The Inflationary and Deflationary Trends in the Global Economy, or ‘the Japanese Disease’ is Spreading

Almanac: Globalistics and Globalization Studies Global Evolution, Historical Globalistics and Globalization Studies

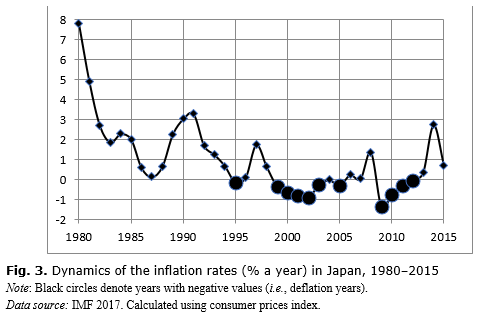

The danger of deflation has been rather frequently mentioned recently among numerous concerns over the European and partly American economies. Analysts cite the Japanese economy which has been suffering from deflation for the last two decades despite the large investments in economy and the government's efforts to increase inflation. Similarly, notwithstanding many trillions of dollars, euros, pounds and yen that were invested in economies over the past few years, the inflation in the Western countries still remains low.

On the whole, there are reasons to maintain that European countries suffer from ‘the Japanese disease’, and this disease can progress or even become chronic. The USA, albeit to a lesser extent, has signs of the disease as well. As a result, the financial infusions can become permanent, as it happened in Japan. The present paper defines reasons of the problem, explains the irregularity of the inflation-deflation processes in the world and also offers some forecasts on this basis that the crisis-depressive phase of development in the global economy will continue for a relatively long time. Based on our analysis of available resources and the theory of long cycles, we suppose that the new crisis will begin in 2018–2019. We also suppose that in the next 5–10 years, the global economy will continue being in the crisis-depression phase with rather sluggish and weak rises. The paper also offers some forecasts for the forthcoming sixth Kondratieff wave (2020 – the 2060/70s), identifies its possible technological basis and discusses possible consequences of the forthcoming technological transformations.

Keywords: forecasts, economic future, inflation, deflation, quantitative easing, prices, investments, the World System core, periphery, Japanese economy, de-mand, economic laws.

The present-day world economy lacks a powerful and developed global mechanism of monetary and nonmonetary measures similar to the regulation at the national level and this has become one of the main causes of the current global financial crisis (see Grinin and Korotayev 2010b). Thus, at the supranational level objective economic laws manifest themselves, as before, in the successive short and long cycles of economic activity.

The cyclic regularity is manifested in the booms and recessions of the medium-term Juglar cycles (see, e.g., Juglar 1889 [1862]; Tugan-Baranovsky 1894, 2008 [1913]; Schumpeter 1939; Grinin and Korotayev 2010a, 2012; Grinin, Malkov, and Korotayev 2010; Grinin, Korotayev, and Malkov 2010; Grinin, Korotayev, and Tsirel 2011), and also in the inflation and deflation phases of long Kondratieff cycles. Let us note that Nikolai D. Kondratieff was the first to make an attempt to present a systematic theory of such fluctuations of conjuncture (Kondratieff 1922 [2002]; 1925 [1993]; 1926, 1926 [2002]; 1928 [2002]; 1935, 1984, 1988 [1923], 2002), but these fluctuations had been noticed much earlier (see, e.g., Tooke and Newmarch 1858–1859; Jevons 1884; Sauerbeck 1886; Wicksell 1898; Parvus 1901, 1908; Lescure 1912, 1932 [1907]; Sombart 1911; Aftalion 1913; Van Gelderen 1913; Lenoir 1913; Mukoseyev 1914; Bresciani-Turroni 1917; Cassel 1918; Kautsky 1912, etc.).

The present-day world economy possesses some other features which allow attributing to it some phenomena which have already gone to the past as a result of government regulation at the national level. Some of them were mentioned in our works (see, e.g., Grinin 2012a, 2012b; Grinin, Korotayev, and Malkov 2010; Grinin, Malkov, and Korotayev 2010; Grinin and Korotayev 2010a, 2012: Ch. 2). One can also note that since there is no common world-wide social legislation on labor, the laws of severe competition act with respect to most basic commodities when the low standard of living and high exploitation contribute to low commodity prices. As we shall see below, the cheap export coming from increasing number of countries with low standard of living contributes to a partial restraining of inflation rates in wealthy countries. But it often has no impact on raw materials. On the whole, there is a disproportion between the raw material producing countries and those countries that produce commodities.

The above-mentioned (and some other) analogies between world economy and national economies lacking government regulation can help to explain the cycles of world conjuncture and its inflation-deflation trends.

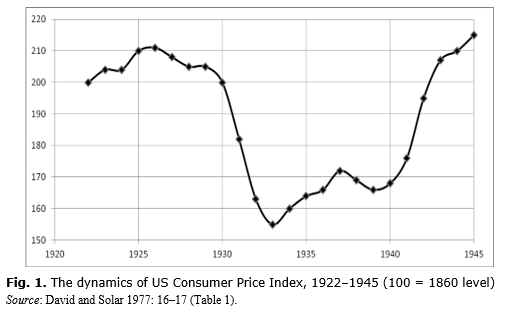

Recently, alongside with numerous problems in European (and partly American) economies, one quite often mentions the danger of deflation which would seem long-forgotten. In the 19th and the first half of the 20th century, from time to time the deflation would put pressure on economies, nibbling away at entrepreneurs' profit. The deflation meant the decline in rate of return, bankruptcies and other critical events. [1] The Great Depression was also connected with the Great Deflation and significant drop in prices (see Fig. 1).

On the whole, the situation seems rather mysterious. There are many factors, that should promote inflation namely: credit rates decrease to the limit (zero), the Central Bank performs all kinds of open market operations (accumulates debt securities with the purpose of creating additional money liquidity), high costs for the state and low profit from the taxes, etc. There are other stimulating actions (in particular, reduction in taxes, direct money distribution, changes in banking rules, etc.). But the long-expected inflation does not start. But at the same time, other indicators in Japan are quite good, for example, the high standard of living and life expectancy. And there is also significant scientific and technological progress.

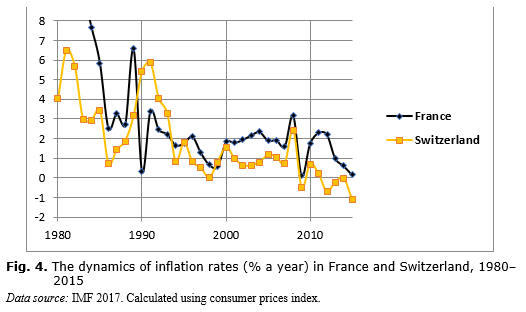

One could attribute such a paradoxical situation (when there is a large amount of money in economy but inflation is still absent) to the ‘mysterious Japanese soul’. Some analysts argue that the Japanese population is getting old and people do not want to spend money but prefer to save it (the Japanese have substantial savings); besides, contrary to the Europeans and Americans, the Japanese are not disposed to consumerism. It makes some sense (especially in the context of population ageing) but this is far from the only reason. The symptoms of the ‘Japanese disease’ have become apparent in Europe (see Fig. 4) and to some extent in the USA.

In fact, in recent years a huge amount of money has been invested in the Western economy. The interest rates have declined to the Japanese (zero) level. [6] But that has not produced the desired effect: the growth is actually weak and a number of European countries even have a negative growth rate. At the same time, people are not willing to increase their consumption and number of credits, while the businessmen do not invest actively despite cheaper loans. The USA in addition to reduced rates until recently also implemented quantitative easing by buying every year government bonds and spending many hundreds of billions of dollars (and overall trillions, about 3 trillion over the past years) on ‘bad’ financial assets. However, even in the USA the efficiency of emissions and ‘easings’ is not high. Europe also intends to use quantitative easing (which is strongly recommended) [7] And in fact, the reduction of quantitative easing immediately caused problems with developing markets and currencies and later with American stock market (especially NASDAQ). The world economy is distorted as it has huge disproportions. But the elimination of these disproportions is very painful; so the quantitative easing turns rather helpful in this situation, it is like an injection for a drug addict.

But the strangest thing is that despite trillions of dollars, euros, pounds, yen, injected into economy in recent years, the inflation in Western economies remains low. And here one should keep in mind that most part of the invested money was created out of thin air through the policy conducted by the Central Bank. The USA failed to reach the inflation target of 2 per cent (which was assumed to be the indicator to stop the quantitative easing). In Europe the inflation is even lower and threatens to turn into deflation.

All this seems even stranger than at first sight. It is obvious that something has fundamentally changed both in the Western and in global economy. But the economists fail to define the essence of this change. Where does money go? Why does the currency emission fail to accelerate inflation? It is very difficult to comprehend the situation. Nevertheless, we would like to present our assumptions about the causes of this situation of ‘disappearance of inflation’.

First of all, economic laws still are in force but with certain modifications. These modifications are related to the development of the economic and financial globalization and also with the so called financial revolution which made the international capital circulation much faster and with more freedom (see, e.g., Doronin 2003; Mikhailov 2000; Rubtsov 2000, 2011; Grinin and Korotayev 2010a, 2010b). In any case in the conditions of currency emission ‘the disappearance of regular inflation’ means that without this emission either the deflationary bias is increasing or inflation gets transformed. Below we will consider both versions.

