for Japan (1885–2010), 57 % for the United States (1840–2010) and 52 % for the United Kingdom (1852–2010).

[9] In fact, the statistics concerning applications appeared late (towards the end of the 19th century) in the publications of the national offices.

[10] For the readers interested in other cliometric applications or a mathematical and complete statistical presentation of the outliers methodology see Darné and Diebolt 2004; Charles and Darné 2011; Metz 2010, 2011.

[11] The critical detection value of outliers is 3.5 for France, Germany and the USA. For the UK it is 3.8.

[12] For the sake of interpretation we consider that the points which appear during the years following the first law are of an endogenous nature to the patent system, although the purely statistical impact cannot be totally excluded.

[13] 1852 is generally considered as the year of the first formal patent law enacted in the United Kingdom with the set-up of a Patent Office and a simplified procedure for obtaining patents of invention.

[14] The number of patent applications pending examination in 1950 amounted to around 130,000.

[15] 4,509 patent filings are recorded in 1906 as opposed to 2,897 filings in 1905.

[16] Utility models protect inventions that comply with the novelty and industrial requirements but do not require such a high degree of inventiveness or technical advance as in the case of patents.

[17] In particular, Japan switched from a first-to-invent to a first-to-file regime.

[18] These amendments include the patent term extended to 20 years from the filing date and the possibility of filing a patent application in English (law of July 1995). Other amendments occurred in 1996, established a post-grant opposition as well as measures to accelerate the procedures for examining patent applications.

[19] According to McLeod (1988), this growth is explained by the optimistic climate in financial markets that led to the formation of a wave of creation of listed company.

[20] For the United States, we observed that the patent applications series was exclusively struck by shocks caused by wars.

[21] On ‘the effects of the American Civil War on patterns of patenting and on the returns to inventive activity among patentees’ see Khan 2009: 239.

[22] The data are available from the Maddison Project website. URL: http://www.ggdc.net/maddison/maddison-project/data.htm.

[23] For Japan, we detected only a temporary shock in 1945 but we still divided the period into two.

[24] There is only one ambiguous case which affects the short period 1840–1864 for the United States. The null hypothesis of stationarity of the KPSS test could not be rejected for patents and GDP. Now, unit root tests have low power due to small sample size and the results should be interpreted with caution. In this case, we considered that the maximum order of integration of both series is one, just like other pairs of variables.

[25] We preferred to study the period of 1919–2010 instead of the shorter one (1919–1945) due to non-robustness of the tests in case of too small samples.

[26] Even if the premises of a system to protect inventions date back to Antiquity, it is in Venice in 1474 that a pioneering text on patent legislation was promulgated. The Parte Veneziana created a right of privilege, an appropriation limited in time for each inventor of a new technique.

[27] The Convention de Paris, which was signed on March, 20, 1883, set several principles, among which is the fundamental principle of treating foreigners as the natives and urging some recalcitrant countries (such as Switzerland) to adopt a protection system or to reinstall one (as was the case with Holland in 1910).

[28] The developed historical landmarks are drawn from the works on the history of patents by Beltran et al. 2001; Plasseraud and Savignon 1983, 1986.

[29] In Europe, during the second half of the 19th century, the supporters of the liberal movement organised a campaign violently hostile to any forms of Monopoly, including the patent (Machlup and Penrose 1950).

[30] Applying this doctrine in cases of infringement protected the inventors against products or processes which showed no substantial differences from the patented product or process.

[31] Among the reforms, one should mention the 1988 law which allows multiple claims when filing applications.

[32] Kwiatkowski et al. (1992) suggest to use the Bartlett window, given by w (l, s) =1 – s/(l + 1).