Inflation at Different Levels and in Different Respects

One should take into consideration the fact that inflation is an economic variable which is measured using particular methods. However, we fail to observe the price increase not only within the market basket (especially in the US market basket which does not include food and energy). In this respect, one can assume that statistics can be manipulated for political benefits. It is rather probable as regards the USA, especially in the period before crisis (see, e.g., Akaev, Korotayev, and Fomin 2012).

Let us suppose that the US statistics is misleading. But why should Japan make figures confirm the deflation? On the contrary, they could easily show that inflation is rising once it is so desirable. The same refers to Europe. Thus, the calculations methodology is of minor importance in this case.

Taking into account that inflation remains the major threat in developing countries, one can assume that today due to the peculiar methods of calculating, the Consumer Price Index can strongly depend on the consumption patterns. The more food products and essential commodities are included, the more evident becomes the consumer inflation.

Now let us consider several types or levels of inflation as the consumer prices constitute the lower level of inflation while the asset price inflation forms the second level. (Let us note that this tendency is not new. Before the Great Depression of 1929, the level of consumer prices remained the same while the level of asset prices was increasing very fast). In 2013, the US GDP rose by 1.9 per cent, the inflation was 1.1 per cent, and stock market increased by 35 per cent.

Thus, if the amount of circulating money increases more than the economic growth requires it and there is no inflation, it means that money goes to the sectors where inflation is not measured (as an inflation). However, in these sectors either the asset value grows or the prices maintain a stable level or increase, or the bubbles are blown, etc. These can be stock markets (shares and securities), raw material markets, real estate markets, etc. Meanwhile, the value of assets becomes an independent component which is not closely related to the actual situation at the enterprises.

Global and National Inflation

The expanding financial and economic globalization together with growing financial sector in general and financial services as a part of GDP (and with the absence of obstacles for a rapid capital transfer) has led to the situation when the emission of money in some places (centers) can cause inflation in other countries. However, the emission of money affects national economies, and this impact is in a way similar to the increase in gold production during the gold-standard period. Indeed, the rapid increase in gold production between the 1850s and 1860s in California and Australia pushed the prices up in many countries. However, contrary to nineteenth-century situation when prices grew fastest in the places of gold mines, today (taking into account that money flows can be immediately transferred for many thousand kilometers) the consumer inflation may not be perceived in the centers of emission (as the movement of air may be hardly perceived at the epicenter of a typhoon).

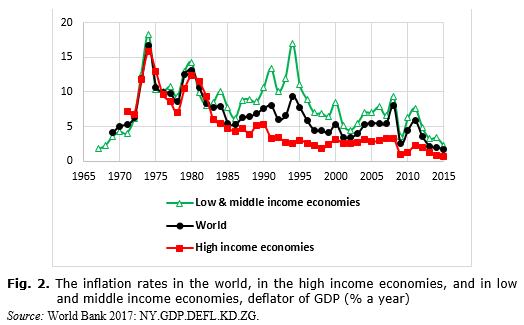

Besides, one should take into account the international division of labor. On the one hand, the Western countries produce and supply capitals and world currency to all economies of the world (but if a certain part of it is created ‘out of thin air’, then there may occur a peculiar effect of the simultaneous export of inflation and deflation); on the other hand, the developing countries produce cheap consumer goods which are in growing numbers supplied to the developed countries. Increasing amounts of money from the core countries go to other countries and affect inflation there in different ways. [8] This can be called an exported inflation. At the same time, the Western countries get cheap import from the developing countries and this also contributes to low inflation. But we should note that export of inflation is not always bad. On the contrary, in current situation it can significantly stimulate the economic growth (since the Keynesian times the moderate inflation is considered as a catalyst for the economic growth). However, the dependence on the fluctuations of economic flows makes the developing markets extremely vulnerable when any external change can cause deterioration.

As

we have already noted, the major part of emission goes not to consumers'

expenses but flows to assets and contributes to the increase in raw materials

(‘commodities’) prices (although this often does not correlate with the

economic situation). [9]

However, in the second half of 2014 the oil prices started to plunge, which can

probably strengthen the deflationary trend. It is very important to realize

that on the global scale it is just these capitals that support high oil and

commodity prices which would drop otherwise. Thus, the emission spreads all

over the world without visible manifestations, but this imposes inflation tax

on all countries and stimulates the growth of resource economies (including

Russia's) sustained via high prices. Thus, due to the pointed factors, the

characteristics and manifestations of inflation change and gain a more global

character. Inflation becomes a part of

the international division of labor but under the conditions of labor division

the benefits and problems are not equally distributed between the actors and

countries and depend on the characteristics of a system. Consequently, with

a certain level of average world inflation there may be deflation in some

countries while the others will suffer from high inflation (thus, in addition

to the internal factors the global ones can also produce a certain

effect). [10]

The global capital flows have a great influence on the value of currency causing its devaluation and revaluation irrespective of internal factors and trade balance and these fluctuations also affect inflationary processes. The peculiarities of international monetary system make the countries with soft currencies transmit inflation to their own territory. Forced to accumulate foreign exchange reserves, they emit national currencies in connection with them and thus accelerate domestic inflation (in particular, Rothbard pointed this in his works [Rothbard 1977, 1994, 1995, 2002, 2005]).

Why does Capital Flow from the Western Countries?

If the return level is low, then capitals search for more profitable applications. As a result, the issued funds are invested not only in national economy but also in other national and world assets and become the source of capital exports and ‘fertilize’ the developing countries' growth. [11] In 1990 when its economy started to fight with inflation, Japan had become the largest capital exporter and the largest loaner. The economic improvements in East Asia were supported by the Japanese (as well as American and European) funds for which their domestic capital markets had become tight. In addition to the corporations' own profits, the Japanese Central Bank's low interest credits together with the emission obviously contributed to such powerful outflow of the Japanese capital (see Bonner and Wiggin 2003). In general, in the 1990s, ten economic development programs were launched totaling 100 trillion yen or about 900 billion dollars (Powell 2003: 111; Herberer 2003: 145; Bonner and Wiggin 2003). The same refers to other Western economies.

The export of capital under low interest rates

is the export of deflation (and the exporting countries become the source of

deflation) which in other (importing) countries can transform into the

inflation (if the latter issue their own currency for imported foreign capital

as, e.g., they do this in Russia,

China, etc.). The more intermediaries

there are,

the more vigorous can be the transformation. It is similar to the situation

with food when products are purchased from the farmers at low prices but in the

process of selling to the ultimate consumer the prices significantly increase.

In general, the growth of the financial sector is not accidental. In the absence of the golden anchor (i.e., gold standard) the necessity to save money from devaluation and increase capital (to give dividends to the owners of the capital) requires a huge amount of highly qualified specialists. The new technologies of rapid transfer and multiple insurance (hedging) of money impede the deflation of the assets and contribute to some leveling of the inflation in the world. However, recently we generally observe a more evident transfer of inflation from the developed to developing countries than in the opposite direction.

The World Deflationary Bias and Mechanisms

One can also explain the weak inflation in Western countries by the strong global deflationary processes and mechanisms which reduce inflation caused by huge emissions. If not for the emissions, the deflation would be more clearly manifested in Western economies. The experts of the international financial organizations realize this quite well and press to continue emission. What are the reasons to maintain that at present the deflationary trend prevails?

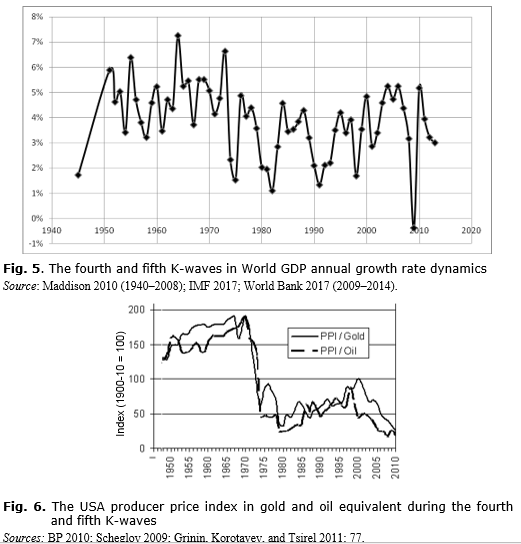

Firstly, we should note that at present we observe the downswing phase of the fifth Kondratieff wave (see Tables 1–2 and Figs 5–6). Kondratieff himself identified the following long waves and their phases (see Table 1).

Table 1. Long waves and their phases, identified by Kondratieff

|

Long wave number |

Long wave phase |

Dates of the beginning |

Dates of the end |

|

I |

A: upswing |

The end of the 1780s – beginning |

1810–1817 |

|

B: downswing |

1810–1817 |

1844–1851 |

|

|

II |

A: upswing |

1844–1851 |

1870–1875 |

|

B: downswing |

1870–1875 |

1890–1896 |

|

|

III |

A: upswing |

1890–1896 |

1914–1920 |

|

B: downswing |

1914–1920 |

|

The subsequent students of Kondratieff cycles identified additionally the following long-waves in the post-World War I period (see Table 2).

Table 2. ‘Post-Kondratieff’ long waves and their phases

|

Long

wave |

Long wave phase |

Dates of the beginning |

Dates of the end |

|

III |

A: upswing |

1890–1896 |

1914–1928/29 [12] |

|

B: downswing |

1914 to 1928/29 |

1939–1950 |

|

|

IV |

A: upswing |

1939–1950 |

1968–1974 |

|

B: downswing |

1968–1974 |

1984–1991 |

|

|

V |

A: upswing |

1984–1991 |

2005–2008? |

|

B: downswing |

2005–2008? |

? |

Sources: Mandel 1980; Dickson 1983; van Duijn 1983: 155; Wallerstein 1984; Goldstein 1988: 67; Chase-Dunn and Podobnik 1995: 8; Modelski and Thompson 1996; Berend 2002: 308; Bobrovnikov 2004: 47; Pantin and Lapkin 2006: 283–285, 315; Ayres 2006; Linstone 2006: Fig. 1; Tausch 2006a; 2006b: 101–104; Thompson 2000; 2007: Table 5; Jourdon 2008: 1040–1043; Korotayev, Zinkina, and Bogevolnov 2011. The last dating (2008) is suggested by the authors of the present paper (Grinin and Korotayev 2012; Grinin, Korotayev, and Tsirel 2011; Korotayev and Tsirel 2010а, 2010b, 2010c; Korotayev, Khaltourina, and Bojevolnov 2010: 188–227). Close datings are also suggested by some other scholars (see Lynch 2004: 230; Pantin and Lapkin 2006: 315; Akaev 2010; Akaev and Sadovnichiy 2010).

Secondly, inflation is multi-faceted. In particular, one should distinguish cost inflation and demand inflation. The cost inflation can have severe consequences especially under non-competitive conditions. The stagflation of the 1970s was connected with cost inflation but not with demand inflation. There was no alternative to oil then. [13] However, globalization has undermined some opportunities for the cost inflation even in the services sector since the rapid means of communication made it possible to outsource the most expensive services. The demand inflation mainly depends on the growing demand. However, there is no such growth in the developed countries. Thus, the absence of deflation during the B-phase of the 4th K-wave looks now as an exceptional phenomenon.

Thirdly, one should consider not only the emission of money but also the factors that level it, namely:

a) the fact that in the period of crisis many capitals were burned or frozen (‘garbage assets’). As we noted earlier, the crisis of 2008–2009 can be called the crisis of overproduction of money (Grinin 2009). The current emission partially substitutes money for these garbage assets. If additional money was not issued, prices would drop and the remaining ‘bubbles’ would completely blow out. In this case, the real deflation would start and restore the health of the world economy but at the same time it would inflict numerous losses (including those for the raw commodity exporters). [14] During the previous decades, there was a tremendous increase in monetary assets. Thus, over 20 years (between 1980 and 1999) the world market capitalization increased by 13 times while the world's aggregate GDP increased only by 2.6 times. As a result, the ratio of capitalization to GDP increased from 23 per cent to 118 per cent. In the 2000s, the capitalization increased not that much, it only doubled, and its growth rates correlated with the GDP growth rates (see Sulakshin 2012: 226–227). However, the emission of derivatives was increasing rapidly, and in 2007 and 2008 it exceeded 2.2 trillion dollars per year: yet, due to the tightening of legislation and some other factors the volume of their emission is reduced.

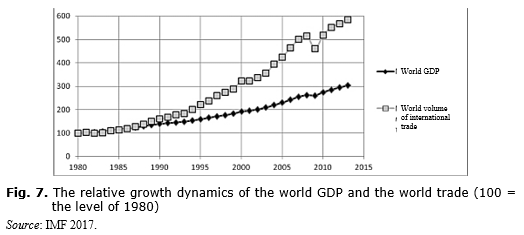

b) The necessity to support global trade. While in the 19th century gold played the role of world money, at present dollars and partly other currencies perform this function. Therefore, some amount of money should be additionally invested into the world economy annually. Let us recall that in recent decades the world trade growth rates surpassed the growth rates of the world economy (see Fig. 7); and thus, a larger amount of world money has been needed.

c) Hoarding means of accumulation and their removal from circulation. At the global scale, it took a form of accumulation of foreign exchange reserves which reached tremendous volumes and this contributes to the absorption of spare money. Over the last decade a number of countries have accrued their international reserves. That is the reason why the inflation is so low in the countries-issuers, but it is high in other countries (as we have already noted, the accumulation of foreign currency reserves is used by such countries to support the issue of their own currency). Besides, these countries accumulate a certain part of the reserves and different national funds in US and other countries' government bonds. Hoarding is expressed in private savings (up to hundred billions of dollars in cash are annually spent on these purposes), etc.

d) The competition for goods and services export to the developed countries (e.g., tourism can become cheaper due to new markets with cheap services and undervalued currency).

e) From time to time the circulation of money slows down, so the amount of money compensates for decelerating velocity of its circulation (according to Fisher equation). Taking into account the current slowdown of the world trade (and of the world financial services) and corresponding deceleration of the currency in circulation, the investment of extra capitals into international finance does not produce a congruent effect on inflation and even fails to keep the prices from decreasing. But in general the deceleration of the world trade has a negative impact on economic growth rates.

Deflationary and Depressive Factors Specific to the Western World

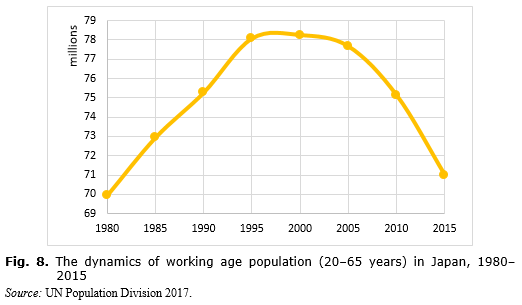

All other things being equal, the weak economic growth is mainly explained by the fact that the main reserves of growth were exhausted in respective societies. The evident reserve, which appeared to be mostly depleted in Japan in the 1990s, was demography. In the 1990s, the process of decline of economically active population began (see, e.g., Vimont 2000) which continues until now (see Fig. 8), but at present we also observe a natural decline in the population.

The next cause of ‘the Japanese disease’ is a very high standard of living which can hardly be adapted to decreasing growth rates. In Europe, for example, the number of working hours per worker is much smaller than in the USA and Japan. The drive to high standards of living, obviously, prevents investment and savings growth. In the USA, there are much fewer social guarantees than in Europe and this has a positive effect on the economic activity, but they also tend to increase there. In general, population ageing together with social guarantees available for the electorate makes a tough problem of budget deficit and government debt due to low growth rates. And this is another reason why ‘the Japanese disease’ can exacerbate in Europe.

The third reason is that these countries are transforming into rentiers due to their specialization within the World System on the export of capital and receiving dividends and also due to their strong financial centers and financial sector. All this reminds the situation in Great Britain in the late 19th – early 20th centuries when capital export and savings were sources of subsistence for many people for whom deflation was profitable. At the same time, the pound was stable. And now the United States live as a rentier largely due to the exceptional position of dollar in the international monetary system. High incomes from the foreign assets do not contribute to the growth of domestic economic activity and GDP.

The fourth reason is that the main reserve of the economic growth in Europe, the USA and Japan is the technological growth. However, in the situation of active export of capital and continued industry export (although there is evidence of the homewards stream) this factor is limited in its action at least until the development of new breakthrough technologies. The insufficient investments give no growth in demand. [15] In Europe this is primarily connected with a hard economic situation and budget cuts; this is similar in Japan, with its ageing population which is less apt to innovations and more concentrated on saving money for bad times. The signs of ‘the Japanese disease’ begin to show up. In the USA, there is also an obvious tendency to repay debts and decrease the number of credits. Energy cost reduction, increase of taxes and insurance payments, deficit and trade balance reduction are used as supplementary anti-inflationary measures in the USA. Low interest rates on deposits also cause low inflation (and the outflow of capital). The most important sign (not only in the USA but also in Europe) is low credit rates which reduce cost inflation (on the contrary, in Russia and China the high credit rates increase cost inflation).

The fifth reason is the deindustrialization in developed economies in which the financial services and flows account for a larger share. And the service economy significantly differs from the previous type, similarly, as the industrial economy differed from the industrializing one. For example, while the crisis in 1970–1980 was associated with oil prices growth, the current crisis arises from the sharp decline in oil prices and it can make many businesses bankrupt. At present housing bubbles and other bubbles pose major threats because the emissions flow primarily into these financial structures. To some extent this is similar to pre-industrial and early industrial economy where basic capitals were separated from the economy (finance would concentrate mainly in serving public debt and large-scale trade). Bursting bubbles are unprofitable because this leads to bankruptcies and requires new niches to save and grow capitals.

The sixth reason is the erosion of the middle class and growing inequality. Especially it is typical of the USA with its weak development of social system, because extra revenues from monetary emission means increasing or sustaining incomes of narrow class of people which leads to growing social stratification in developed countries. [16] This can increase the risk of social unrest. But we also observe a growing social stratification in other developed countries (see, e.g., Ortmans et al. 2017). This tendency is typical of the largest Western states. Thus, the erosion of middle class provokes deflationary processes as the household incomes decrease (or stop growing), while in developing countries, on the contrary, the growing middle class affects positively the inflation rates.

Implications for Future Global Economic Development

On the whole, there are reasons to maintain that European countries suffer from ‘the Japanese disease’, and this disease can progress or become chronic. The USA, although to a lesser extent, also demonstrates some symptoms of this disease. As a result, financial injections can become constant, as this has already happened in Japan.

The main problem is that the driving force of the growth weakens and the economies cannot grow without emissions and financial injections. The worst is that they cannot grow even with financial injections; at best they can demonstrate a sluggish development. As a result, the real business forces move to the spheres of financial and other technologies and this leads to decreasing investments into real technologies. In the situation of economic difficulties everyone requires emission on a growing scale. So, there starts a certain emission race among different states. However, in the situation of relatively low demand the emission will hardly bring a rapid increase of inflation, dollar devaluation, or other results. But, of course, it will leave its mark. However, we will most likely see the consequences in a few years and as usual they will come unexpectedly. The continuous accumulation of money and financial instruments (especially combined with their accelerated circulation or weakening of deflationary processes) can become a detonator. This situation will lead to the bursting of another financial bubble that can cause another large-scale crisis because the debt and emission overhang will significantly increase by that time. Besides, the central banks' manipulations cause remittance of money flows to the speculative channel (due to the actual repayment of debts by means of emission and repurchase of ‘bad’ assets) which significantly distorts proportions and creates a large overhang in the form of overvalued exchange assets which are most likely to burst. Of course, it is very difficult to forecast the time, place and the trigger of that burst. One should take into account that many social funds and capital owners invest in stocks and this fact will make the collapse hard for everyone.

Thus, probably, the cycle of monetary over-accumulation within the World System has not finished yet and it will take several years before the abscess breaks somewhere. The situation can be exacerbated if more countries and their central banks (including the ECB) are involved in the process of quantitative easing and the USA and Japan fail to cope with this process in the way they intend.

In the next few years the deflationary factors will prevail or even increase. According to Paul Krugman (in Hilsenrath 2010), it is time to focus on the stable trend of decrease and on its consequences. After all, everything indicates that we will have to deal with repressed economy for a long time. Remarkable efforts and reforms will be needed to overcome the economic depression. The time will show if Western countries are ready for such sacrifices.

Thus, on the basis of our analysis of available resources and the theory of long cycles, we arrive at the conclusion that in the next 5–10 years, the global economy will continue being in the crisis-depression phase with rather sluggish and weak rises. This conclusion is implied by the long cycle theory.

We suggest that the A-phase of the 5th K-wave ended with the start of the global crisis in 2008, when the B-phase started. In this case – taking into account the active search throughout the World System for effective anti-crisis measures – the duration of the B-phase should not be more than two ‘Juglars’, and it is very likely that the duration of J-cycles within the cluster should not be very long. We should also take into account the tendency for the duration of B-phases to decrease. But at the same time B-phase shall not be less than two ‘Juglars’, whereas, as we have seen, short J-cycles are less typical for B-phases than for A-phases. Therefore, we can suggest a tentative forecast that the present B-phase of the 5th K-wave will have a duration of 14 to 18 years. Thus, the 5th K-wave downswing will continue till the mid-2020s, and the problem of deflation, apparently, will be quite serious till that time.

Forecasts

Recent developments in the global economy, commodity and stock markets, as well as in the policies of central banks indicate the intensification of depressive and deflationary effects. We assume that the world economy is moving toward a new financial or financial-economic crisis. But unlike 2008, this will be probably not a sudden collapse, but rather a slow retraction into the recession and financial contraction for some segments of the economy, which will have a cumulative impact on the financial sector and other areas of the economy.

We assume that more obvious signs of crisis (when it will be possible to speak about the crisis, not its precursors) may manifest itself in 2018–2019. At the same time, it is likely that we will have a ‘sticky’ recession without major failures, but without the possibility to change the situation for 2–3 years or even more.

On the one hand, various negative developments in the economy in 2015 and 2016 are in certain moments reminiscent of the situation in 2006–2007 (when one could observe the beginning of the mortgage crisis, increased volatility in the stock markets and other harbingers of the crisis, which, however, seemed surmountable and transient). On the other hand, the situation now is significantly different. As we have mentioned above, the period up to 2006–2008 can be considered as the upward phase of the 5th Kondratieff wave. Then we can talk about a downward phase of this wave. For the upward phase is characterized by the growth of inflation and price bubbles (this is what we observed in the early 2000s). As noted by researchers of Kondratieff waves (see, e.g., Grinin and Korotayev 2010a, 2012, 2014), the crisis at the turn of a Kondratieff wave (between its upward and downward phases) is particularly profound. This also explains the large scale of the crisis of recent years (as well as the crisis of 1974–1975).

Crises of the downward phases of Kondratieff waves are of a different character, they are less pronounced (collapses and busts might be absent or may not be as strong), as the preceding booms are relatively weak. But these crises are more stubborn and protracted. We assume that the next crisis (which will begin in 2018–2019) will be of this kind.

Deflation is characteristic of the downswing phases of Kondratieff waves. At the downswing phase of the 4th Kondratieff wave (in the 1970s and early 1980s) deflation was not visible because it was prevented by the rise in oil prices, as well as by the departure from the gold standard. However, during the downswing phase of the 5th K-wave (i.e., just at present) deflationary phenomena began to appear as companions of the Kondratieff wave downswing. Unprecedented actions of central banks resorting to the emission in a variety of forms to saturate the economy with cheap money do not let the deflationary trend to develop fully, though in general it is becoming increasingly evident. Deflation begins to be also observed in some developing economies, including China – though a few years ago inflation was one of the main concerns of the Chinese administration. We expect further strengthening of deflationary phenomena (of course, with fluctuations and variations in different countries). The strengthening of deflationary processes can be accelerated by the exhaustion of national funds of oil-producing countries, by the reduction of investment in companies producing oil and other raw materials, as well as by a number of other circumstances. Strengthening of these trends can be expressed in the future collapse of price bubbles.

In recent years, we could observe the collapse of a few price bubbles that remained after 2008 due to the quantitative easing programs of the FRS. In this context, we assume that oil prices and prices of other raw materials is unlikely to grow significantly in the next three to four years, although some may rise (due to withdrawal of the less efficient players from the market). That is, they will not nearly reach the maximum levels that were two or three years ago.

Currently a very few bubbles can be observed in the world markets. These are some stock assets' bubbles, the dollar bubble (that increases the cost of the already existing great difficulties for the development of all economies, including the United States), as well as national debts' bubbles, since government bonds have become a haven for investors.

In this context, we assume that the stocks indices will be rather volatile in the forthcoming years, but the overall trend will be generally bearish (though with rather significant fluctuations). Thus, the ‘stock bubble’ will gradually (but not abruptly) deflate, possibly reaching as a result the level of 2009. Such a trend will contribute to the reduction in corporate profitability, which we are already witnessing in 2017.

As regards the US dollar, we can say that even though objectively its cost is too high, the next year and a half we do not expect its significant decline, as long as the Fed continues to insist on raising rates and the US economy continues to grow (although at a relatively slow pace). Therefore, the dollar will remain a safer asset for investors.

But during the crisis forecasted above, we can expect the fall of the dollar relative to other currencies due to the deteriorating economic situation in the United States and the corresponding actions by the Fed to ease the monetary policy. This, incidentally, may somehow counteract deflationary trends (but not in a radical way).

As for the government bond bubble, the situation will be ambiguous. Currently, due to the sharp decline in areas of favorable capital investment, which we assume will continue further, the primary aim of investors is to preserve their capitals. This is especially true with respect to conservative investors such as pension and other social and national funds. The number of those investors who prefer riskier operations, is unlikely to grow, it will rather decline, as is already evidenced by the problems of many hedge funds.

Nevertheless, one would expect that the absence of embedding spheres beneficial to investors, firstly to support the gold market and possibly other precious metals, and in the future these markets will grow. And secondly, it can enhance the mobility of the capital, which would seek to come to any market with expected higher profits, but also it will contribute to the loss of capital as a result of falls or drops in these markets. Example with Shanghai and other stock markets in China shows how this can be.

In connection with the above, the bubble of government bonds is likely to continue growing (even against the background of negative interest rates). However, these will not be government bonds of all the states. Obviously, the debt market of government obligations can be divided into the market with reliable bonds and less reliable ones.

Accordingly, the market of reliable (American, German, Japanese) government bonds will be inflated (though central banks will become more and more important holders of them in connection with the policy of quantitative easing). As for the bond market of less reliable states (that has recovered from the crisis of 2009–2011), it is not likely to grow for a long time, whereas later it may turn out to be a source of a new general crisis.

In general, we note that today the Western economies are between Scylla of weak economic growth with low interest rates and Charybdis of over-indebtedness, which can threaten the state default. It is kind of a trap from which exit is difficult. In general, by trying through the increase in the national debt and all kinds of financial technologies (quantitative easing, zero and negative rates) to support the economy, Western countries have begun to ‘eat away’ their financial superiority. We called the crisis of 2008 the crisis of overproduction of money (Grinin 2009). This is confirmed to a significant extent. As we have just said, today the main problem is the lack of profitable and/or safe investments for monetary mass and financial derivatives that have increased dramatically since 1990. Therefore, the financial systems of a number of countries have been transformed into delayed-action mines. These are countries whose financial systems are parts of the Western monetary system, but whose economic systems are not as highly developed as the one of, say, Germany, which create greater risks of the crisis (Greece and the countries of Southern Europe are rather indicative in this respect).

As we have found, as a result of almost any Juglar crisis one can observe emergence, significant modification (or diffusion) of new financial technologies, which are then used to prevent or mitigate crises (Grinin and Korotayev 2010a). Today the role of such technologies is played by quantitative easing with purchase of government obligations and negative interest rates. It can be assumed that as a result of a new crisis (that we have forecasted) their use may increase. However, they are unlikely to produce a radical effect.

Today there is a unique situation in many countries, when their debt is increasing, and the debt service costs decline; this looks beneficial in the short term, but in reality drives respective countries into a trap.

Firstly, their own pension and social funds suffer, as they cannot (as a result of lower bonuses) ensure the growth of pension and social savings for tens of millions of future pensioners.

Secondly, this situation worsens the possibility of a new round of economic growth since the emergence of new areas of profitable investment will inevitably raise the cost of credit, and with this the service of colossal public debt will be very difficult, and sometimes even impossible. This situation gives us further reason to believe that the forecasted crisis and depression (in 2018 and subsequent years) will be rather prolonged. As in the period between 2010 and 2015, there will be some rises in these years, but they are likely to be sluggish.

Overall, the end of the depression is likely to be associated with the completion of the downswing phase of the 5th Kondratieff wave and the beginning of the upward phase of the 6th K-wave (around the 2020s, most likely, in the mid-2020s, but probably earlier). Thus, in the 2020s and 2030s we will expect the upswing of the forthcoming 6th Kondratieff wave, which will introduce the sixth technological paradigm (system). As is known, for this forecasted sixth technological paradigm they widely use abbreviation NBIC-technology (or NBIC-convergence), where NBIC = nano-bio-information and cognitive (see Lynch 2004; Bainbridge and Roco 2005; Dator 2006). There are also those scientists (e.g., Jotterand 2008) who consider another system of technologies to be leading in the future – GRAIN (Genomics, Robotics, Artificial Intelligence, Nano-technology). However, we believe that this complex will be larger. Moreover, we assume that this sixth technological paradigm will organically grow into a new technological revolution, which we call Cybernetic (Grinin A. and Grinin L. 2015a). The drivers of the final phase of the Cybernetic Revolution will be medical, additive (e.g., 3 D-printers), nano- and bio- technologies, robotics, IT, cognitive sciences, which will together form a sophisticated system of self-regulating production. We can denote this complex as MANBRIC-technologies. [17] However, all those revolutionary technological changes will be connected, first of all, with breakthroughs in medicine and related technologies (for more details see Grinin A. and Grinin L. 2015b; Grinin and Korotayev 2015; Grinin, Korotayev, and Tausch 2016; Gri-nin L., Grinin A., and Korotayev 2017a, 2017b).

Then, given the favorable conditions as they have been mentioned above, during this wave the final phase of the Cybernetic Revolution will begin. In such a situation, it is possible to assume that the 6th K-wave's A-phase (the 2020 – 2050s) will have much stronger manifestation and last longer than that of the 5th one due to more dense combination of technological generations. And since the Cybernetic Revolution will evolve, the 6th K-wave's downward B-phase (2050 – the 2060/70s), is expected to be not so depressive, as those during the third or fifth waves. In general, during this K-wave (2020 – the 2060/70s) the Scientific and Information Revolution will come to an end, and the scientific and cybernetic production principle will acquire its mature shape.

Thus, the management of the economy should reach a new level. K-waves appeared at a certain phase of global evolution and they are likely to disappear at its certain phase.

References

Aftalion, A. 1913. Les crises périodiques de surproduction. T. 1–2. Paris: Rivière.

Akaev, A. A. 2010. Current Financial-Economic Crisis in the Light of the Theory of Innovation and Technological Economic Development and Management of Innovation Process. The System-Based Monitoring: Global and Regional Development / Ed. by D. A. Khaltourina, and A. V. Korotayev, pp. 230–258. Moscow: LIBROKOM. In Russian (Акаев А. А. Современный финансово-экономический кризис в свете теории инновационно-техноло-гического развития экономики и управления инновационным процессом. Системный мониторинг: Глобальное и региональное развитие / Ред. Д. А. Халтурина, А. В. Коротаев, с. 230–258. М.: Либроком/URSS).

Akaev, A., Korotayev, A., and Fomin, A. 2012. Global Inflation Dynamics: Regularities & Forecasts. Structure & Dynamics 5(3): 3–18.

Akaev, A. A., and Sadovnichiy, V. A. 2010. On the New Methodology of the Long-Term Cyclical Forecast of the Dynamics of the World System and Russia. Forecast and Modeling of Crises and World Dynamics / Ed. by A. A. Akaev, A. V. Korotayev, and G. G. Malinetsky, pp. 5–69. Moscow: LKI. In Russian (Акаев А. А., Садовничий В. А. О новой методологии долгосрочного циклического прогнозирования динамики развития мировой системы и России. Прогноз и моделирование кризисов и мировой динамики / Ред. А. А. Акаев, А. В. Коротаев, Г. Г. Малинецкий, с. 5–69. М.: ЛКИ/URSS).

Ayres, R. U. 2006. Did the Fifth K-Wave Begin in 1990–92? Has it been Aborted by Globalization? Kondratieff Waves, Warfare and World Security / Ed. by T. C. Devezas, рр. 57–71. Amsterdam: IOS Press.

Bainbridge, M. S., and Roco, M. C. 2005. Managing Nano-Bio-Info-Cogno Innovations: Converging Technologies in Society. N. Y.: Springer.

Berend, I. T. 2002. Economic Fluctuation Revisited. European Review 10(3): 305–316.

Biryukova, O., and Pakhomov, A. 2013. The Global Trade: Situation and Prospects. URL: http://ecpol.ru/2012-04-05-13-42-46/2012-04-05-13-43-05/788-mirovayatorgovlya-sostoyanie-i-perspektivy.html. In Russian (Бирюкова О., Пахомов А. Мировая торговля: состояние и перспективы).

Bobrovnikov, A. V. 2004. The Macrocycles in Latin-American Economies. Moscow: Institute of Latin America Studies RAS. In Russian (Бобровников А. В. Макроциклы в экономике стран Латинской Америки. М.: Ин-т Латинской Америки РАН).

Bonner, W., and Wiggin, A. 2003. Financial Reckoning Day: Surviving the Soft Depression of the 21st Century. Hoboken, NJ: John Wiley and Sons.

BP. 2010. BP Statistical Review of World Energy 2010. URL: http://bp.com/statisticalreview.

Bresciani-Turroni, C. 1917. Movimenti di longa durata dello sconto e del prezzi. Giornale degli economisti e rivista di statistica 5(1).

Cassel, G. 1918. Theoretische Sozialökonomie. Leipzig: A. Deichert.

Chase-Dunn, Ch., and Podobnik, B. 1995. The Next World War: World-System Cycles and Trends. Journal of World-Systems Research 1(6): 1–47.

Dator, J. 2006. Alternative Futures for K-Waves. Kondratieff Waves, Warfare and World Security / Ed. by T. C. Devezas, pp. 311–317. Amsterdam: IOS Press.

David, P. A., and Solar, P. 1977. A Bicentenary Contribution to the History of the Cost of Living in America. Research in Economic History 2: 1–80.

Dickson, D. 1983. Technology and Cycles of Boom and Bust. Science 219(4587): 933–936.

Doronin, I. G. 2003. The Global Stock Markets. The World Economy: Global Trends for a Century / Ed. by I. S. Korolyov, pp. 10–133. Moscow: Ekonomist. In Russian (Доронин И. Г. Мировые фондовые рынки. Мировая экономика: глобальные тенденции за 100 лет / Ред. И. С. Королев, с. 101–133. М.: Экономистъ).

Duijn, J. J. van. 1983. The Long Wave in Economic Life. Boston, MA: Allen and Unwin.

Fels, R. 1949. The Long-Wave Depression, 1873–1897. The Review of Economics and Statistics (The MIT Press) 31(1): 69–73.

Goldstein, J. 1988. Long Cycles: Prosperity and War in the Modern Age. New Haven, CT: Yale University Press.

Grinin, L. E. 2009. Global Crisis as the Crisis of Overproduction of Money. Filisofiya i obschestvo 1: 5–32. In Russian (Гринин Л. Е. Глобальный кризис как кризис перепроизводства денег. Философия и общество 1: 5–32).

Grinin, L. E. 2012a. Kondratieff Waves, Technological Principles, and the Theory of Production Revolutions. Kondratieff Waves: Aspects and Prospects / Ed. by A. A. Akaev, R. S. Grinberg, L. E. Grinin, and A. V. Korotayev, pp. 222–262. Volgograd: Uchitel. In Russian (Гринин Л. Е. Кондратьевские волны, технологические уклады и теория производственных революций. Кондратьевские волны: аспекты и перспективы / Отв. ред. А. А. Акаев, Р. С. Гринберг, Л. Е. Гринин, А. В. Коротаев, С. Ю. Малков, с. 222–262. Волгоград: Учитель).

Grinin, L. E. 2012b. Macrohistory and Globalization. Volgograd: Uchitel Publishing House.

Grinin, L. E. 2013. The Dynamics of Kondratieff Waves in the Light of the Theory of Production Revolutions. Kondratieff Waves: The Range of Approaches / Ed. by L. E. Grinin, A. V. Korotayev, and S. Yu. Malkov, pp. 31–83. Volgograd: Uchitel. In Russian (Гринин Л. Е. Динамика кондратьевских волн в свете теории производственных революций. Кондратьевские волны: палитра взглядов / Oтв. ред. Л. Е. Гринин, А. В. Коротаев, С. Ю. Малков, с. 31–83. Волгоград: Учитель).

Grinin, A. L., and. Grinin, L. E. 2015a. The Cybernetic Revolution and Historical Process. Globalistics and Globalization Studies: Big History & Global History / Ed. by L. E. Grinin, I. V. Ilyin, P. Herrmann, and A. V. Korotayev, pp. 18–57. Volgograd: ‘Uchitel’ Publishing House.

Grinin, A. L., and. Grinin, L. E. 2015b. Cybernetic Revolution and Forthcoming Technological Transformations (The Development of the Leading Technologies in the Light of the Theory of Production Revolutions). Evolution: From Big Bang to Nanorobots / Ed. by L. E. Grinin and A. V. Korotayev, pp. 251–330. Volgograd: ‘Uchitel’ Publishing House.

Grinin, L. E., Grinin, A. L., and Korotayev, A. V. 2017a. Forthcoming Kondratieff Wave, Cybernetic Revolution, and Global Ageing. Technological Forecasting and Social Change 115: 52–68.

Grinin, L. E., Grinin, A. L., and Korotayev, A. V. 2017b. The MANBRIC-Technologies in the Forthcoming Technological Revolution. Industry 4.0: Entrepreneurship and Structural Change in the New Digital Landscape / Ed. by T. Devezas, J. Leitão, and A. Sarygulov, pp. 243–261. Heidelberg – New York – Dordrecht – London: Springer International Publishing.

Grinin, L. E., and Korotayev, A. V. 2010a. Global Crisis in Retrospective. Short History of Rises and Crises from Lycurgus to Alan Greenspan. Мoscow: LIBROKOM. In Russian (Гринин Л. Е., Коротаев А. В. Глобальный кризис в ретроспективе. Краткая история подъемов и кризисов: от Ликурга до Алана Гринспена. М.: ЛКИ/ URSS).

Grinin, L. E., and Korotayev, A. V. 2010b. Will the Global Crisis Lead to Global Transformations. 1. The Global Financial System: Pros and Cons. Journal of Globalization Studies 1(1): 70–89.

Grinin, L. E., and Korotayev, A. V. 2012. Cycles, Crises and Traps of the Modern World-System. Research of Kondratieff, Juglar and Secular Cycles, Global Crises, Malthusian and Post-Malthusian Traps. Moscow: LKI. In Russian (Гринин Л. Е., Коротаев А. В. Циклы, кризисы, ловушки современной Мир-Системы. Исследование кондратьевских, жюгляровских и вековых циклов, глобальных кризисов, мальтузианских и постмальтузианских ловушек. М.: ЛКИ/URSS).

Grinin, L. E., and Korotayev, A. V. 2014. Interaction between Kondratieff Waves and Juglar Cycles. Kondratieff Waves. Juglar – Kuznets – Kondratieff / Ed. by L. E. Grinin, and A. V. Korotayev, pp. 25–95. Volgograd: Uchitel.

Grinin, L. E., and Korotayev, A. V. 2015. Great Divergence and Great Convergence. A Global Perspective. Heidelberg – New York – Dordrecht – London: Springer.

Grinin, L., Korotayev, A., and Malkov, S. 2010. A Mathematical Model of Juglar Cycles and the Current Global Crisis. History & Mathematics. Processes and Models of Global Dynamics / Ed. by L. Grinin, P. Herrmann, A. Korotayev, and A. Tausch, рр. 138–187. Volgograd: Uchitel.

Grinin, L., Korotayev, A., and Tausch, A. 2016. Economic Cycles, Crises, and the Global Periphery. Heidelberg – New York – Dordrecht – London: Springer.

Grinin, L. E., Korotayev, A. V., and Tsirel, S. V. 2011. Developmental Cycles of Modern World-System. Мoscow: LIBROCOM. In Russian (Гринин Л. Е., Коротаев А. В., Цирель С. В. Циклы развития современной Мир-Системы. М.: Либроком/URSS).

Grinin, L. E., Malkov, S. Yu., and Korotayev, A. V. 2010. Mathematical Model of a Medium-Term Economic Cycle. Forecast and Modeling of Crises and World Dynamics / Ed. by A. A. Akaev, A. V. Korotayev, and G. G. Malinetsky, pp. 287–299. Moscow: LKI. In Russian (Гринин Л. Е., Малков С. Ю., Коротаев А. В. Математическая модель среднесрочного экономического цикла. Прогноз и моделирование кризисов и мировой динамики / Ред. А. А. Акаев, А. В. Коротаев, Г. Г. Малинецкий, c. 286–299. М.: ЛКИ/URSS).

Herberer, G. 2003. Goodbye to the Japanese ‘Miracle’. The Master of Boom. Lessons from Japan / Ed. by A. V. Kuryaev, pp. 138–154. Cheliabinsk: Sotsium. In Russian (Херберер Дж. Прощай, японское “чудо”. Маэстро бума. Уроки Японии / Ред. А. В. Куряев, с. 138–154. Челябинск: Социум).

Hilsenrath, J. 2010. Deflation Defies Expectations – and Solutions. The Wall Street Journal. URL: http://online.wsj.com/news/articles/SB10001424052748704249004575384944103200032?mg=reno64-wsj&url=http%3A%2F%2Fonline.wsj.com%2Farticle%2FSB100014240 52748704249004575384944103200032.html.

IMF – International Monetary Fund. 2014. World Economic Outlook (WEO). Recovery Strengthens, Remains Uneven. Washington, DC: International Monetary Fund. Statistical Supplement. 2014. URL: http://www.imf.org/external/pubs/ft/weo/2014/01/weodata/index. aspx.

Jevons, W. S. 1884. Investigations in the Currency and Finances. London: Macmillan.

Jotterand, F. 2008. Emerging Conceptual, Ethical and Policy Issues in Bionanotechnology. Vol. 101. N. p.: Springer Science & Business Media.

Jourdon, Ph. 2008. La monnaie unique europeenne et son lien au developpement economique et social coordonne: une analyse cliometrique. Thèse. Montpellier: Universite Montpellier I.

Juglar, C. 1862. Des crises commerciales et de leur retour périodique en France, en Angle-terre et aux États-Unis. Paris: Guillaumin.

Juglar, C. 1889 [1862]. Des crises commerciales et de leur retour périodique en France, en Angleterre et aux Etats-Unis. 2nd ed. Paris: Librairie Guillaumin et Cie.

Kautsky, K. 1912. Gold, Papier und Ware. Die Neue Zeit 30(1), Nr. 24 and Nr. 25: 837–847, 886–893.

Kondratieff, N. D. 1922 [2002]. The World Economy and its Conjunctures During and After the War. In Kondratieff 2002: 40–341. In Russian (Кондратьев Н. Д. Мировое хозяйство и его конъюнктура во время и после войны. В: Кондратьев 2002: 40–341).

Kondratieff, N. D. 1925 [1993]. The Long Waves in Economic Life. Selected Works, pp. 24–83. Moscow: Ekonomika. In Russian (Кондратьев Н. Д. Большие циклы конъюнктуры. Избранные сочинения, с. 24–83. М.: Экономика).

Kondratieff, N. D. 1926. Die langen Wellen der Konjunktur. Archiv für Sozialwissenschaft und Sozialpolitik 56(3): 573–609.

Kondratieff, N. D. 1926 [2002]. The Long Waves in Economic Life. In Kondratieff 2002: 34–400. In Russian (Кондратьев Н. Д. Большие циклы экономической конъюнктуры. В: Кондратьев 2002: 341–400).

Kondratieff, N. D. 1928. Long Cycles of Economic Activity: Reports and Debates on them in the Institute of Economic Studies. Moscow: Institute of Economic Studies. In Russian (Кондратьев Н. Д. Большие циклы конъюнктуры: Доклады и их обсуждения в Ин-те экономики. М.: Рос. ассоц. н.-и. ин-тов обществ. наук, Ин-т экономики).

Kondratieff, N. D. 1928 [2002]. Dynamics of Industrial and Agricultural Prices. In Kondratieff 2002: 401–502. In Russian (Кондратьев Н. Д. Динамика цен сельскохозяйственных и промышленных товаров. В: Кондратьев 2002: 401–502).

Kondratieff, N. D. 1935. The Long Waves in Economic Life. The Review of Economic Statistics 17(6): 105–115.

Kondratieff, N. D. 1984. The Long Wave Cycle. New York: Richardson & Snyder.

Kondratieff, N. D. 1988 [1923]. Some Controversial Questions Concerning the World Economy and Crisis (Answer to Our Critiques). Mirovaya ekonomika i mezhdunarodnye otnosheniya 9: 64–76. In Russian (Кондратьев Н. Д. Спорные вопросы мирового хозяйства и кризиса (Ответ нашим критикам). Мировая экономика и международные отношения 9: 64–76).

Kondratieff, N. D. 2002. Long Cycles of Business Activity and the Theory of Foresight. Selected Works. Moscow: Ekonomika. In Russian (Кондратьев Н. Д. Большие циклы конъюнктуры и теория предвидения. Избранные труды. М.: Экономика).

Korotayev, A. V., and Grinin, L. E. 2012. Kondratieff Waves in the World System Perspective. Kondratieff Waves. Dimensions and Prospects at the Dawn of the 21st Century / Ed. by L. E. Grinin, T. C. Devezas, and A. V. Korotayev, pp. 23–64. Volgograd: Uchitel.

Korotayev, A. V., and Grinin, L. E. 2014. Kondratieff Waves in the Global Studies Perspective. Globalistics and Globalization Studies: Aspects & Dimensions of Global Views / Ed. by L. E. Grinin, I. V. Ilyin, and A. V. Korotayev, pp. 65–98. Volgograd: ‘Uchitel’ Publishing House.

Korotayev, A. V., Khaltourina, D. A., and Bojevolnov, Yu. V. 2010. The Laws of History. Secular Cycles and Millenial Trends. Demography, Economy, and Wars. Moscow: LKI/URSS. In Russian (Коротаев А. В., Халтурина Д. А., Божевольнов Ю. В. Законы истории. Вековые циклы и тысячелетние тренды. Демография. Экономика. Войны. М.: ЛКИ/URSS).

Korotayev, A. V., and Tsirel, S. V. 2010а. Kondratieff Waves in the World Economic Dynamics. The System-Based Monitoring of Global and Regional Development / Ed. by D. A. Khaltourina, and A. V. Korotayev, pp. 189–229. Moscow: LIBROKOM/URSS. In Russian (Коротаев А. В., Цирель С. В. Кондратьевские волны в мировой экономи-ческой динамике. Системный мониторинг глобального и регионального развития / Ред. Д. А. Халтурина, А. В. Коротаев, с. 189–229. М.: Либроком/URSS).

Korotayev, A. V., and Tsirel, S. V. 2010b. Kondratieff Waves in the World-System Economic Dynamics. Forecast and Modeling of Crises and World Dynamics / Ed. by A. A. Akaev, A. V. Korotayev, and G. G. Malinetsky, pp. 5–69. Moscow: LKI. In Russian (Коротаев А. В., Цирель С. В. Кондратьевские волны в мир-системной экономичес-кой динамике. Прогноз и моделирование кризисов и мировой динамики / Ред. А. А. Акаев, А. В. Коротаев, Г. Г. Малинецкий, с. 5–69. М.: ЛКИ).

Korotayev, A., and Tsirel, S. 2010c. A Spectral Analysis of World GDP Dynamics: Kondratieff Waves, Kuznets Swings, Juglar and Kitchin Cycles in Global Economic Development, and the 2008–2009 Economic Crisis. Structure and Dynamics 4(1): 3–57. URL: http://www.escholarship.org/uc/item/9jv108xp.

Korotayev, A., Zinkina, J., and Bogevolnov, J. 2011. Kondratieff Waves in Global Invention Activity (1900–2008). Technological Forecasting and Social Change 78(7): 1280–1284.

Krugman, P. 2013a. The Developed Countries cannot Go Bankrupt. Finmarket. October 30. URL: http://www.finmarket.ru/main/article/3535583. In Russian (Кругман П. Развитые страны не могут обанкротиться. Финмаркет, 30 октября).

Krugman, P. 2013b. When Economic Wariness Becomes Folly. Nezavisimaya Gazeta, May 27. URL: http://www.ng.ru/krugman/2013-05-27/5_wariness.html. In Russian (Кругман П. Когда экономическая осмотрительность становится безрассудством. Независимая газета. Май 25).

Lenoir, M. 1913. Etudes sur la formation et le mouvement des prix. Paris: Giard.

Lescure, J. 1912. Les hausses et baisses générales des prix. Révue d’économie politique 26(4): 452–490.

Lescure, J. 1932 [1907]. Des crises génerales et périodiques de surproduction. 4th ed. Paris: Domat-Montchrestien.

Linstone, H. A. 2006. The Information and Molecular Ages: Will K-Waves Persist? Kondratieff Waves, Warfare and World Security / Ed. by T. C. Devezas, pp. 260–269. Amsterdam: IOS Press.

Lynch, Z. 2004. Neurotechnology and Society 2010–2060. Annals of the New York Academy of Sciences 1031: 229–233.

Maddison, А. 2010. World Population, GDP and Per Capita GDP, A.D. 1–2008. URL: www.ggdc.net/maddison.

Mandel, E. 1980. Long Waves of Capitalist Development. Cambridge: Cambridge University Press.

Mikhailov, D. M. 2000. The World Financial Market. Trends and Mechanisms. Moscow: Ekzamen. In Russian (Михайлов Д. М. Мировой финансовый рынок. Тенденции и инструменты. М.: Экзамен).

Mukoseyev, V. 1914. The Increase of Commodity Prices. Saint-Petersburgh: Ministerstvo Finansov. In Russian (Мукосеев В. Повышение товарных цен. СПб.: Мин-во финансов).

Modelski, G., and Thompson, W. R. 1996. Leading Sectors and World Politics: The Coevolution of Global Politics and Economics. Columbia, SC: University of South Carolina Press.

Nikolskiy, A. 2013. Krugman: ‘Only Bubbles and Extraterrestrial Invasion can Save Us’. URL: http://www.finmarket.ru/main/article/3552122. In Russian (Никольский А. Кругман: «Нас спасут пузыри и вторжение инопланетян»).

Ortmans, O., Mazzeo, E., Zlodeev, D., and Korotayev, A. 2017. Modeling Social Pressures Toward Political Instability in the United Kingdom after 1960: A Demographic Structural Analysis. Cliodynamics 8(1).

Pantin, V. I., and Lapkin, V. V. 2006. Philosophy of Historical Forecasting: Rhythms of History and Prospects of Global Development in the First Half of the Twenty-First Century. Dubna: Feniks+. In Russian (Пантин В. И., Лапкин В. В. Философия истори-ческого прогнозирования: ритмы истории и перспективы мирового развития в первой половине XXI века. Дубна: Феникс+).

Powell, B. 2003. The Explanation for the Japanese Recession. The Master of Boom. Lessons from Japan / Ed. by A. V. Kuryaev, pp. 108–136. Cheliabinsk: Sotsium. In Russian (Пауэлл Б. Объяснение японской рецессии. Маэстро бума. Уроки Японии / Ред. А. В. Куряев, с. 108–136. Челябинск: Социум).

Parvus, A. 1901. Die Handelskrisis und die Gewerkschaften. München.

Parvus, A. 1908. Die Kapitalistische Produktion und das Proletariat. Berlin: Buchhandlung Vorwärts.

Rothbard, M. 1977. Power and Market: Government and the Economy. Kansas City: Sheed Andrews and McMeel.

Rothbard, M. 1994. The Case against the Fed. Auburn, AL: Mises Institute.

Rothbard, M. 1995. Wall Street: Banks and American Foreign Policy. Auburn, AL: Mises Institute.

Rothbard, M. 2002. A History of Money and Banking in the United States: The Colonial Era to World War II. Auburn, AL: Ludwig Von Mises Institute.

Rothbard, M. 2005. What Has Government Done to Our Money? Auburn, AL: Mises Institute.

Rubtsov, B. B. 2000. The World Stock Markets: Current State and Patterns of Development. Moscow: Finansovaya akademiya. In Russian (Рубцов Б. Б. Мировые фондовые рынки: современное состояние и закономерности развития. М.: Финансовая академия).

Rubtsov, B. B. 2011. The Global Stock Markets: Scale, Structure, and Regulation. Vek Globalizatsii 2: 73–74. In Russian (Рубцов Б. Б. Глобальные финансовые рынки: масштабы, структура, регулирование. Век глобализации 2: 73–74).

Sauerbeck, A. 1886. Prices of Commodities and the Precious Metals. Journal of the Statistical Society of London 49(3): 581–648.

Scheglov, S. I. 2009. The Kondratieff Cycles in the Twenty-First Century, or How the Economic Forecasts Come True. URL: http://schegloff.livejournal.com/242360. html#cutid1. In Russian (Щеглов С. И. Циклы Кондратьева в 20 веке, или Как сбываются экономические прогнозы).

Schumpeter, J. A. 1939. Business Cycles. New York: McGraw-Hill.

Sombart, W. 1911. Die Juden und das Wirtschaftsleben. Leipzig: Duncker.

Sulakshin, S. S. 2012.

(Ed.). The Political Dimension of Global Financial Crises.

Pheno-menology, Theory, and Overcoming. Moscow: Nauchniy ekspert. In Russian (Сулак-

шин С. С. (Ред.) Политическое измерение мировых финансовых кризисов.

Феномено-логия, теория, устранение. М.: Научный эксперт).

Tausch, A. 2006a. From the ‘Washington’ towards a ‘Vienna Consensus’? A Quantitative Analysis on Globalization, Development and Global Governance. Buenos Aires: Centro Argentino de Estudios Internacionales.

Tausch, A. 2006b. Global Terrorism and World Political Cycles. History &

Mathematics: Analyzing and Modeling Global Development / Ed. by L. Grinin,

V. C. de Munck, and

A. Korotayev, pp. 99–126.

Moscow: KomKniga/URSS.

Thompson, W. R. 2000. The Emergence of a Global Political Economy. London: Routledge.

Thompson, W. R. 2007. The Kondratieff Wave as Global Social Process. World System History, Encyclopedia of Life Support Systems, UNESCO / Ed. by G. Modelski, and R. A. Denemark. Oxford: EOLSS Publishers. URL: http://www.eolss.net.

Tooke, T., and Newmarch, W. 1858–1859. Die Geschichte und Bestimmung der Preise während der Jahre 1793–1857. Zwei Bände. 1–2. Dresden: R. Kuntze.

Tugan-Baranovsky, M. 1894. The Industrial Crises in Modern Britain, their Causes and Forthcoming Impacts on People's Life. Saint-Petersburg: Tipografiya Skorokhodova. In Russian (Туган-Барановский М. Промышленные кризисы в современной Англии, их причины и ближайшие влияния на народную жизнь. СПб.: Тип. И. Н. Скороходова).

Tugan-Baranovsky, M. 2008 [1913]. Periodic Industrial Crises. Moscow: Direktmedia Publishing. In Russian (Туган-Барановский М. И. Периодические промышленные кри-зисы. М.: Директмедиа Паблишинг).

UNCTAD 2013. World Investment Report 2013: Global Value Chains: Investment and Trade for Development. New York – Geneva: UNO.

UN Population Division. 2017. World Population Database. New York: United Nations.

Van Gelderen, J. 1913. Springvloed: Beschouwingen over industrieele ontwikkeling en prijsbeweging. De nieuwe tijd 18.

Vimont, C. 2000. Evolution demographique, marche du travail et croissance de la productivite. Problemes economiques 2656(2657): 37–41.

Wallerstein, I. 1984. Economic Cycles and Socialist Policies. Futures 16(6): 579–585.

Whitney, M. 2013. Blowing Bubbles with Paul Krugman. CounterPunch, November 22–24. URL: http://www.counterpunch.org/2013/11/22/blowing-bubbles-with-paul-krugman/

Wicksell, K. 1898. Geldzins und Güterpreise: Eine Studie über die den Tauschwert des Geldes bestimmenden Ursachen. Jena: Fischer.

World Bank. 2017. World Development Indicators Online. Washington, DC: World Bank. URL: http://data.worldbank.org/indicator.

* This research has been supported by the Russian Foundation for Basic Research (Project No 17-02-00521).

[1] The complaints about deflation were rather widespread, e.g., at the times of ‘the Long Depression’ in the USA from 1873 to 1879 (which had been also called the Great Depression before the crisis of the 1930s). It was the longest recession in the history of the US economy, so it was even longer (though much less severe) than the Great Depression (see, e.g., Fels 1949: 69). It lasted for 65 months. And the whole period from 1873 to 1897 was also called the Long-wave Depression in the US economy. The same refers to Britain of the same period, but the situation there was much more difficult in some respects. Thus, Tugan-Baranovsky (2008 [1913]: 195) states that the stagnation in British trade had hardly ever been so continuous and destructive for the country as it was in the 1880s. ‘The complaints about low prices, reducing all business profit, in the mid-1880s were common’ (Ibid.). At the same time it follows from the reports that ‘in some industries the production by no means had reduced, but there were complaints of no profit’ (Ibid.). Lescure was among the first who quite clearly identified the long depression and deflation between 1873 and 1893 (Lescure 1932 [1907]: 167–168).

[2] Moreover, Milton Friedman and other economists of this approach even stated that one could have easily escaped from the Great Depression if they had actively used quantitative easing. In our opinion, it is generally an illusion. The essence of the Great Depression was not only financial but this was a decisive, structural crisis which could not be easily resolved.

[3] For example, the sales tax was raised from 5 to 8 per cent.

[4] Keynes explained this paradox by the fact that consumers delay their purchases hoping for price cutting. But the situation in Japan and in the West is much more complicated than this psychological obstacle to expansion of demand.

[5]‘All this confirms an important conclusion that as I said very early in the crisis, virtue becomes vice and prudence is folly. In our world, a responsible behavior is a way to economic failure’ (cited in Whitney 2013). Krugman proposes to keep the negative interest rates, to raise spending by any means and not to be afraid of increasing public debt. He recommends the politicians from the USA, Great Britain and other countries with independent currencies to be wiser and not to be afraid of default (Krugman 2013a).

[6] Moreover, the European Central Bank has recently realized something that used to be just a theoretical possibility, namely, imposed a minus 0.1 per cent interest rate on deposits. In other words, to encourage the credit expansion, the European Central Bank makes the banks pay the ECB to hold their money there. Now the banks should impose the negative interest rates on their clients. It means that they will not give money for keeping deposits but will get interests stimulating the growth of demand. And in this case the financial mirror-world will come true.

[7] As stated in the International Monetary Fund report (IMF 2014), the extremely low growth rates of consumer prices in developed countries, especially in the Eurozone, pose a threat to the global economic recovery.

[8] At the same time, the Central Bank's low interest rates make almost every financial operation profitable and that is the reason of tendency to conservatism (to invest into government bonds or some shares) which leads to deflation. Thus, the low interest rates contrary to the expectations can create a deflationary spiral.

[9] Money does not fall directly into people's hands (in the

USA the taxes rose and the tax collection was tightened) but goes directly to

the banks and financial companies. If 85 billion dollars were monthly given in

the form of aid,

the acceleration of inflation would be inevitable.

[10] The development of globalization and emergence of new cheap manufacturers can produce an effect similar to the decline in crop and food prices in the 19th century (in the 1870s and 1890s). Just as the export of Russian and American cheap wheat in the 1870s and 1880s gave the European workers cheaper food but at the same time put pressure on the economy, today the consumers benefit from the Chinese and other exports, which puts pressure on economy.

[11] The low-interest credits quite often obtained in the countries with artificially low rates are used for the purpose of buying more profitable assets in other countries.

[12] The most noticeable variation in dates is observed at the threshold of the A and B phases of the 3rd Kondratieff Wave.

[13] The inflation in Russia is in many ways related just to cost inflation due to natural monopolies.

[14] The decrease in prices, e.g., for aluminum, has led to the shutdown of some factories in Russia and some other countries. A more significant decrease could lead to the world (and national) GDP decline. That used to be the pattern of Juglar cycles. Now we do not observe the decrease but at the same time the growth is lacking either. The money injections act in a non-cyclical manner and are not the engine of the growth.

[15] In 2012, global FDI declined by 18 per cent and amounted US$ 1.35

trillion. UNCTAD indicated that in 2013 FDI remained close to the 2012 level,

with an upper limit of US$ 1.45 trillion. The recovery will be more prolonged

than it has been expected mainly due to the global economic instability and political

uncertainty. With the account of revival of investors' mid-term assurance, it

was expected that the FDI flows could reach the amount of US$

1.6 trillion in 2014 and US$ 1.8 trillion in 2015. There are still considerable

risks associated with this growth scenario. The FDI outflows from the developed

countries dropped to the level close to the level of 2009. The uncertain

economic prospects make the developed countries' TNCs to maintain their

wait-and-see approach with respect to new investments or to divest foreign

assets, rather than undertake major international expansion. In 2012, 22 of the

38 developed countries experienced a decline in FDI outflow which constituted

23 per cent of the general decline (UNCTAD 2013). FDI flows to developed

economies sharply declined. FDI inflows to developed economies declined by 32 per

cent and amounted 561 billion dollars, this level was lastly achieved almost 10

years ago. There was a significant decline in FDI inflows in most developed

countries, in particular, in the European Union which accounts for two thirds

of the global FDI reduction. According to UNCTAD report, despite the struggle

against tax havens their number increases which reduces expenses on business;

the number of countries offering favorable tax conditions for SPEs

(special-purpose entities) is also increasing.

[16] In developing countries, on the contrary, the smaller role of financial sector leads to the growth in incomes of most people, so there is a growth of the middle class promoted by real economic growth and growing significance of the intellectuals.

[17] The order of the letters in the acronym does not reflect our understanding of the relative importance of areas of the complex. E.g., biotechnologies will be more important than nanotechnologies, let alone additive technologies. The order is determined simply by the convenience of pronunciation.